Agora is shifting focus from DeFi-driven growth toward using stablecoins in real business payments. The company’s TVL grew 60% last month following DeFi launches, but founder Nick van Eck says the longer-term opportunity is payroll, B2B and cross-border payments. Van Eck, who will be speaking at CoinDesk's Consensus Hong Kong conference next month, stresses that traditional firms face internal hurdles before they can adopt stablecoins at scale.

Agora's Shift to Enterprise Payments

Agora is concentrating on concrete corporate use cases such as payroll, business-to-business settlements and cross-border transfers where firms face practical problems. According to van Eck, adoption by traditional companies is likely but proceeds slowly because of unfamiliar infrastructure, missing internal policies and gaps in basic knowledge. This lack of familiarity is stark: he compares deep stablecoin knowledge inside crypto to very low awareness outside it.

Agora's Stablecoin Offerings

Agora issues AUSD, a U.S. dollar-backed stablecoin, and also provides a stablecoin-as-a-service product for projects that want to mint branded tokens. Van Eck warns that issuing a proprietary stablecoin typically makes sense only for closed-loop ecosystems; otherwise, businesses should opt for an established major stablecoin. For teams evaluating token issuance, Agora positions its service as an option but not a universal recommendation.

Opportunities in Cross-Border Payments

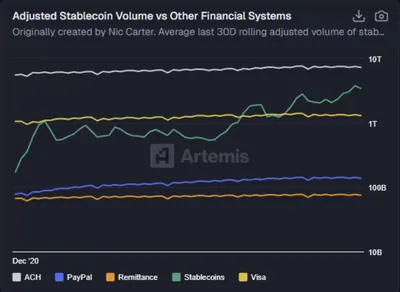

Van Eck highlights cross-border payments as a key area where stablecoins can reduce the friction of pre-funding and high transaction costs, which eat into corporate margins. He gives a concrete example of how modest revenue savings can have disproportionate effects on profitability, and points to multinational firms with global vendor networks as the most likely early adopters. For context on stablecoins as institutional infrastructure, see stablecoins as infrastructure and recent industry moves such as Circle's USDC usage in payments.

Future of Stablecoin Adoption

Looking ahead, van Eck predicts consolidation of activity onto a handful of corporate chains as major firms bring scale and distribution to the market. He names corporate-led platforms as likely to pull activity away from open-source blockchains, and says Agora’s goal is to rank among the top five global stablecoin issuers. The company aims to win by building payment tools that businesses find familiar and easy to use—something that feels like a bank account but with added benefits.

Why this matters (for a miner in Russia)

For most miners running between one and a thousand devices, Agora's focus on enterprise payments won’t change daily mining operations overnight. However, a shift of large payment flows toward specific stablecoins and corporate chains could gradually affect where transaction volume concentrates, which in turn may influence fee patterns across networks miners serve.

It's useful to know which platforms and stablecoins gain traction because that can affect demand for block space on particular chains. Van Eck’s view about consolidation into corporate chains means miners should watch announcements from major players and stablecoin issuers to understand potential shifts in on‑chain activity.

What to do?

- Monitor announcements from Agora and major firms named by van Eck to track where transaction volume moves.

- Keep node and mining software updated to remain compatible with multiple chains and token standards.

- Watch fee patterns and pool performance; consider switching pools or chains if transaction flows shift materially.

- Manage operational costs (electricity, ventilation) to stay flexible if market conditions change.

- Follow coverage of stablecoin infrastructure and institutional adoption to anticipate long-term trends.