In 2025, cryptocurrency activity in Brazil saw a significant rise: the total transaction volume increased by 43%, and the average investment amount per user surpassed $1,000, equivalent to roughly 5,700 Brazilian reais. These figures come from a Mercado Bitcoin report reflecting activity on the largest exchange platform in Latin America.

Growth of Cryptocurrency Activity in Brazil

The Mercado Bitcoin report highlights a market shift from pure speculation toward more structured investments and portfolio planning. Alongside the overall transaction volume growth, 18% of investors allocated funds across more than one crypto asset, indicating a gradual adoption of diversification among users.

Popular Crypto Assets and Stablecoins

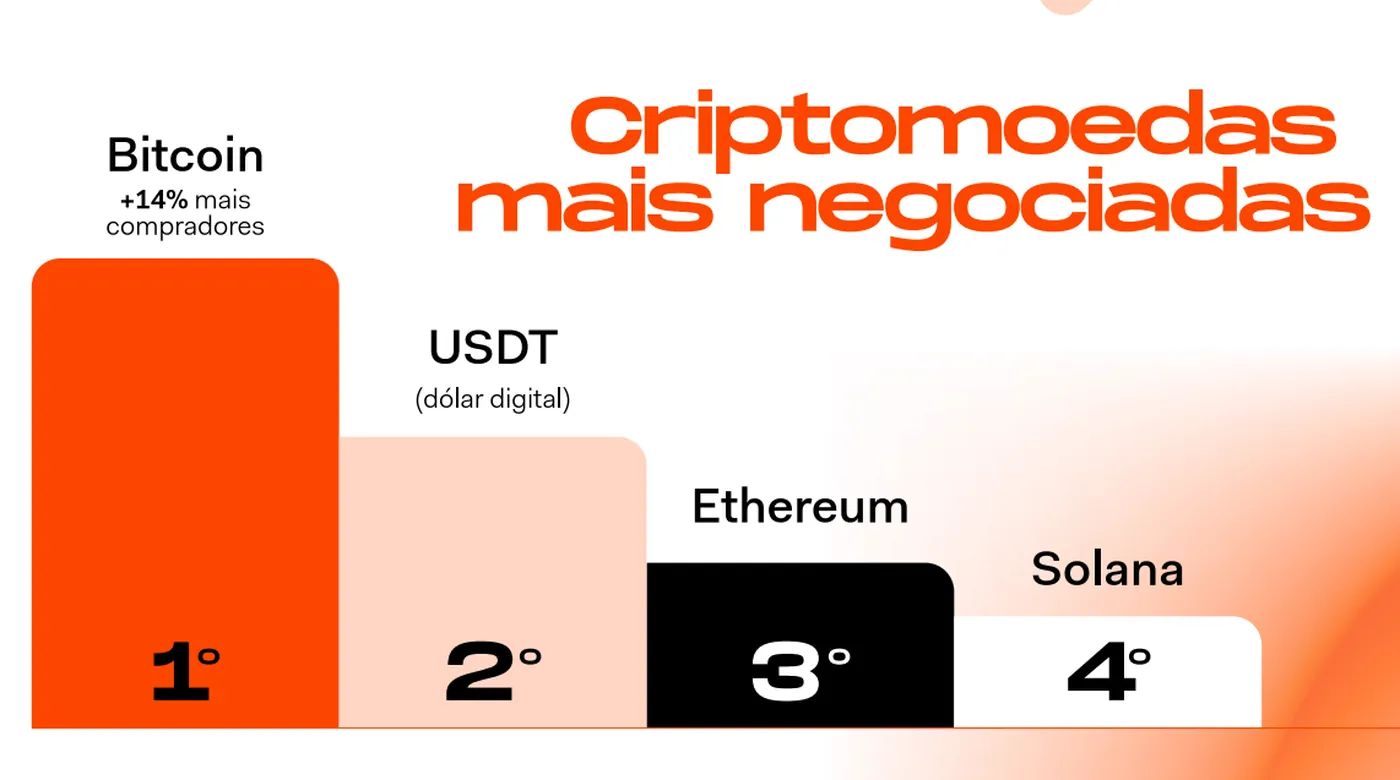

According to the report, Bitcoin (BTC) leads in trading volume, followed by the dollar-pegged stablecoin USDT, Ether (ETH), and Solana (SOL). Transactions involving stablecoins have roughly tripled compared to the previous year, making these coins a notable entry point for both new and existing investors.

- Bitcoin is the most traded asset.

- USDT, Ether, and Solana hold the next positions in trading volume.

- Stablecoins have driven a threefold increase in transaction numbers.

Growth of Low-Risk Crypto Products

Low-risk products based on digital assets have attracted substantial capital inflows: Renda Fixa Digital (RFD) recorded a 108% increase in investment volume. Additionally, Mercado Bitcoin distributed about $325 million among investors in 2025, underscoring growing interest in more stable instruments within the crypto ecosystem.

Demographic Changes and Regional Trends

Young investors are actively entering the market: the number of investors under 24 years old grew by 56% year-over-year. Demand is also expanding among other age groups, including wealthier and institutional participants. Regionally, the highest transaction volumes are concentrated in the southeast and south of the country, particularly in São Paulo and Rio de Janeiro; for more on youth and stablecoins, see the article stablecoin growth.

Investment Recommendations for Bitcoin

Itaú Asset Management, in its research, recommends allocating 1% to 3% of a portfolio to Bitcoin, viewing it as a distinct asset class with its own return profile and potential hedging role. Strategist Renato Eid noted Bitcoin's unique return characteristics, supporting the idea of a small targeted allocation within portfolios.

Why This Matters

For miners in Russia, Brazil's statistics do not directly affect equipment operation but reveal important market trends influencing liquidity and user behavior. The sharp rise in stablecoin transactions and interest in low-risk products indicates that some demand for crypto trading and exchange is shifting toward more "calm" instruments, while Bitcoin remains central to trading activity.

What to Do?

If you operate between 1 and 1,000 devices, it’s useful to stay informed about market benchmarks and prepare for various scenarios. First, consider that some investors prefer stablecoins and low-risk products, so plan liquidity and withdrawal options accordingly. Second, diversifying income streams and regularly maintaining equipment will help reduce operational risks and preserve mining profitability.

- Monitor exchange liquidity and demand for BTC and stablecoins.

- Consider converting part of your revenue into stablecoins to reduce volatility.

- Maintain equipment and document expenses to understand profitability.

If you need more information on stablecoin development and exchange initiatives, the article on launching an exchange stablecoin is helpful — exchange stablecoin, which discusses potential effects on liquidity.