Hut 8 said it has signed a 15-year, $7 billion lease with AI cloud provider Fluidstack for a data center development at its River Bend campus in West Feliciana Parish, Louisiana. The company reported that the agreement covers 245 megawatts of IT capacity and that its shares rose about 20% in pre-market trading after the announcement. The lease includes a right of first offer for Fluidstack on up to an additional 1,000 MW in future expansion phases, subject to power availability at the site.

Hut 8's Stock Surge and Lease Agreement

The market reaction was immediate: Hut 8 shares jumped about 20% in pre-market trading following the announcement of the deal. The lease term is 15 years and totals $7 billion, tying Fluidstack into a long-term commitment at the River Bend campus. For more background on the announcement and its terms, see Hut 8 15‑year lease.

Details of the Lease Agreement

Hut 8 described the contract as a triple-net lease that includes a 3% annual base rent escalator over the initial term. The company said the arrangement is expected to produce roughly $454 million in average annual net operating income across the 15-year base term, totaling about $6.9 billion over that period. The agreement also grants Fluidstack a right of first offer on up to 1,000 MW of additional capacity for future expansion, contingent on available power at the site.

Financial Backing and Construction Plans

Fluidstack’s lease obligations and related pass-through costs are backed by Google, which the companies say provides a financial backstop for the deal. Hut 8 expects the first data hall at River Bend to be delivered by the second quarter of 2027, with additional halls scheduled later that year. To fund construction, Hut 8 plans site-level financing with up to 85% loan-to-cost funding expected to be underwritten by J.P. Morgan and Goldman Sachs, subject to final agreements and customary closing conditions.

Fluidstack's Expansion and Investor Interest

Fluidstack has been active in signing long-term colocation and infrastructure agreements with several public miners, including past deals with Cipher Mining and Terawulf, as it pivots toward AI and high-performance computing workloads. Bloomberg reported that Fluidstack was in talks to raise roughly $700 million in a funding round valuing the company at about $7 billion, illustrating investor interest in AI-focused data center platforms. Additional context on Fluidstack’s fundraising is available in Fluidstack $700M round.

Hut 8's Transition and Project Scale

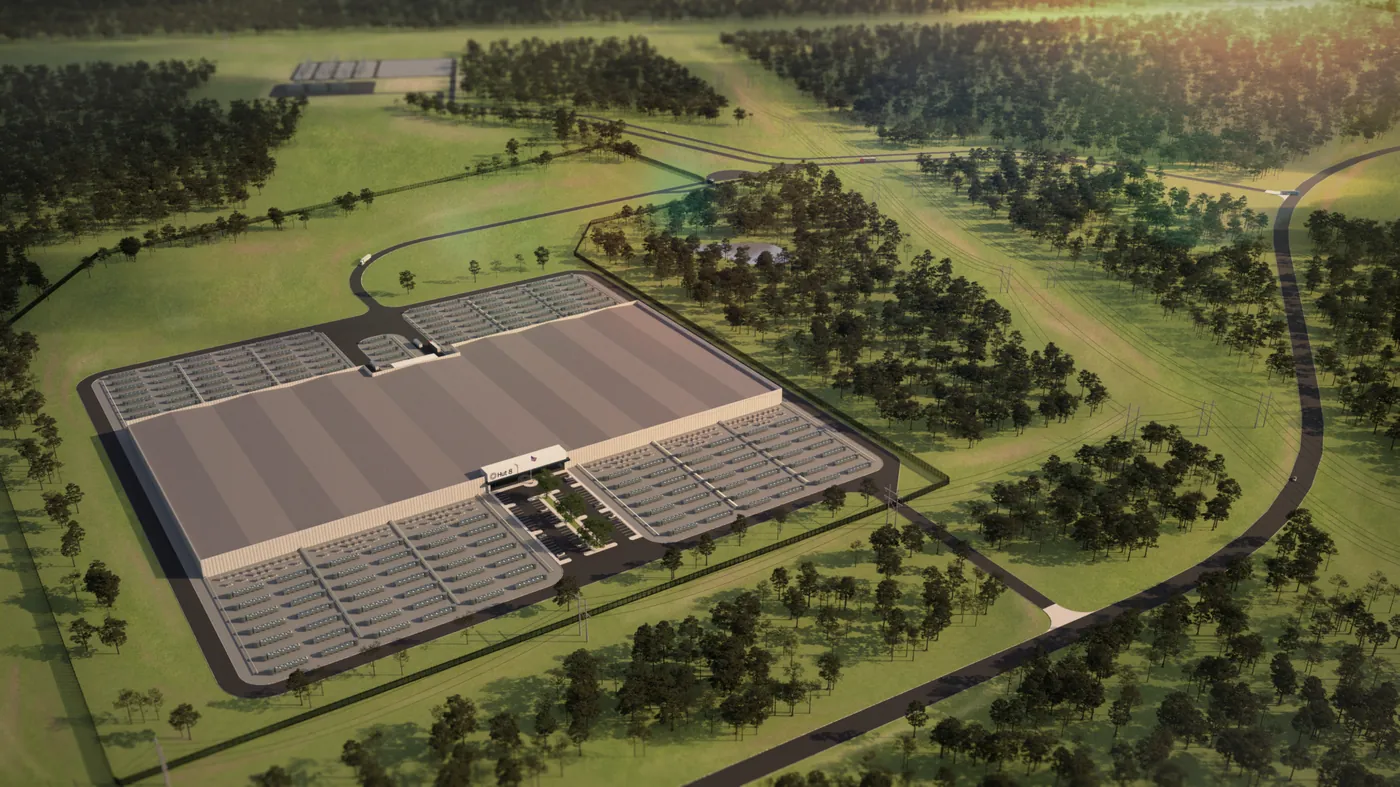

The deal is presented by Hut 8 as part of its transition from a pure-play bitcoin miner toward broader digital infrastructure and energy services. The company said it has secured an initial 330 MW of utility capacity for River Bend through Entergy Louisiana, with the potential to expand power availability by as much as an additional 1,000 MW in later phases. At full scale, Hut 8 stated the campus could rank among the largest data center developments globally.

Construction and Employment Impact

Jacobs will serve as the engineering, procurement, and construction management partner for the project, working alongside infrastructure provider Vertiv. Hut 8 said peak construction is expected to involve around 1,000 workers, while the completed campus would initially support at least 75 direct jobs and roughly 190 indirect and induced jobs in the surrounding region. These figures outline the local employment footprint the company expects during construction and early operations.

Why this matters

For an individual miner in Russia operating from a few rigs up to a small farm, the Hut 8–Fluidstack agreement shows how large power users are converting capacity into multi-year AI leases backed by major technology firms. The deal itself does not change local power rules or availability in Russia, but it reflects a broader shift where operators with large sites sign long-term contracts and secure external financial backing. Understanding this trend helps place local decisions—like seeking colocation or diversifying workloads—into a wider industry context.

What to do?

If you run from one to a thousand devices, consider these practical steps to stay prepared and responsive to industry changes. First, review your electricity contracts and tariffs to know how flexible your power costs are and whether long-term changes in demand could affect them. Second, evaluate simple diversification options, such as offering excess capacity for colocation or exploring high-performance workloads if technically feasible. Third, keep documentation ready—power agreements, equipment inventories, and cooling capabilities—so you can respond quickly if a colocation or repurposing opportunity arises.

Quick checklist

- Audit current power contracts and rates to understand cost structure.

- Document equipment, uptime, and cooling capacity for potential partners.

- Explore local colocation offers and regulatory requirements before approaching partners.