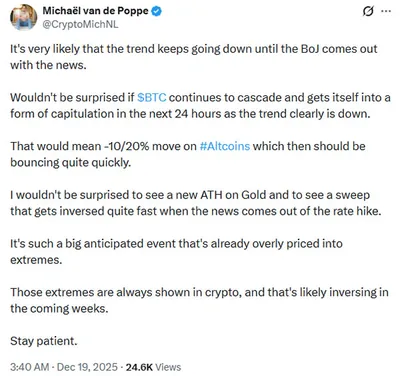

The crypto market showed high volatility again: over the week, Bitcoin's price dropped more than 5%, falling to a weekly low of $84,398 on Thursday, then rebounded above $87,769 on Friday. Investor activity declined ahead of the upcoming holiday period, exacerbating price fluctuations. These movements affected not only the spot price but also perceptions of the stability of corporate crypto asset holders.

Bitcoin and Cryptocurrency Market Volatility

During the reporting week, Bitcoin exhibited significant swings: a drop of more than 5% to $84,398 followed by a partial recovery above $87,769. Reduced trading activity before holidays often intensifies price volatility due to lower transaction volumes and liquidity. More details on the recent drop and its causes can be found in the article about the fall below $88,000.

Challenges for Digital Assets and DAT Companies

Solmate CEO Marco Santori noted that digital treasuries (DAT) are vulnerable to market volatility because of the multiple-to-net-asset-value (mNAV) mechanism. When tokens on the balance sheet lose value, mNAV decreases, limiting these companies' ability to grow effectively and raise capital. From a capital management perspective, this turns some DATs' development into "mNAV roller coasters," a factor important for both investors and project leaders to consider.

Regulatory News and Aave's Plans

Significant news for the industry: the U.S. Securities and Exchange Commission (SEC) closed a four-year investigation into Aave, marking a major regulatory milestone for the platform. Following this, Aave founder Stani Kulechov presented a "master plan" for 2026, with the key goal of attracting $1 billion in real asset deposits through the launch of Aave v4, Horizon, and Aave App. These steps aim to scale the protocol and expand the lending platform's functionality.

Hyperliquid Vote and ETHGas Updates

Hyper Foundation proposed that validators vote to formally recognize HYPE tokens held in the Assistance Fund address as permanently inaccessible, removing them from circulating and total supply; at the time of publication, the wallet holds approximately $1 billion in tokens. Meanwhile, ETHGas announced a $12 million seed funding round led by Polychain Capital. Discussions have also revived around onchain "gas futures," a topic Vitalik Buterin touched on and ETHGas is considering in debates about blockspace allocation.

SEC and Tokenized Securities

Separately, the SEC's Trading and Markets division clarified how broker-dealers can custody tokenized stocks and bonds under existing client protection rules. The regulator emphasized that tokenized securities must fit within traditional control and security frameworks rather than being treated as a completely new category. This provides the industry with greater clarity on custody and operational requirements for tokenized assets.

Why This Matters

If you mine with anywhere from one to a thousand devices and reside in Russia, the main implications of this summary are less about direct operational impact on farms and more about financial and regulatory signals. Price fluctuations affect revenue from selling mined BTC and asset valuations for corporate holders, influencing the market overall. Regulatory decisions and news from major projects shift institutional interest dynamics, potentially affecting liquidity and demand in the long term.

What To Do?

- Monitor price and liquidity: keep a simple reserve in fiat or stablecoins to cover electricity costs during downturns.

- Plan sales: stagger BTC sales over time to avoid selling during peak volatility.

- Follow regulation: track news on tokenized asset custody rules and major decisions (e.g., regarding Aave) relevant to infrastructure and exchanges.

- Maintain equipment: regular servicing and consumption monitoring help preserve margins amid price swings.

- Read analytical materials: comparing current fluctuations with market explanations, such as in reviews on Why Bitcoin Is Falling, supports informed decision-making.

Subscribe for updates and check news on key projects and regulators — this will help make more balanced decisions on selling, storing, and upgrading equipment.