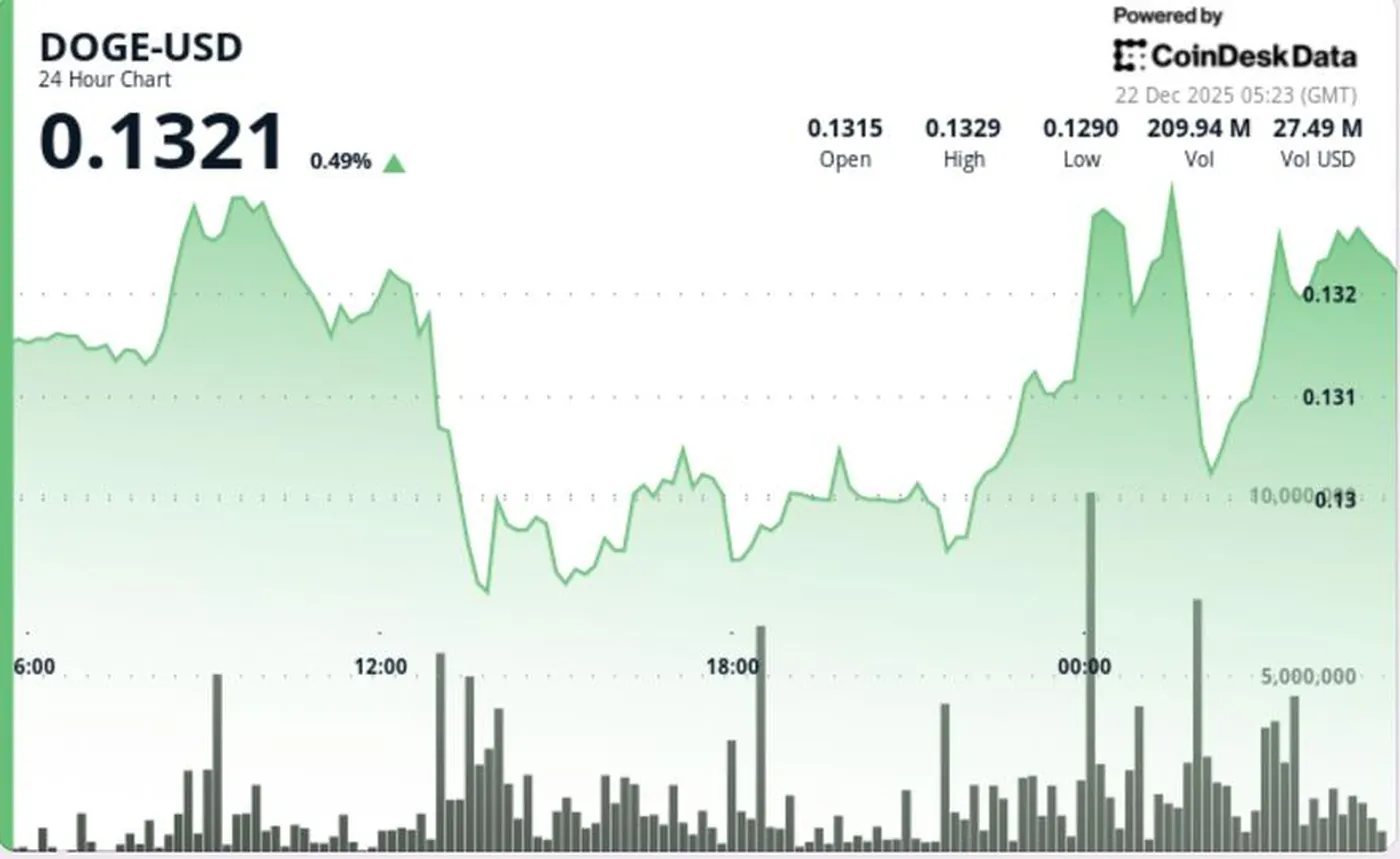

Dogecoin edged lower as sellers pushed the token below a short-term support area near $0.129, with higher turnover confirming a break from the recent consolidation. The 24-hour move was modest in percentage terms, but price action showed increased sensitivity around nearby technical levels and more active trading than in prior sessions.

Dogecoin Price Decline Overview

Over the 24-hour period ending Dec. 22, DOGE slipped roughly 0.3%, moving from $0.1309 to $0.1305 after failing to hold a support level that had contained price for several sessions. While the net percentage change was small, intraday volatility reached roughly 4%, reflecting sharper swings within the trading range. Aggregate volume rose sharply during the session, with turnover spiking well above recent averages as the market tested both the upper and lower bounds of that range.

Technical Analysis of the Breakdown

The technical picture weakened during U.S. and early Asian hours when DOGE lost footing near $0.1289, a level that had repeatedly drawn buyers in recent sessions. The breakdown coincided with a sharp increase in volume, which suggests active participation rather than a low-liquidity drift. The most decisive move occurred shortly after 02:00 UTC, when price slid from the $0.132 area toward $0.130 on a concentrated burst of selling, marking a clear exit from the prior consolidation and flipping former support into resistance.

Price Action Summary

During the session DOGE traded between roughly $0.134 and $0.130, with an early rally failing near $0.134 resistance before sellers stepped in. Late-session selling pushed price below $0.129 briefly before the market found some footing and stabilized near $0.130. On shorter timeframes, DOGE now trades below its immediate moving averages, and momentum indicators are leaning lower rather than showing divergence.

Key Levels to Watch

Near-term overhead pressure sits around the $0.132–$0.134 area after the failure to hold the range. The $0.129 mark is the first downside level to monitor, since late-session selling breached that level before price steadied. Reclaiming $0.129–$0.130 on rising volume would be needed to neutralize the bearish setup, while continued elevated volume without upside follow-through could point to further consolidation lower.

Why this matters

For miners, the move signals that short-term technical support has weakened and that the market is trading with higher volume and volatility. Even if your operation is small, the increased intraday swings and volume mean trading conditions can become choppier, affecting decisions around selling mined DOGE or timing conversions. Understanding which levels traders are watching helps you avoid selling during brief liquidity-driven moves and informs when to consider converting holdings.

What to do?

If you run mining equipment in Russia with anywhere from one to a thousand devices, prioritize simple risk steps: track the $0.129–$0.130 area as the immediate reference for short-term price behavior, since that band was tested and briefly broken during the session. Consider spacing out sales rather than liquidating a full batch at once, especially while volume remains elevated and momentum indicators lean lower.

Also keep an eye on moves back above $0.132–$0.134; a reclaim with rising volume would reduce near-term bearish pressure. For more on Dogecoin market context and exchange mechanics, see our Dogecoin exchange overview and the Dogecoin price forecast for longer-term perspective.