Senate Democrats filed amendments on Friday to the Agriculture Committee's draft of the crypto market structure bill, seeking to add several of their priority policy changes. The draft had been unveiled as a partisan effort without Democratic sign‑off, and the amendments aim to insert measures that Democrats say are missing from the Republican text. Key requests include bans on certain government and issuer protections, stronger CFTC procedures, and limits on senior officials' crypto involvement.

Overview of the Crypto Market Structure Draft

The Agriculture Committee's draft is the product of a Republican push to set a market structure framework for digital assets, and Democrats have moved to alter parts of that text through formal amendment requests. Because the draft was released without Democratic agreement, the filing of amendments formalizes those policy disagreements and sets specific items for the committee to consider. The debate now centers on whether the committee will accept, reject or modify the proposed changes during its upcoming markup.

Key Democrat Amendments

- Ban on bailouts: Senator Richard Durbin seeks a prohibition on bailouts of digital‑asset issuers, removing an explicit government backstop for such companies.

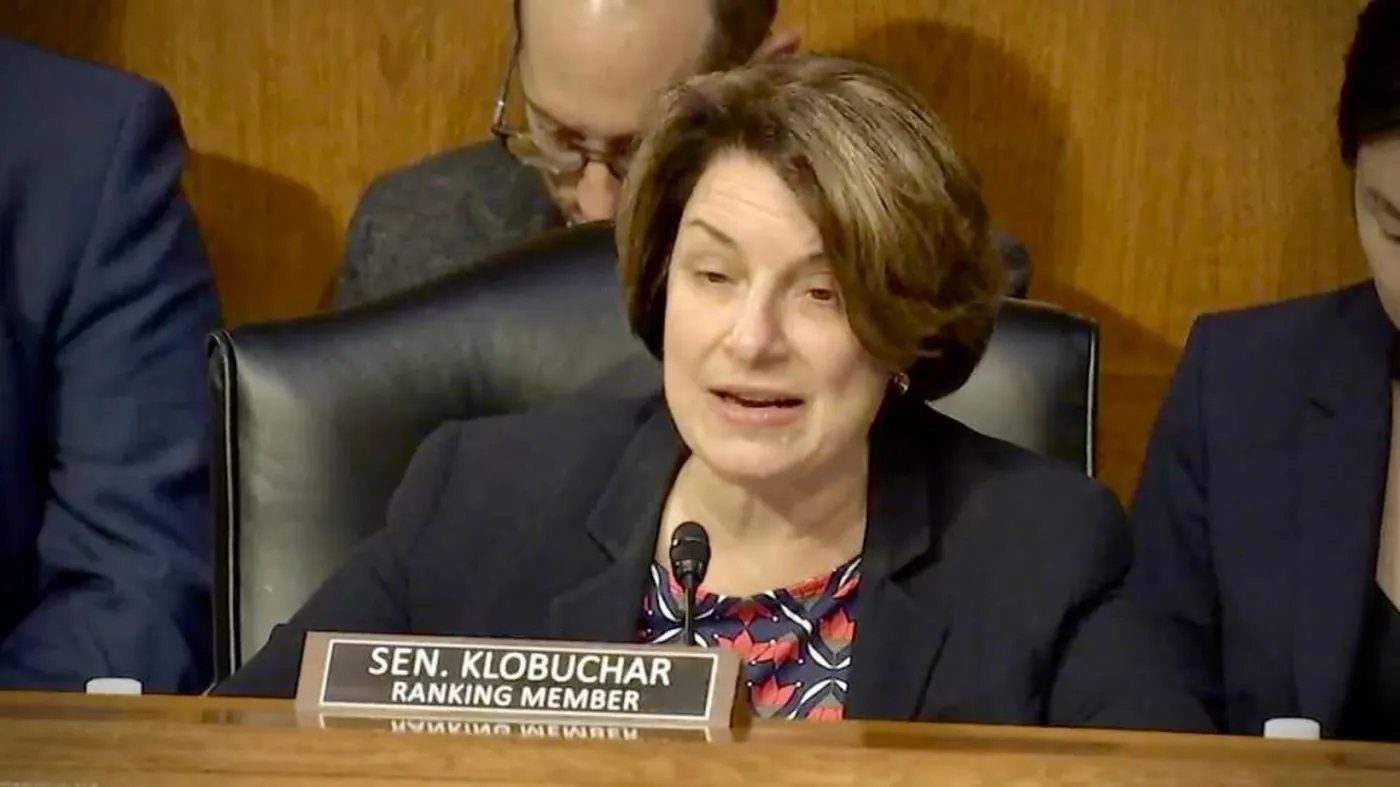

- CFTC quorum requirement: Senator Amy Klobuchar is asking that the Commodity Futures Trading Commission have a quorum of commissioners in place before rules for digital assets can take effect, in a more binding form than in the current draft.

- Anti‑corruption limits: Senator Michael Bennet proposed measures to restrict crypto involvement by senior government officials, aiming to limit conflicts of interest and related conduct.

Republican Proposals

Republican members have also put forward changes to the draft, including Senator Tommy Tuberville's proposal to bar crypto platforms that are affiliated with foreign adversaries of the United States. Other GOP adjustments have been pitched as part of the same negotiations, reflecting competing priorities between the parties. These Republican proposals remain part of the markup debate alongside the Democrat amendments.

Next Steps and Challenges

The Agriculture Committee is scheduled to mark up the bill next week, at which point members will consider the filed amendments and may vote to advance a revised text. The session could face scheduling issues, and some observers have said it may be delayed, but the amendments are now on the record and will be part of the committee's work. Separately, the Senate Banking Committee must also move forward with its own version of the legislation; only after both committees approve the Digital Asset Market Clarity Act can it be taken up by the full Senate.

Broader Implications

If the Agriculture and Banking committees each advance their versions and reconcile differences, the result would be a committee‑approved path for the Digital Asset Market Clarity Act to reach the Senate floor. The presence of both Democrat and Republican proposals in the record highlights how contentious key choices remain, especially around enforcement mechanics and conflict‑of‑interest rules. Companies and stakeholders will watch committee actions closely once markups and potential negotiations proceed.

Why this matters — concise note for miners in Russia

For a miner operating in Russia with a small or mid‑sized setup, these developments do not immediately change day‑to‑day mining operations, but they shape the U.S. regulatory framework that influences global market structure. Rules about market oversight, platform access and conflicts of interest can affect liquidity, exchange practices and which firms participate in global markets, which in turn can alter where and how miners sell or custody coins.

At the same time, proposals like a ban on bailouts or stricter CFTC rulemaking procedures are primarily aimed at market governance and do not directly impose new technical or tax obligations on individual miners. Still, changes in U.S. law can ripple through exchanges and institutional counterparties that many miners use to cash out or hedge.

What to do? — practical steps for miners (1–1,000 devices)

- Monitor committee actions: follow markup outcomes from the Agriculture and Banking committees to see which amendments are adopted, as those indicate possible market impacts.

- Review your exchange and custody arrangements: ensure counterparties you use are responsive to regulatory changes and have contingency plans if platform access rules shift.

- Keep records and compliance basics up to date: maintain clear transaction logs and identity documents so any changes in counterparty due diligence do not disrupt your operations.

- Stay informed via reliable sources: track official committee releases and reputable coverage rather than speculation to understand concrete legal changes when they occur.

For broader context on evolving U.S. crypto rules and how they affect developers and platforms, see reporting on crypto regulation and recent coverage of the bill's scheduling and potential delays.