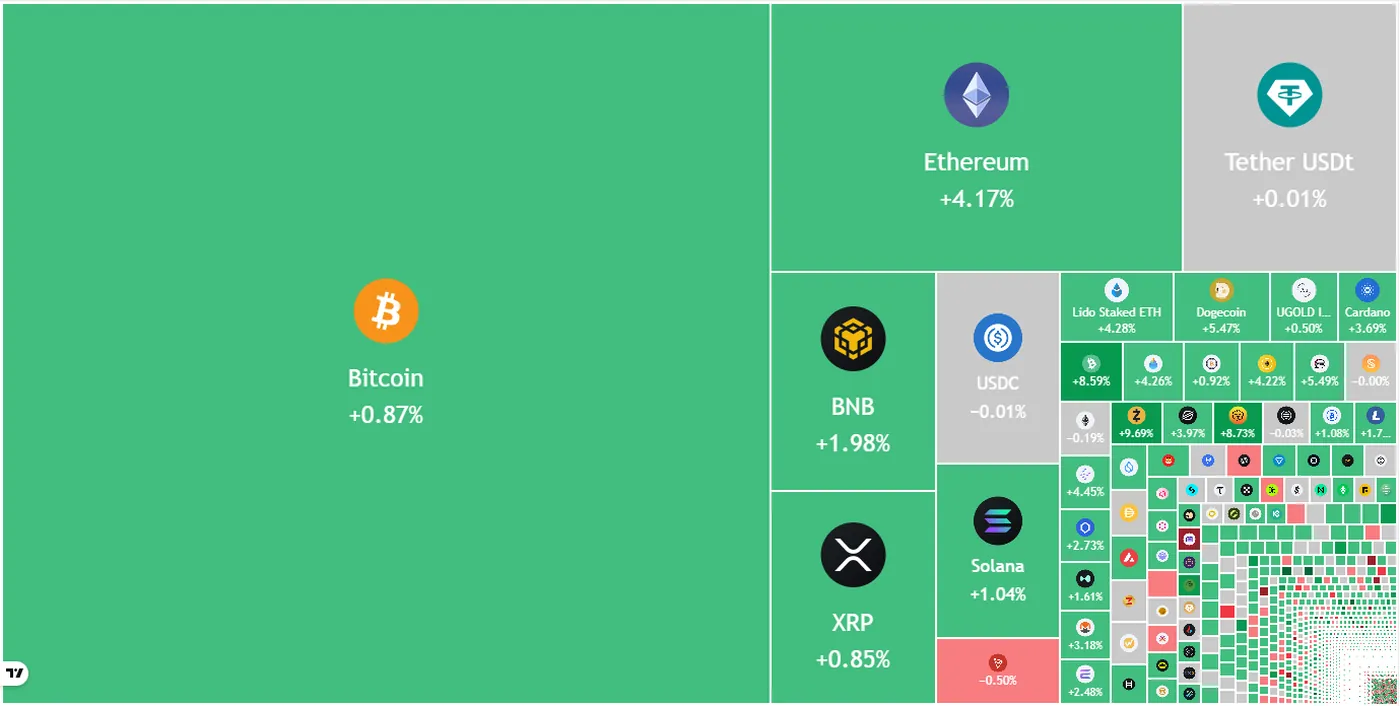

Bitcoin and many major altcoins are attempting a recovery, but negative sentiment and selling at range highs are limiting follow-through. The market saw Bitcoin move above $89,000 after the Bank of Japan raised rates to around 0.75%, yet bulls have had difficulty keeping prices elevated. Several top tokens show short-term rebounds from defined supports, while selling pressure at moving averages and resistance zones remains a constraint for a sustained uptrend.

Overview of Current Cryptocurrency Market

Across the board, buyers are testing supports but rallies tend to attract sellers, which keeps the near-term trend uncertain. Bitcoin is attempting to recover from the $84,000 level, and many altcoins are in relief rallies or trying to reclaim recent breakdowns. The Bank of Japan rate decision pushed Bitcoin above $89,000, a move covered in more detail in our BoJ rate hike report, though bulls are still struggling to hold higher levels.

