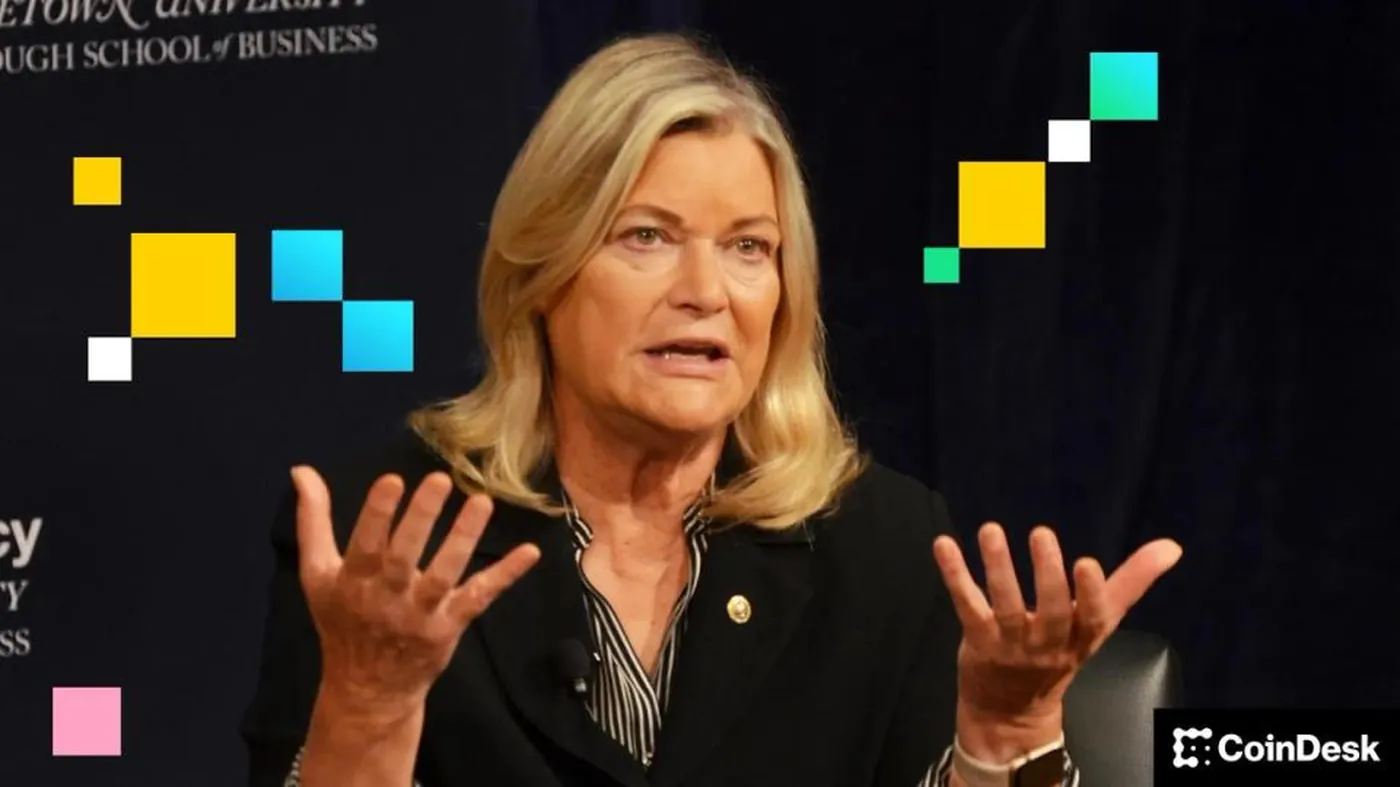

Republican Senator Cynthia Lummis and Democrat Ron Wyden introduced a standalone bill intended to protect decentralized finance (DeFi) software developers from treatment as money transmitters when they do not control customers' assets. The measure mirrors the House-originated Blockchain Regulatory Certainty Act and gives the House text a matching Senate counterpart, underlining bipartisan interest in that specific protection. Lawmakers are introducing it separately even as negotiators continue to hammer out a broader market-structure bill that would cover many aspects of U.S. crypto regulation.

Introduction of the DeFi Protections Bill

The Lummis–Wyden text focuses on one clear point: developers who write code but do not custody or control users' funds should not be labeled money transmitters. Sponsors say the change restores language that had appeared in an earlier Senate draft but returned to the negotiating floor, and the standalone filing emphasizes cross-party support for that safeguard. For background on the policy aim behind the proposal, see DeFi developer protection which outlines the legislative intent and previous versions of the idea.

Background and Context

The Blockchain Regulatory Certainty Act began in the House and was later incorporated as a section of the Senate's larger market-structure effort; the Lummis–Wyden bill restores the House language as a full Senate measure. That approach creates a standalone Senate counterpart to the original House bill while leaders continue negotiating the content of the comprehensive bill. These moves reflect both attempts to lock down specific protections and uncertainty over which provisions will remain in the final market-structure draft.

Key Issues in the Market-Structure Bill

Negotiators are still resolving several hot-button topics: how to address illicit-finance risks, the regulatory treatment of DeFi, whether stablecoins can be associated with yield or rewards, and whether the bill should curb senior government officials from profiting from the industry. Lobbyists were preparing for legislative language to be finalized quickly; that text was set for markup at the Senate Banking Committee hearing scheduled for Thursday, January 15, 2025.

Industry Reactions

Centralized exchanges and DeFi interests are not uniform in their priorities, and the draft may test where different segments draw their red lines. Coinbase CEO Brian Armstrong publicly said his company would abandon any bill that restricts crypto firms from paying interest or offering rewards on stablecoins, calling such limits a red line for the firm. Coinbase also reported earning $355 million in stablecoin-related revenue in the third quarter of 2025, a figure the company has highlighted in industry discussions.

Legislative Process and Delays

The Senate Banking Committee's markup was scheduled for January 15, 2025, but the parallel process in the Senate Agriculture Committee was moved toward the end of the month, according to Chairman John Boozman. Boozman said additional time was needed to finalize details and build broader support, and the Agriculture Committee planned to mark up the legislation during the last week of January. These scheduling shifts reflect the negotiation's complexity and multiple committees' involvement.

Why this matters

For a miner operating in Russia with between one and a thousand devices, the direct effect of a developer-protection clause is limited: it primarily concerns software authors and DeFi protocol code, not raw mining operations or block validation. At the same time, debates over stablecoin yield and broader market structure can influence the exchanges, custody services, and payment rails miners use to convert rewards into fiat or stablecoins.

Keep in mind that committee votes and final language determine which rules actually reach implementation. Even if this standalone bill secures developer protections, other parts of the market-structure package—if enacted—could change how platforms handle stablecoins, custody, or on- and off-ramps that miners rely on.

What to do?

- Follow the Senate Banking Committee markup on Jan 15 and subsequent Agriculture Committee action to see which provisions survive; tracking those hearings will tell you whether protections remain or other rules change.

- Watch statements from major platforms and services you use—announcements about stablecoin rewards or custody policies can affect where and how you convert mining proceeds.

- Keep your wallets, node software and exchange accounts secure and up to date, and consider maintaining multiple withdrawal paths in case some services change terms under new rules.

- Read short explainers and legislative summaries to spot concrete changes for miners; for related background, see reporting on the market bill and delays such as market structure delay.