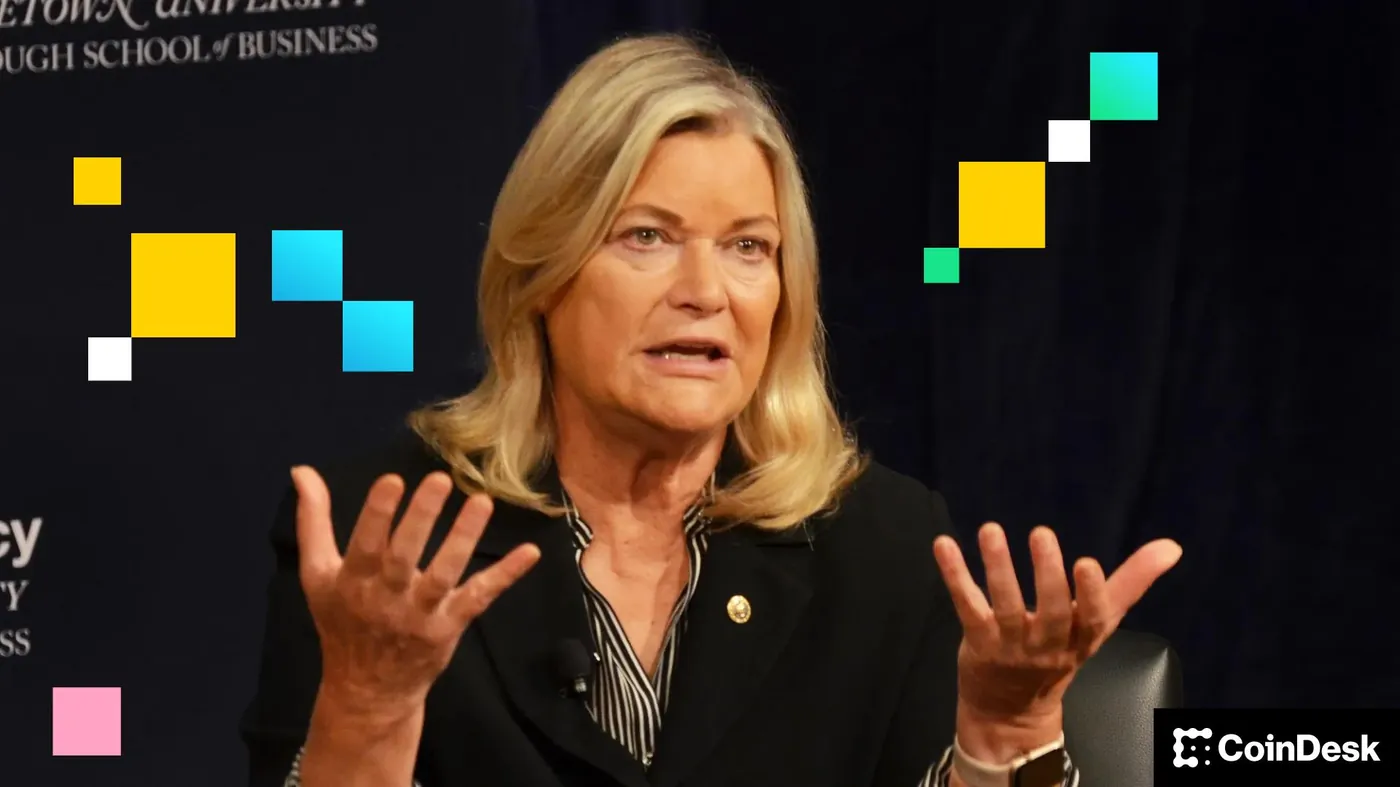

Senator Cynthia Lummis announced she will not seek re-election and will leave Congress at the end of her six-year term in January 2027. This marks the loss of a prominent crypto industry supporter in the federal legislative process, although she pledged to continue working on key bills until her term concludes.

Cynthia Lummis’s Departure from Congress

In her statement, Lummis explained her decision was due to fatigue from the intense parliamentary workload, comparing herself to a sprinter running a marathon who has exhausted her energy. She confirmed she will not run for re-election and intends to focus on completing her current initiatives during her Senate term.

Announcement and Reasons for the Decision

According to her, the intensity of session weeks and the energy required make it impossible to continue for another six years in the same manner, so she decided not to run again. Nevertheless, Lummis plans to work on her priority legislation until the end of her mandate.

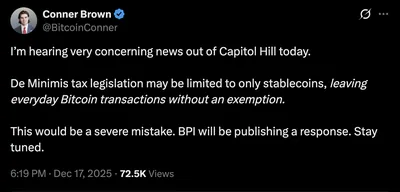

Impact on the Crypto Industry

Lummis’s departure means the loss of a clear advocate for digital assets in Congress, who actively promoted sector initiatives throughout her term. Discussions and agreements on key proposals, including market structure, will continue, but without her, the balance of votes and negotiation dynamics may shift; for details see the article Cynthia Lummis and Cryptocurrencies.

Reactions from Colleagues and Experts

Lummis mentioned she received support from President Trump and plans to channel her energy into passing important legislative agendas during her remaining time. Industry representatives responded with regret: Ji Kim, CEO of the Crypto Council for Innovation, called her a leading champion of digital assets in Washington.

Lummis’s Contribution to Crypto Regulation

During her Senate tenure, Lummis became the first chair of the cryptocurrency subcommittee under the Senate Banking Committee, prioritizing digital asset issues. Under her leadership, initiatives aimed at easing crypto’s path to regulatory recognition and integration appeared on the agenda.

Role in the Cryptocurrency Subcommittee

As initiator and chair of the subcommittee, Lummis shaped discussions on regulatory approaches and helped advance industry-focused bills. These efforts brought digital asset topics into the federal banking committee’s spotlight.

Negotiations on Crypto Market Structure

Lummis remains one of the key negotiators on the crypto market structure bill and intends to participate in final discussions on this initiative. Details on the negotiation progress and timelines can be found in the article about the bill’s delay on crypto market structure.

Political Situation in Wyoming

Lummis’s departure will leave a Republican seat open in a state with a strong party majority, making the campaign to fill it crucial for maintaining Senate balance. In her statement, Lummis emphasized her intention to uphold "common sense" governance and support party priorities until her term ends.

Crypto Community Reaction

Crypto activists and industry groups expressed regret over her decision, noting Lummis played a significant role in advancing regulatory initiatives. Specifically, a representative of the Crypto Council for Innovation directly called her a leading digital asset advocate in the capital, highlighting her influence on shaping the political agenda.

Why This Matters

For miners in Russia, Lummis’s departure is the loss of a clear crypto industry defender at the federal level in the US, where important rules affecting the global market are made. Although immediate changes won’t occur, the absence of her voice may slow some initiatives and alter the balance in future industry-related votes.

What to Do?

If you mine with one to a thousand devices, it’s advisable to focus soon on practical matters directly under your control and unrelated to US politics. Pay attention to cost management, network reliability, and compliance with local regulations — this will improve your operation’s resilience regardless of external political shifts.

- Monitor energy consumption and rates: optimizing costs directly impacts mining profitability.

- Ensure backup solutions for cooling and power supply: this minimizes downtime and profit loss.

- Stay updated on local rules and tax requirements: international political changes don’t exempt you from national compliance.

- Diversify mining pools and, if needed, distribute equipment across locations to reduce operational risks.

These steps will help maintain your farm’s profitability and stability amid international uncertainty, even if political shifts occur in the US.