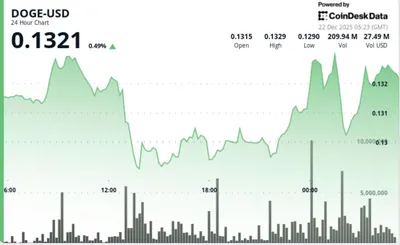

Dogecoin and PEPE led a sharp rally among meme coins as markets started the year, with Dogecoin up about 11% over 24 hours and PEPE rising roughly 17% on the day after a stronger intraday push. The move was not limited to those two names: token groups tied to dog themes and smaller-cap meme coins also posted gains, signaling broader speculative interest rather than a single-token event.

Meme Coins Surge in Early 2026

The biggest moves came from Dogecoin and PEPE, which showed the largest single‑day gains among major meme tokens. For additional context on Dogecoin price action and expectations, see Dogecoin price outlook, which discusses recent dynamics and technical setups.

Other notable performers included several dog-themed and community-driven tokens. Shiba Inu was up 8%, Solana’s Bonk added nearly 11%, and Floki climbed close to 10%. Smaller-cap names moved faster in some cases: Mog Coin was up about 14% on the day and roughly 37% over seven days, while Popcat gained nearly 9% and is up more than 17% on the week.

Market Overview and Trends

CoinGecko’s GMCI Meme Index category showed a market value of roughly $33.8 billion, with about $5.9 billion in 24‑hour trading volume, indicating that activity stretched across the meme-coin basket rather than concentrating in a single token. That breadth suggests traders were rotating into multiple meme names during the move.

Alongside the headline numbers, market participants noted momentum-driven flows and traders chasing liquid meme names after the holiday period. For further reading on how Dogecoin and related tokens have behaved, see the piece Dogecoin and Shiba Inu analysis, which examines key levels and recent dynamics.

Reasons Behind the Surge

- Bitcoin’s range-bound action removed an obvious macro catalyst, leaving room for risk-on rotations.

- Liquidity remained uneven after the holidays, which can amplify moves in higher‑beta assets.

- Traders looked for the highest‑beta places to express risk, and meme coins often attract momentum flows without requiring a fundamental narrative.

Future Outlook and Risks

Short-term bursts in meme coins can be self-reinforcing but remain fragile: when positioning gets crowded, spot demand thins, or Bitcoin weakens, the same leverage that pushes prices up can accelerate downside moves. That makes these rallies prone to quick unwinds if speculative appetite reverses.

One way market participants frame this action is as a gauge of speculative appetite: if more large meme tokens continue to outperform Bitcoin over a set window, it points to rotation into higher-risk corners of the market; if not, the move can fade rapidly.

Why this matters

If you run mining equipment — from a single rig to a small farm of several hundred units — a meme‑coin surge like this mostly reflects trader behavior rather than changes in mining fundamentals. Mining revenue from PoW networks isn't directly tied to meme-coin prices, but shifts in market speculation can influence broader market sentiment and short-term liquidity conditions.

For small operators in Russia, the key takeaway is that such rallies can be fast and volatile; they rarely change power costs or block rewards overnight, yet they can affect how quickly holders move assets and how liquid secondary markets feel.

What to do?

- Monitor your cashflow and electricity costs first — short speculative rallies rarely alter those operational factors.

- Keep a clear reserve policy for payouts and avoid reacting to short-term price spikes when making equipment or financing decisions.

- If you trade mined coins, watch liquidity and volume (the GMCI numbers above show the level of trading activity) and avoid adding leverage during highly speculative moves.

- Track a few reliable sources for price and volume updates, and set alerts rather than checking prices continuously to reduce reactive decisions.