Dogecoin rose to $0.1516 as buyers pushed the token back through a key technical band, registering a 4.36% gain over the 24-hour period ending Jan. 4. This move came with volume running well above its 30-day norm, a signal traders use to judge participation in a rally. The upswing was part of a broader memecoin bounce that included both large- and small-cap tokens, rather than an isolated spike in a single name.

Dogecoin and Memecoin Rally Overview

The memecoin surge featured Dogecoin and Pepe at the front of the move: DOGE rose about 11% on the day while PEPE gained roughly 17%. Other dog-themed tokens also advanced, with Shiba Inu up about 8%, Bonk up nearly 11%, and Floki up close to 10%, reflecting broad speculative flows across the segment. For additional context on Dogecoin’s recent price behavior and related token dynamics, see Dogecoin and Shiba Inu.

The rally extended beyond the largest memecoins. Mog Coin climbed about 14% on the day and around 37% over seven days, while Popcat gained nearly 9% and is up more than 17% for the week. CoinGecko’s GMCI Meme Index category showed a market value of roughly $33.8 billion with about $5.9 billion in 24-hour trading volume, suggesting the move involved meaningful market-wide activity rather than a single-token burst.

Technical Analysis of Dogecoin's Price Movement

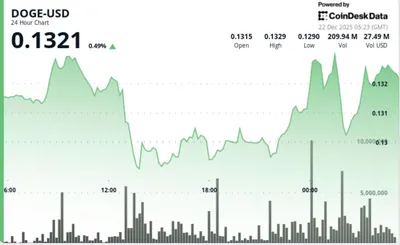

Over the 24-hour period ending Jan. 4, DOGE climbed 4.36% to $0.1516, outperforming the broader crypto market during the session. The rally came with volume running stronger than trend — the 24-hour volume moving average is elevated relative to the 30-day average (+40.10%), which traders view as confirmation that the breakout had participation behind it. Price action flipped structure late in the session as DOGE broke out of the $0.1422–$0.1431 consolidation pocket and built a new base above $0.1463, shifting where buyers and sellers are located.

Sellers are now identified around $0.1520–$0.1530, a nearby supply cluster that often tests momentum trades after a rebound. If DOGE can hold the new base near $0.1463 on pullbacks, that support increases the odds the $0.1520–$0.1530 band becomes an achievable near-term target rather than an immediate ceiling. For perspective on how recent moves fit into last year’s patterns, consult Dogecoin 2025 review.

Golden Cross Signal and Market Implications

Short-term trend signals also improved during the session: an hourly "golden cross" formed as the 9-period simple moving average crossed above the 26-period SMA. This is not a classic long-timeframe golden cross, but in fast markets it can be meaningful when paired with rising volume and a clean break through prior resistance. In this case, the pattern reinforced that the move attracted trading activity rather than being a quiet drift higher.

Still, such short-term signals are fragile in highly liquid and leveraged segments like memecoins; rising volume helps validate a breakout, but crowded positioning can reverse quickly if liquidity thins or larger markets wobble. That makes monitoring both price structure and volume essential in the hours and days after a spike.

Trader Insights and Risk Factors

The immediate technical question is whether DOGE can hold $0.1463 on pullbacks. If that level remains intact, traders may press toward the $0.1520–$0.1530 supply zone; if it fails, the prior range near $0.1432 becomes the next level of interest. These competing scenarios form the basis for both short-term bullish and bearish trading plans.

Meme tokens can stay bid even when larger benchmarks are range-bound, but they also tend to reverse quickly when positioning becomes crowded or macro liquidity shifts. Volume-confirmed momentum matters, yet durability requires conversion of short-term support into a dependable floor before higher targets are treated as sustainable.

Why this matters (for a miner in Russia)

As a miner in Russia with one to a thousand devices, short-lived memecoin rallies rarely change your operational needs, but they can affect the local crypto trading ecosystem and miner sentiment. Higher speculative activity can temporarily increase network activity on some chains and stir chatter in trading communities, which may influence short-term demand for mined coins or local exchange flows. At the same time, these moves are often fragile and do not necessarily create lasting changes to mining economics or power usage.

What to do? (practical steps for a miner in Russia)

- Monitor price and volume: keep an eye on DOGE holding above $0.1463 and the 24-hour volume trend; high-volume breakouts are more likely to stick than thin-volume spikes.

- Limit exposure: if you hold any memecoins, consider position sizing that reflects high volatility — avoid increasing leverage or concentration during quick rallies.

- Watch liquidity and exchanges: sudden memecoin flows can affect local order books and spreads, so check exchange liquidity before large trades or conversions.

- Maintain operations: don’t change core mining settings based solely on short-term token moves; operational decisions should be based on longer-term economics.