Twenty One Capital made its public market debut on the New York Stock Exchange under the ticker XXI and experienced a sharp initial reaction from investors. The shares fell by nearly 20% on the first trading day, with the stock opening at $10.74 and closing at $11.96. The company launched with a reported treasury of more than 43,500 BTC, valued at roughly $3.9–4.0 billion, and counts several institutional backers.

Twenty One Capital’s NYSE Debut Overview

Twenty One positioned itself as a Bitcoin-focused public firm, building a large corporate treasury of BTC as a core part of its strategy. Its disclosed backers include Cantor Fitzgerald, Tether, Bitfinex and SoftBank, which together underscored the institutional interest in the listing. Given the scale of its holdings, the company's market value moved closely with the underlying cryptocurrency rather than separating into a distinct operating premium, a dynamic tied to recent moves in the bitcoin price.

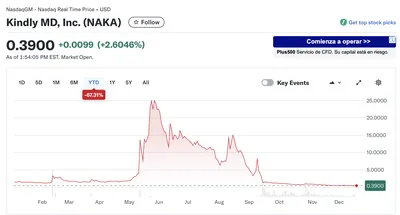

First-Day Trading Performance

The new stock opened at $10.74 and finished the day at $11.96, a move that amounted to an almost 20% decline on its first trading session. Trading settled near the value of the firm's Bitcoin treasury, indicating that investors did not assign a meaningful premium for the company's future business plans. That pricing outcome left XXI trading essentially as a close proxy to its net asset value rather than as a distinct growth story.

Factors Behind Investor Caution

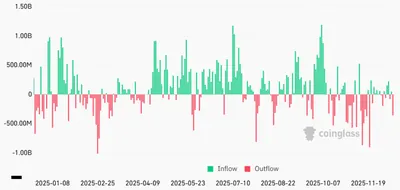

Several forces contributed to the muted market reception. The multiple-to-net-asset-value (mNAV) premium that some Bitcoin-treasury firms have previously enjoyed has eroded, reducing the extra valuation investors once paid above asset backing. At the same time, Bitcoin had fallen roughly 25–30% from its October peak before the debut, and enthusiasm for SPAC-driven public listings has softened, which together weighed on demand for this type of equity.

Market Shift: Demand for Proven Business Models

XXI’s reception highlighted a broader market tendency to favor companies that pair digital-asset holdings with clear, predictable revenue streams. Investors appear increasingly reluctant to pay for pure treasury plays unless management can demonstrate differentiated, revenue-generating operations. This shift raises the bar for Bitcoin-native firms that seek durable public-market multiples.

Why this matters (for a miner in Russia)

For an individual or small-scale miner in Russia with between one and a thousand devices, the XXI debut mainly matters as a signal about market sentiment toward Bitcoin-linked public firms rather than as a direct operational change. The company’s stock trading near its BTC value shows that public investors are placing heavier weight on the underlying bitcoin price and on clear revenue outcomes, rather than on large corporate treasuries alone.

That sentiment can indirectly affect access to capital for larger industry players and the broader narrative around Bitcoin holdings, but it does not change day-to-day mining operations like hardware performance or electricity costs. Still, heightened market caution can make fundraising or secondary market support harder for firms that miners might partner with or sell to.

What to do?

- Keep a close eye on Bitcoin price and volatility. Price swings affect the value of any BTC you hold and can change cash-flow planning if you sell mined coins to cover operating expenses.

- Manage operating costs and uptime. Focus on electricity efficiency, preventive maintenance and pool selection to keep margins stable when market sentiment turns.

- Maintain a working reserve. Set aside a short-term BTC or fiat buffer to cover at least several weeks of fixed costs, reducing pressure to sell during dips driven by market sentiment.

- Follow industry listings and capital markets news. Changes in how public markets value Bitcoin treasuries can influence counterparties, service providers and potential partners, so stay informed via reliable coverage such as reports on NYSE listings.