The Lightning Network (LN), a Bitcoin layer-2 scaling solution, has achieved a new all-time high capacity of 5,606 BTC in December 2025, surpassing its previous record set in March 2023. Analytics platform Amboss reported a similar peak of 5,637 BTC, valued at approximately $490 million, highlighting a significant surge in capacity during November and December after a period of decline.

Despite this growth in capacity, the number of Lightning nodes and channels has decreased compared to their 2022 peaks. Currently, there are 14,940 nodes, down from 20,700 in March 2022, and 48,678 channels, also lower than previous highs. This suggests that while more Bitcoin is being added to the network, the overall number of participants and connections has contracted.

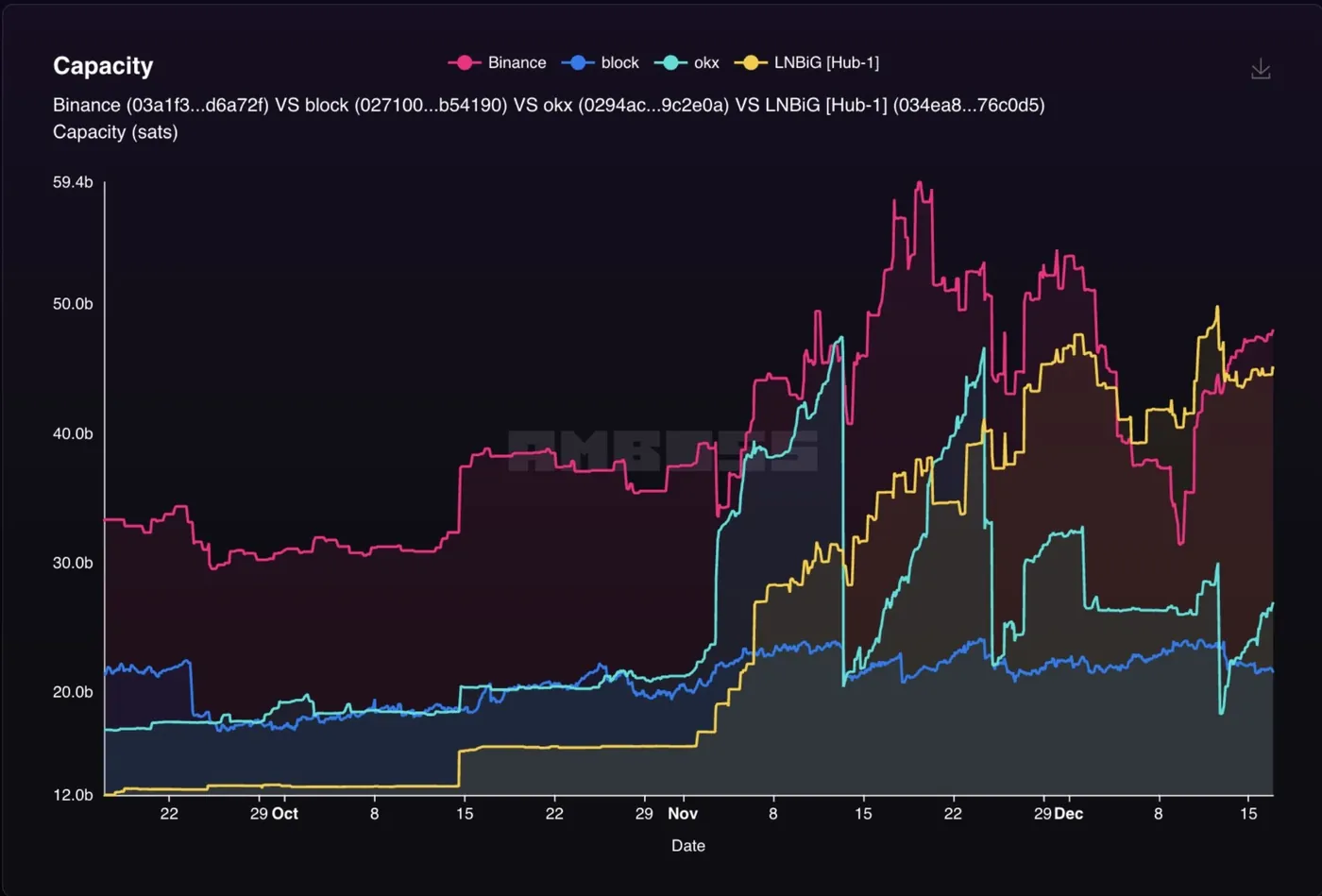

Exchange Adoption Driving Capacity Growth

The recent increase in Lightning Network capacity is largely attributed to major cryptocurrency exchanges expanding their Bitcoin deposits on the network. Notably, Binance and OKX have been actively adding more BTC to the LN in December 2025. This broader trend of multiple companies integrating Bitcoin into the Lightning Network is enhancing its capacity, which in turn supports faster and more cost-effective Bitcoin transactions.

Taproot Assets Protocol Upgrade

Lightning Labs announced the release of Taproot Assets version 0.7, introducing important new features such as reusable addresses, a fully auditable asset supply, and the ability to conduct larger and more reliable multi-asset transactions on the Lightning Network. Taproot Assets is a protocol that enables assets like stablecoins to be minted on Bitcoin and transferred over the LN, leveraging Bitcoin's security with instant and low-fee payments.

Stablecoins and Wallet Support on Lightning Network

In a related development, stablecoin issuer Tether led an $8 million funding round for the Bitcoin startup Speed, aiming to facilitate stablecoin payments on the Lightning Network. This investment supports the integration of stablecoins with Bitcoin's layer-2 scaling solution, enhancing payment options within the ecosystem. Meanwhile, the popular crypto wallet MetaMask has added Bitcoin support; however, its transactions utilize the Native SegWit derivation path rather than the Lightning Network.

Why This Matters

For miners operating in Russia with up to a thousand devices, these developments indicate growing institutional adoption of the Lightning Network, which could influence Bitcoin transaction dynamics. The increased capacity driven by major exchanges suggests that layer-2 solutions are becoming more integral to Bitcoin's ecosystem, potentially affecting transaction fees and speeds. Additionally, the Taproot Assets upgrade and stablecoin integration point to expanding use cases for Bitcoin beyond simple transfers, which may impact network demand and utility.

What Should Miners Do?

- Stay informed about Lightning Network capacity trends and exchange activity, as these can affect Bitcoin transaction throughput and fees.

- Monitor developments in Taproot Assets and stablecoin protocols to understand emerging opportunities for multi-asset transactions on Bitcoin.

- Consider the implications of wallet support changes, like MetaMask's Bitcoin integration, for how users might interact with Bitcoin and layer-2 solutions.

For more details on stablecoin integration and funding, see Tether Invests $8M to Accelerate Bitcoin Lightning Network Payments and Tether Leads $8M Investment in Speed to Enhance USDT Payments on Bitcoin Lightning.