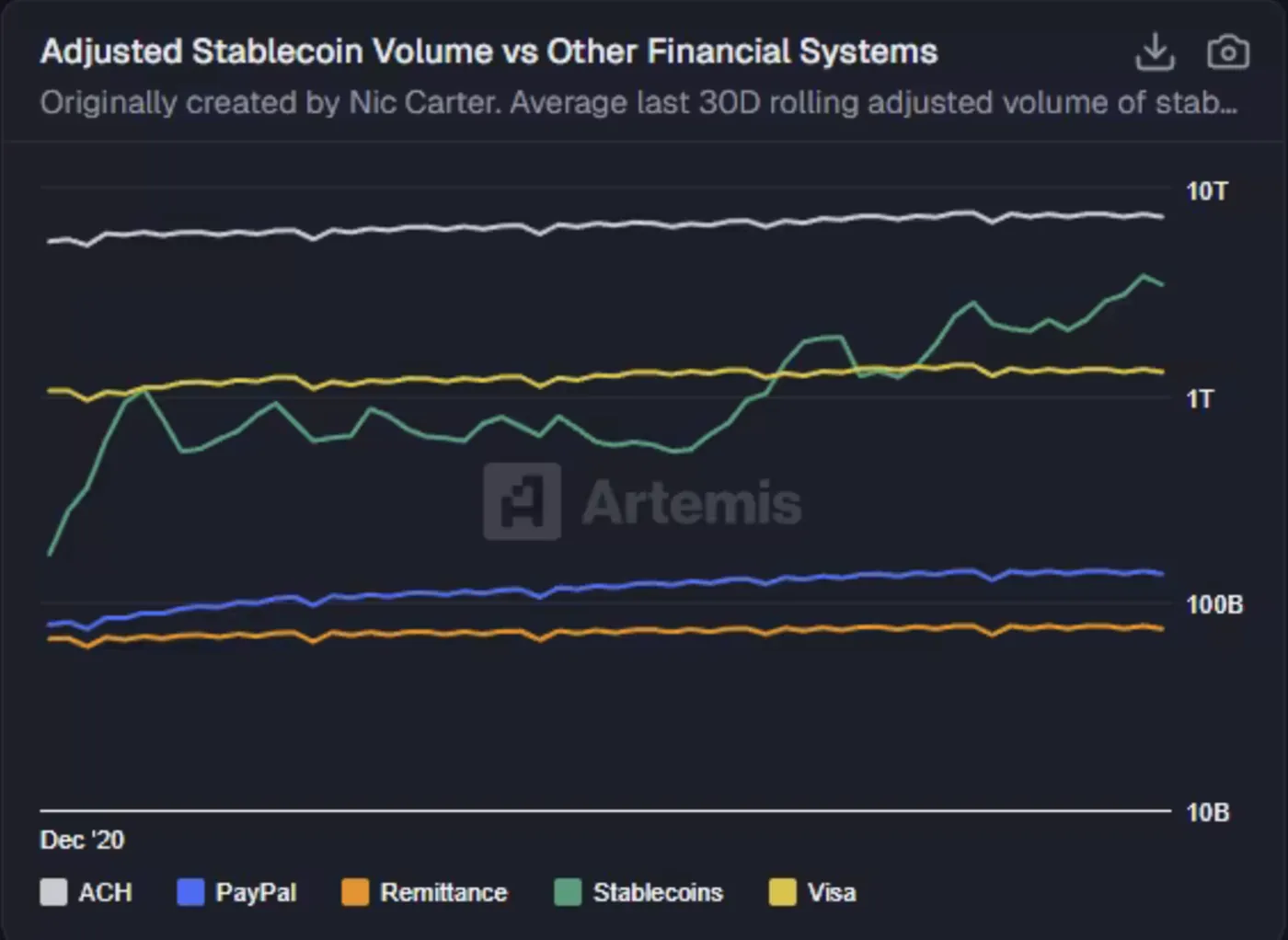

Galaxy Research, in its annual report, forecasts that by 2026 the transaction volume of US dollar stablecoins will exceed that of the American Automated Clearing House (ACH) system. Analysts note steady growth in stablecoin supply and cite regulatory clarity as a key factor supporting their wider adoption. The report also includes a Bitcoin price forecast — a possible level of $250,000 by the end of 2027, while describing 2026 events as too volatile for definitive predictions.

Galaxy Research Forecast for 2026

The main thesis of the report is that stablecoins could process a higher transaction volume than ACH in 2026 if current growth rates continue and further regulatory clarity emerges. Galaxy points out that stablecoin transactions already exceed volumes on some payment networks and currently represent about half of ACH’s transactional activity. No slowdown in supply growth is expected: Thad Pinakiewicz notes that stablecoin issuance increases on average by 30–40% annually, with transaction volumes growing alongside issuance.

The report also highlights the impact of regulatory changes: the implementation of definitions under the GENIUS law, planned for early 2026, is seen as a factor that could reinforce further adoption of stable tokens. For readers interested in stablecoin regulations, there is a separate publication reviewing relevant regulatory proposals, discussing initial directives under the new rules.

Stablecoin Market in 2025

According to DefiLlama data cited in the report, the market capitalization of US dollar stablecoins currently stands at about $309 billion, with leaders remaining Tether (USDT) and Circle (USDC). Alongside them, new issuers from the payment and financial services sectors are entering the market, expanding the range of available digital dollars and increasing competition for adoption among users and commercial platforms.

Among new players, Galaxy names Western Union, Sony Bank, and SoFi Technologies. Western Union announced the issuance of the US Dollar Payment Token on the Solana blockchain, Sony Bank is preparing a dollar stablecoin for use within the Sony ecosystem, and SoFi has already launched SoFiUSD as a fully reserved dollar stablecoin on Ethereum. The growth in such initiatives strengthens the role of stablecoins in payments and cross-border transfers.

Bitcoin Outlook

A separate section of the report is dedicated to Bitcoin: Galaxy analysts indicate the possibility of BTC reaching $250,000 by the end of 2027, while noting that 2026 may be too unstable for precise forecasts. For readers interested in Bitcoin forecasts across different years, more detailed insights from Galaxy’s research team are available.

Why This Matters

If stablecoin transaction volumes truly rise to ACH levels, it will enhance the role of blockchain payments in everyday transactions and inter-service settlements. For miners, this likely won’t have a direct technical effect on ASIC device operations; however, increased on-chain activity impacts the overall load and demand for blockchain infrastructure used by users and services.

Regulatory clarity and the emergence of corporate issuers could lower barriers for businesses and increase the number of transactions in digital dollars, affecting stablecoin liquidity and accessibility. Changes in adoption and settlement practices primarily affect users and exchanges rather than directly impacting mining hardware operations.

What to Do?

- Monitor news from regulators and major issuers to understand which tokens are increasingly used for payments and settlements.

- Check if the platforms and wallets you use support new corporate stablecoins and assess the reliability of partners for fund withdrawals.

- Keep your software and security measures up to date, as rising on-chain activity increases the number of transactions and interactions with blockchain infrastructure.

- Evaluate whether operational processes—such as withdrawal, exchange, and storage of funds—need adjustment to accommodate new payment tools.

Additional materials on Bitcoin forecasts and regulatory initiatives help better understand the connection between price expectations and payment infrastructure development. For a detailed view of BTC expectations in 2026, you can review Galaxy’s analytics team reports, while an overview of stablecoin regulatory proposals provides insight into potential regulatory changes.

Also read: Bitcoin forecast for 2026 and an overview of stablecoin regulations for context on market and regulatory expectations.