Bitcoin Price Prediction

Buyers are defending the $84,000 support, but overhead moving averages and selling at rallies indicate bears have the upper hand for now. If price turns down sharply from the shorter-term EMA, the BTC/USDT pair could slip toward lower support near $80,600, while a sustained move above key resistance around $94,589 would be needed to signal a near-term trend change. Longer-range upside targets mentioned in the analysis include $100,000 and $107,500, but the path depends on whether bulls can overcome the selling pressure at the moving averages.

Ether Price Prediction

Ether is attempting a relief rally from support near $2,700, which shows buying interest on dips. Overhead resistance is clustered between the 50-day SMA at $3,161 and $3,450, and a failure at those levels could send ETH back to the $2,700–$2,623 support zone or lower toward $2,250. Conversely, a convincing break above $3,450 would invalidate the near-term bearish view and could open the way toward higher targets such as $3,918.

Altcoin Price Predictions

BNB is attempting to bounce off its uptrend line, but higher levels tend to attract sellers and a drop to $790 could become likely if moving averages cap the rally. XRP is showing demand at the support line of a descending channel, though downsloping averages and RSI suggest bears retain an edge unless buyers push above the 50-day SMA. Solana fell below the $121 level, with sellers unable so far to sustain lower prices, while Dogecoin remains beneath $0.14 as bulls try to kick off a relief move.

Cardano recently slipped below the $0.37 support and buyers are working to reclaim that level, supported by a positive RSI divergence that hints at reduced selling pressure. For broader perspective on ether and other tokens, see our ETH and altcoins outlook, which reviews similar support and resistance dynamics for major altcoins.

Bitcoin Cash and Other Altcoins

Bitcoin Cash shows relative strength after buyers successfully defended the 50-day SMA near $535, and bulls will look to push the price above $615 to resume the up move. Hyperliquid has turned up from $22.19, signaling aggressive defense of the Oct. 10 low, while Chainlink is finding buying interest in the $11.61 to $10.94 support zone as bulls attempt to halt its slide. These pockets of support contrast with tokens that are still failing to sustain rallies at key moving averages.

Expert Opinions and Market Sentiment

Market commentators offer divergent long-term views that feed current sentiment. Arthur Hayes projected dollar/yen to reach the 200 level and said “BTC to a milly,” a bullish macro take tied to currency moves. Jurrien Timmer of Fidelity suggested BTC may have topped at $125,000 and expects an off-year in 2026 with support in the $65,000 to $75,000 zone, while Tether CEO Paolo Ardoino said Bitcoin might not face 80% corrections like prior cycles.

Why this matters

For miners, price moves and sentiment directly affect the fiat value of mined coins and the timing of any coin sales. Even if your farm is small, swings between the cited supports and resistances change daily revenue in rubles, so knowing where BTC and major altcoins are finding support helps with short-term cash-flow planning. At the same time, defended technical levels—like BCH’s 50-day SMA or HYPE turning up from $22.19—show where buying interest may reduce downside risk for specific coins.

What to do?

If you run 1–1,000 devices in Russia, prioritize clear, low-cost actions: track USD and crypto price levels that the analysis highlights, keep an eye on the $84,000 BTC support and $2,700 ETH support, and avoid assuming rallies will hold without confirmation above resistance zones. Maintain basic operational hygiene by reducing downtime, checking power contracts, and ensuring rigs run efficiently to protect margins when prices retreat.

For cash management, consider staged selling instead of liquidating large holdings at once, and set alerts on the key levels discussed here so you can act when prices either break support or clear resistance. Finally, stay informed about market-moving commentaries and on-chain signals, but avoid treating any single forecast as guaranteed; use the technical levels in this update to guide, not dictate, your operational and selling decisions.