Anthropic, the company behind the Claude chatbot, is set to raise $20 billion in fresh investment in a round that would value the firm at $350 billion. The financing, originally targeted at $10 billion, quickly attracted more capital than expected and is being led by Singapore’s sovereign wealth fund GIC together with U.S. investor Coatue. According to reporting, $10–15 billion of the new funds will arrive as early as Tuesday, with the rest to be finalised in the coming weeks.

Anthropic's $20 Billion AI Funding Round

The round significantly exceeds Anthropic’s initial $10 billion target and includes participation from Sequoia Capital alongside the lead investors. The structure, with a sizeable portion delivered quickly and the remainder staggered, underlines the scale of interest from venture and institutional backers. The reported terms place Anthropic at a $350 billion valuation following the financing.

Impact on Bitcoin Mining Sector

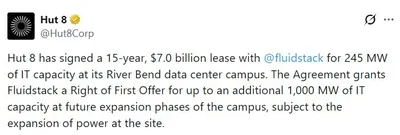

Markets reacted to the funding by favouring miners with AI and high-performance computing positions; IREN and Cipher Mining rose by more than 12%, while Hut 8 and TeraWulf posted gains of more than 8%. Smaller AI-linked tokens showed modest moves as well. For background on IREN’s position among miners, see IREN leads, and for Hut 8’s AI deals more broadly see Hut 8 deal.

Tech Giants' Previous Investments in Anthropic

Before this round, Microsoft and Nvidia had already committed significant capital to Anthropic, with Microsoft putting forward $10 billion and Nvidia $5 billion. Those earlier commitments are part of the company’s broader financing history and help explain why the latest round attracted large institutional interest. Together, these investments reflect ongoing capital flow from major tech firms into Anthropic.

Market Implications for AI Infrastructure

The size and speed of the round signal strong investor appetite for AI-related businesses and infrastructure, and they highlight a rotation of capital toward AI and high-performance computing use cases. This shift has been one factor behind recent stock moves in miners that are positioning for AI workloads. For more on how AI trends affect mining economics, see AI and margins.

Why this matters

For small and mid-size miners in Russia running from 1 to 1,000 devices, the headline funding round does not change day-to-day mining operations directly. However, the market reaction shows that investors reward companies pivoting to AI/HPC, and that can lift equity prices and interest in firms offering those services. If you supply capacity, components or services to larger AI-focused operators, those demand signals may be relevant to future business opportunities.

What to do?

- Monitor your cost base and power contracts carefully; short-term market moves do not alter electricity or hardware fundamentals.

- Track price and operational news for miners you hold or compete with, as equity moves can affect financing and partner choices.

- Assess whether any of your hardware or rack space can be repurposed for AI/HPC workloads, and weigh conversion costs against potential bids.

- Keep liquidity and paperwork ready in case counterparties seek quick capacity sales or equipment purchases following market shifts.