Brazil’s Federal Supreme Court has launched a formal review of the country’s prohibition on using cryptocurrency in political campaigns. The review is led by Justice Alexandre de Moraes and the panel is required to complete its analysis by March 2025. Under current rules, Law 9,504/1997 and Resolution 23,610 prohibit cryptocurrency donations, a framework the court is now re-examining in light of growing digital-asset use.

Background and Legal Context

The existing electoral framework explicitly restricts anonymous contributions and requires traceable transactions, which is why cryptocurrency donations have been excluded under Law 9,504/1997 and later reinforced by Resolution 23,610. The Superior Electoral Court (TSE) has enforced these limits as part of broader efforts to keep campaign finance transparent and auditable. The Supreme Court’s reconsideration focuses on whether updated rules or safeguards could allow compliant cryptocurrency use without undermining those transparency goals.

Supreme Court’s Review Process

Justice Alexandre de Moraes heads the review panel charged with assessing legal and technical options for regulated cryptocurrency donations. The court set a firm deadline: the analysis must be finished by March 2025, which leaves time for any judicial guidance to be considered before the 2025 election cycle. The review examines legal precedent and possible regulatory adjustments rather than immediately changing the status quo.

Political and Public Advocacy

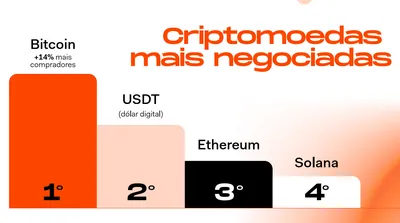

Political voices have pushed for integration of digital assets into campaign finance, with some candidates arguing that cryptocurrencies can expand participation while remaining transparent if properly regulated. A 2024 survey from the Brazilian Cryptocurrency and Blockchain Association (ABCB) found that 16% of Brazilian adults hold some form of cryptocurrency, and that demographic shift has driven part of the political momentum. This discussion takes place alongside reporting that crypto activity rose in recent years, which parties and campaigns are watching as they shape proposals.

International Comparisons

The Supreme Court’s review explicitly looks at foreign models, including the U.S. Federal Election Commission’s approach to cryptocurrency donations and more comprehensive integrations implemented elsewhere. Comparisons to those frameworks help the court assess practical safeguards—such as donor identification and reporting requirements—that have been applied in other jurisdictions. The goal is to find a path that preserves electoral integrity while considering international experience.

Technological and Security Considerations

The court and its technical advisors are weighing whether available technologies can address long-standing concerns about anonymity, traceability and compliance. Discussions referenced in reporting include cryptographic and blockchain-based mechanisms that could, in principle, verify donation legality without exposing sensitive personal data. Any adoption would depend on demonstrable, audit-ready systems that meet Brazil’s legal standards for transparency and accountability.

Economic and Voter Impact

Public interest in cryptocurrency policy is concentrated among younger voters: a February 2025 Datafolha poll found that 34% of voters aged 18–34 consider crypto policy “very important” when evaluating candidates. Proponents argue that permitted crypto donations could open new funding channels and engage tech-savvy constituencies, while regulators remain attentive to risks tied to market volatility and illicit finance. These debates are particularly salient in urban areas with higher digital-asset adoption trends such as those covered in analyses of youth and stablecoins.

Почему это важно

Если запрет будет пересмотрен, это не изменит напрямую работу майнера в РФ, но может повлиять на спрос и обращение криптовалют в международном информационном поле. Для майнера с 1–1000 устройств важнее следить за юридическими рамками в своей юрисдикции и сохранять прозрачность операций, чтобы избежать проблем с отчётностью или платёжными потоками.

Что делать?

- Следите за итогом решения Верховного суда Бразилии и профессиональными сводками — это поможет оценивать международные тренды, не вводя в заблуждение о локальных рисках.

- Ведите подробный учёт поступлений и переводов криптовалют, фиксируйте источники средств и адреса, чтобы при необходимости подтвердить легальность операций.

- Не используйте криптовалюту для политических пожертвований без чёткой юридической базы; консультируйтесь с юристом при сомнениях по трансграничным переводам и налогам.