Major payment networks continue to view stablecoins with caution for ordinary consumer payments. Visa’s CEO Ryan McInerny said that in digitally developed markets consumers already have easy options to pay from checking or savings accounts, and therefore “we don’t see a lot of product market fit for stablecoin payments and consumer payments in digitally developed markets.” At the same time, Mastercard’s CEO Michael Miebach framed stablecoins as another currency the company can support within its existing network, signalling a more infrastructure‑focused stance.

Visa and Mastercard's Stablecoin Skepticism

Visa emphasises the convenience of existing payment rails for everyday purchases and views stablecoins as not yet solving a clear consumer problem in advanced markets. That position reflects a conservative approach: exploring blockchain options without treating stablecoins as a replacement for current retail payment flows. For additional context on how these companies discussed stablecoins in prior coverage, see Visa and Mastercard coverage for 2025.

Mastercard has signalled openness to supporting stablecoins but positions its role mainly as enabling infrastructure rather than driving end‑user adoption. CEO Michael Miebach said, “For us, stablecoins are another currency we can support within our network,” and pointed to partnerships and pilots while noting trading and settlement remain the dominant use cases. The company has moved forward with pilots for on‑chain identity and settlement tools while observing where consumer demand develops.

Blockchain Initiatives and Market Realities

Both networks have run experiments on blockchain settlement and related tooling: Visa has experimented with stablecoin settlement using USDC, and Mastercard has piloted on‑chain identity and settlement approaches. These efforts indicate interest in infrastructure capabilities even as consumer payment adoption remains limited. JP Morgan described stablecoins as “a digital, on‑chain form of fiat money,” highlighting both potential operational benefits and attendant risks.

JP Morgan's analysis also cautioned about run risk in 24/7 tradable assets, noting that “the collapse of TerraUSD in May 2022 highlights just how quickly a run can occur...” That warning underscores why large incumbents balance experimentation with conservative risk assessments rather than rushing into broad consumer rollouts.

Transaction Volume Comparison: Crypto vs Traditional

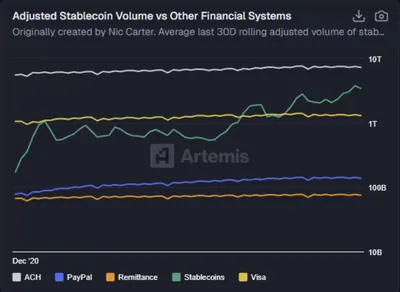

On‑chain settlement activity is sizable: data show bitcoin settled over $25 trillion in transactions in 2025, a figure larger than the combined settlement volumes reported for Visa ($17 trillion) and Mastercard ($11 trillion). Much of that bitcoin volume reflects high‑frequency and large institutional transfers, but the comparison illustrates the scale of blockchain traffic relative to card networks' settled value. These numbers inform conversations about where stablecoins might fit — as niche rails, institutional settlement tools, or consumer payment options.

SoFi's Contrasting Crypto Strategy

SoFi is taking a different tack by leaning into crypto as part of its product strategy. The company reported just over 63,000 accounts actively buying, selling, and holding digital assets in the fourth quarter of 2025, and CEO Anthony Noto described the push as “delivering crypto and blockchain innovation backed by bank‑grade stability and security.” SoFi’s approach highlights a commercial bet on retail and integrated crypto services even as card networks proceed cautiously.

Why this matters

For miners and small operators, the debate between payment incumbents and crypto firms shapes demand for on‑chain settlement and liquidity options. If networks like Visa and Mastercard favour an infrastructure role over consumer adoption, that could mean slower mainstream use of stablecoins for everyday purchases, while institutional and settlement use cases continue to grow. At the same time, large on‑chain volumes show there is real activity that can affect liquidity and service offerings you depend on.

Regulatory and stability warnings — including JP Morgan's note about the TerraUSD collapse in May 2022 — matter because runs or sudden liquidity events can change access to onramps, custodial services, or fiat conversions you use to monetize mined coins. Even if everyday payment adoption is limited, infrastructure and settlement developments can influence fees, timing, and counterparty risk for miners.

What to do?

Keep operational resilience simple and practical: ensure reliable fiat withdrawal paths and test them periodically, monitor liquidity on the exchanges and custodial services you use, and avoid overconcentration with a single counterparty. These steps help mitigate disruption if a stablecoin or service you rely on faces stress.

Watch infrastructure developments and partner announcements from payment networks and banks, because pilots and settlement tools can change rails or fee structures that affect your margins. If you use stablecoins for settlement, prioritise providers with clear custody and redemption mechanisms, and maintain up‑to‑date backups and power/connection contingencies for your rigs.

For further reading on stablecoins as market infrastructure, see stablecoins as infrastructure, which discusses institutional use cases and how networks are integrating on‑chain tools.