Kevin O'Leary has been shifting his focus toward infrastructure that can support artificial intelligence, cloud computing and cryptocurrency activity. He says he now controls 26,000 acres of land across several regions intended for those uses, with half of that land already disclosed and the other half undergoing permitting. Rather than building data centres himself, O'Leary describes a strategy of securing land and power and preparing sites to be leased to firms that will construct and operate the facilities.

Kevin O'Leary's Infrastructure Investments

According to O'Leary, his 26,000-acre position includes 13,000 acres in Alberta, Canada, and another 13,000 acres in locations he has not disclosed that are in permitting. He frames these holdings as pieces of essential real estate for energy- and land-intensive projects such as bitcoin mining and large-scale data centres. This approach is focused on acquiring shovel-ready sites and the necessary power allocations to make them lease-ready for buyers and operators.

O'Leary has compared the rush for suitable land to a real estate play, arguing that miners and AI firms need both land and power before they can build. For readers tracking mining trends, this ties into recent coverage of broader shifts in the industry and capacity deployment, as discussed in Bitcoin mining 2025. His public statements emphasise control of land and infrastructure rather than operating the centres himself.

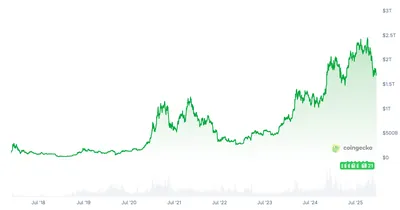

Crypto Portfolio and Market Views

O'Leary says he has delegated a significant portion of his financial exposure to the crypto space, with over 19% of his portfolio invested in crypto-related positions that include digital assets, infrastructure and land. He has publicly invested in the bitcoin miner BitZero in Norway and describes bitcoin mining as akin to a real estate business because it depends on site and power availability. That framing helps explain why he prioritises land and power deals alongside token holdings.

On market strategy, O'Leary argues that institutional capital — the type that moves large pools of money — focuses primarily on two assets, bitcoin and ether. He states that those two positions alone capture 97.2% of historical crypto market volatility, and he has expressed skepticism about smaller tokens and many newer projects. For broader market perspectives and forecasts that touch on institutional flows, see Pantera 2026 forecast.

Regulatory Challenges and Opportunities

O'Leary says regulation is a key factor that will determine whether large institutions move beyond limited exposure to crypto. He has followed the crypto market structure bill being discussed in the U.S. Senate and criticised a provision that would ban yield on stablecoin accounts, calling that clause an unlevel playing field that advantages traditional banks. He notes that crypto firms and stablecoin issuers want the ability to offer yields, and he pointed to Coinbase's reported $355 million in revenue from stablecoin yield offerings as an example of the product's economic importance.

Despite his criticism of parts of the bill, O'Leary remains optimistic that regulatory fixes are possible and that a corrected framework could open the door to larger institutional allocations into bitcoin. His view links regulatory clarity directly to potential inflows from institutions that currently prefer a narrow set of crypto exposures.

Why this matters for miners in Russia

For small and mid-size miners in Russia, O'Leary's emphasis on land and power highlights that site economics remain central to competitiveness. Even if you operate a few dozen or a few hundred machines, access to reliable power and sites that can scale matters when firms and capital buyers decide where to grow operations. Observing where investors secure land and power can inform local decisions about expansion, equipment deployment and partnerships with service providers.

At the same time, his views on institutional demand suggest that most large capital flows will concentrate in bitcoin and ether, which can affect market liquidity and institutional product development. Miners should factor potential shifts in demand and regulatory developments into both operational planning and how they allocate mined coins or proceeds.

What to do?

- Check your power contract and scalability: confirm that your current site can handle load increases or that you can move to a site with clearer power arrangements.

- Prioritise bitcoin and ether exposure when planning sales or treasury policy if you want to align with likely institutional demand.

- Monitor regulatory developments in the U.S. and globally that affect stablecoin yields and exchange services, since these rules can influence exchange features and product availability.

- Consider partnerships or leasing options rather than large upfront land or build investments if you prefer operational flexibility.

- Follow industry reporting on infrastructure deals and energy issues, including coverage of mining trends and AI energy impacts, to anticipate changes in site economics; for example, see AI energy impact.