Veteran trader Peter Brandt says the proposed U.S. CLARITY Act improves regulatory clarity but is unlikely to change Bitcoin’s core value proposition. He views the bill as useful "housekeeping" rather than a catalytic event that would automatically send prices much higher.

Peter Brandt’s Perspective on the CLARITY Act

Brandt described the CLARITY Act as a positive step toward clearer rules for the crypto market, noting that it helps define roles for agencies such as the SEC and the CFTC. At the same time, he emphasized that clearer regulation is not, by itself, a fundamental driver that will redefine Bitcoin’s value.

Why Regulatory Clarity May Not Skyrocket Bitcoin’s Price

Brandt argues that while regulation can change market sentiment, the Bitcoin price depends on a broader mix of factors and is not driven solely by U.S. legislative moves. In his view, the bill might ease some bearish sentiment but should not be expected to trigger a sudden, large rally.

- Bitcoin’s price reflects global adoption, macroeconomic conditions, and scarcity rather than a single regulatory act.

- The CLARITY Act is useful for market structure but is not presented as a primary price catalyst.

- Short-term market moves are shaped by many interacting technical and economic pressures.

Brandt’s Previous Bitcoin Price Forecast

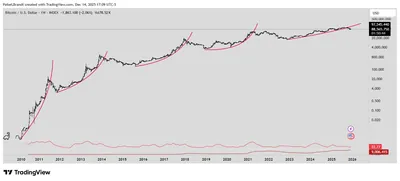

This stance aligns with Brandt’s recent technical reading of Bitcoin. He drew a parallel between Bitcoin’s chart patterns and the soybean market of the 1970s, using that analogy to outline possible downside risks. Based on that comparison, he warned of a potential correction to the $60,000 level, a view that informs his caution about regulatory headlines.

Why this matters (for miners)

If you run mining hardware in Russia—whether one device or a thousand—the immediate practical effect of the CLARITY Act on your daily operations is likely limited. Brandt’s point is about price mechanics, so your costs, power availability, and equipment efficiency remain the primary determinants of profitability.

What to do?

For miners, the sensible response is to avoid reacting to the legislation as if it were a guaranteed price catalyst and instead focus on operational resilience. Keep monitoring revenue versus costs, plan for price volatility, and maintain clear risk management rules so that a regulatory headline does not force rushed decisions.

Actionable Insights for Investors

Brandt’s message is a reminder to prioritize long-term strategy over headline hunting. Don’t rely on a single bill to drive investment decisions; consider adoption trends, scarcity, and macro conditions as the more durable influences on Bitcoin’s value.

For readers interested in how demand dynamics are shaping price pressure, see the CryptoQuant slowdown analysis in our archive. For perspectives on possible near-term technical retests, consult this price retest warning piece.

FAQ

What is the CLARITY Act?

The CLARITY Act is a proposed U.S. bill intended to create a clearer regulatory framework for cryptocurrencies and digital asset markets, defining the roles of agencies like the SEC and the CFTC.

Why does Brandt think it won’t affect Bitcoin’s price much?

Brandt believes that while the bill improves regulatory clarity, Bitcoin’s value is determined by broader factors such as adoption, macroeconomic conditions, and scarcity, so the legislation alone is not a fundamental price driver.

Did Brandt give a price forecast?

Yes. Drawing an analogy to the soybean market of the 1970s, Brandt suggested a possible correction down to the $60,000 level, a technical view that underpins his cautious take on regulatory news.

Should miners change their plans based on this bill?

Brandt’s analysis suggests not to base operational or investment decisions solely on the bill’s passage. Miners should focus on cost control, equipment efficiency, and risk management rather than expecting a regulatory event to significantly and immediately boost prices.