Financial Times reports that companies linked to the founder of Tether have acquired Bitcoin miner Peak Mining from the German data center operator Northern Data. The publication notes that in November 2025, Northern Data announced the sale of its mining business for up to $200 million, with three companies as buyers. The deal occurs amid already known financial ties between Northern Data and entities connected to Tether, alongside ongoing regulatory investigations in Europe.

Deal Summary

The asset sold is specifically the Bitcoin miner Peak Mining, previously owned by Northern Data, whose majority owner is identified in the article as Tether. The company had announced intentions to sell its mining business since October 2024 and in November 2025 disclosed a potential deal value of up to $200 million. The source of this information is Financial Times.

Who Bought Peak Mining

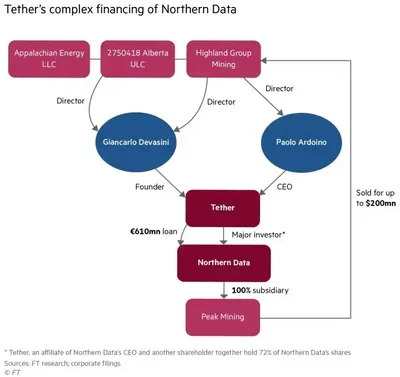

According to U.S. regulatory documents, the buyers are Highland Group Mining Inc, Appalachian Energy LLC, and 2750418 Alberta ULC. Documents from the British Virgin Islands indicate that the directors of Highland Group are Giancarlo Devasini and Paolo Ardoino, while the Canadian registry lists Devasini as the sole director of 2750418 Alberta ULC. The controlling party of Appalachian Energy, registered in Delaware, is not disclosed in available documents.

Buyers’ Links to Tether and Rumble

The article emphasizes the connection between the buyers and Tether’s management: Giancarlo Devasini is named as co-founder and head of Tether, and Paolo Ardoino as CEO. The announcement of acquiring Peak Mining appeared just days before the U.S. platform Rumble, in which Tether owns nearly 50%, agreed to acquire Northern Data; details of the Rumble deal are discussed separately in the Rumble transaction. According to FT, Tether along with affiliated entities and another shareholder controls 72% of Northern Data, which has a market capitalization of about €885 million.

Previous Sale Attempts and Deal Values

The sale of Peak Mining was not the first attempt to transfer the asset: Northern Data had been discussing selling its mining business since October 2024, and in August reported a non-binding agreement worth $235 million with Elektron Energy. Those documents also mention Devasini as a director, underscoring recurring ties between management and buyer entities.

Regulatory and Tax Risks for Northern Data

Northern Data remains under scrutiny by European prosecutors: in September, the company’s offices in Germany and Sweden were searched as part of an investigation into possible large-scale tax fraud, with investigators estimating potential unpaid taxes exceeding €100 million. The company responded by calling it a "misunderstanding regarding the tax regime for GPU services and the legal structure of historical mining operations," emphasizing a different interpretation of the circumstances.

Financial Relations with Tether and Future Obligations

Northern Data’s balance sheet still includes a €610 million loan from Tether: half of this amount is to be received in Rumble shares, and the other half is planned to be restructured as a new loan from Rumble secured by Northern Data’s assets. Previously, in November 2023, Tether had extended a credit line of €575 million to Northern Data until 2030; these connections explain the complex financial picture surrounding the deals and restructurings. Additionally, Paolo Ardoino has publicly stated Tether’s intention to become the largest Bitcoin miner by the end of 2025.

Why This Matters

If you mine in Russia on a scale from one to a thousand devices, this deal is unlikely to affect your daily operations directly, as it involves corporate asset transfers and internal structural ties. However, it is important to monitor regulatory and tax risks around major operators, since investigations and large corporate deals can impact equipment supply, contracts, and service availability in the supply chain.

Moreover, the presence of significant credit obligations and complex intercompany relationships shows that asset decisions are made within a large group of interested entities, affecting market transparency and access to counterparty information. For miners, this means assessing partner risks and paying close attention to official disclosures becomes increasingly important.

What To Do?

- Follow official publications and ad hoc disclosures from Northern Data and Financial Times reports to promptly receive verified information about asset status and deals.

- Keep and organize documents related to equipment purchases, contracts, and electricity payments — increased regulatory scrutiny will make interactions with tax authorities easier.

- Vet counterparties before major transactions: pay attention to ownership structure, public statements, and ongoing investigations to reduce the risk of unexpected supply or service disruptions.

- Evaluate financial risks when working with large operators: significant loans and restructurings may affect service stability and contractual obligations.

Source: Financial Times; company quote is from the original material.