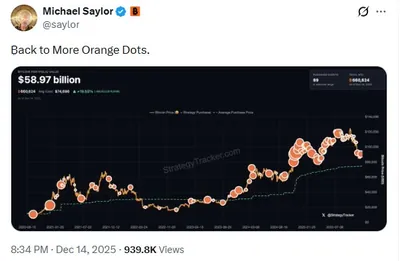

Michael Saylor recently completed a substantial Bitcoin purchase, acquiring nearly $1 billion worth of the cryptocurrency. This acquisition took place at a notable moment in the market, drawing attention from investors and analysts alike.

Michael Saylor's Bitcoin Purchase

The purchase involved close to $1 billion in Bitcoin, marking one of the larger individual acquisitions in recent times. The timing of this purchase was significant, occurring amid fluctuating market conditions that have kept investors cautious.

Bitcoin Market Reaction

Following Saylor's acquisition, Bitcoin's price experienced a decline of about 4%. This drop was influenced by several market factors, including broader investor sentiment and trading dynamics that often accompany large transactions in the cryptocurrency space. See also: Michael Saylor Hints at Next Bitcoin Buy as BTC Drops Below $88,000

Implications for Investors

For Bitcoin investors, this event highlights the complex relationship between large-scale purchases and market price movements. While a significant acquisition might suggest confidence in the asset, the subsequent price drop indicates that market reactions can be unpredictable. Investors should consider these dynamics when evaluating their strategies and remain attentive to ongoing market trends.

About Michael Saylor

Michael Saylor is a well-known figure in the cryptocurrency market, recognized for his strategic investments in Bitcoin. His previous activities have included multiple substantial purchases, positioning him as an influential participant in the digital asset space. Understanding his role provides context for the impact of his latest acquisition on the market.

Why This Matters

For miners and investors in Russia managing from one to a thousand devices, Michael Saylor's purchase and the ensuing price drop illustrate the volatility inherent in the Bitcoin market. Large transactions by influential figures can trigger unexpected price movements, affecting profitability and investment decisions. See also: Michael Saylor’s Monday Bitcoin Buying Ritual Adds 10,645 BTC in 2025

What To Do

Miners should monitor market developments closely, recognizing that significant purchases do not always lead to immediate price increases. Maintaining flexibility in operational strategies and staying informed about market sentiment can help mitigate risks associated with such volatility.