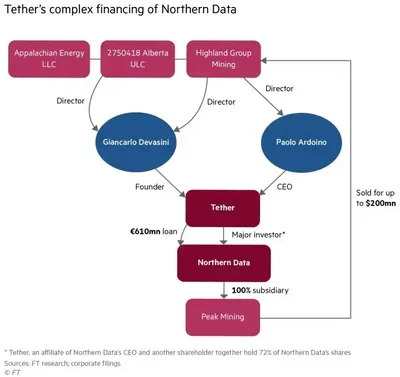

Northern Data has agreed to sell its Bitcoin mining arm, Peak Mining, to companies run by two senior Tether executives. The deal is structured with payments over time and can total up to $200 million depending on how the mining assets perform under new ownership. Following the sale, Northern Data will shift its resources toward cloud computing and artificial intelligence infrastructure.

Overview of the deal

The agreement transfers Peak Mining from Northern Data to purchasing entities operated by Giancarlo Devasini and Paolo Ardoino. The transaction includes staged payments that may bring the final price to as much as $200 million, contingent on performance metrics. This transfer marks a change in ownership of notable mining capacity and frees capital for Northern Data’s core businesses.

Strategic shift for Northern Data

By divesting Peak Mining, Northern Data intends to prioritize its cloud computing and AI infrastructure operations. The company will use proceeds and the structured payments to support investment in high-performance computing rather than operating large-scale mining. At the same time, Northern Data retains some exposure to the broader crypto sector through other ventures.

Key players in the acquisition

The buyers are led by two prominent figures associated with Tether: Giancarlo Devasini and Paolo Ardoino. They bought the mining business via separate corporate structures as a personal investment, not as a direct acquisition by Tether the company. For more on the purchase details, see Tether companies buy Peak Mining.

Implications for the crypto industry

Market observers read the deal as evidence of continued institutional interest in mining assets and as an example of strategic consolidation in the sector. The transaction’s structure and the profile of the buyers highlight how experienced crypto operators can acquire mining capacity without involving their employers directly. Related coverage of broader corporate moves in this space can be found in reporting about Rumble and Northern Data deal.

Future of Bitcoin mining

This sale may encourage further transfers of mining assets between well-capitalized players and could support more vertical integration across crypto services. Such shifts affect how mining capacity is concentrated and managed, with potential consequences for operational efficiency and industry structure. The immediate technical functioning of the Bitcoin network is unchanged by this ownership transfer.

Why this matters (for a miner in Russia with 1–1000 devices)

The change of ownership does not directly alter network rules or Bitcoin’s protocol, so your rigs continue to contribute to validation as before. However, new owners can change operational practices, reach different efficiency levels, or reconfigure capacity over time, which may influence local competition for electricity and hosting services.

For small to mid-size miners, the main practical effects are indirect: shifts in market consolidation can alter service availability, pricing, or buyer interest for second‑hand equipment. It’s useful to monitor operational announcements from the new owners and providers you use.

What to do?

- Check contracts and service agreements: review power, hosting, and maintenance terms to confirm continuity under new ownership or management.

- Monitor costs and efficiency: track your electricity and hash-rate metrics regularly and compare against expected returns to spot changes early.

- Keep equipment options open: maintain records of serials and performance in case you need to relocate or sell machines; liquidity in the secondary market can change.

- Follow official communications: subscribe to updates from your providers and from the new Peak Mining owners to learn about operational or policy changes that may affect you.

Conclusion

The sale of Peak Mining moves mining capacity into the hands of experienced cryptocurrency executives while allowing Northern Data to focus on cloud and AI infrastructure. For individual miners, the development is chiefly relevant as part of broader industry consolidation and changing ownership of large-scale operations.