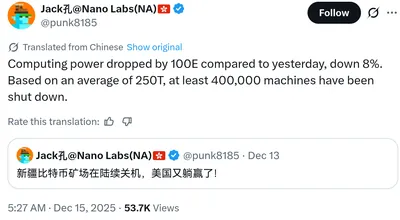

Bitcoin’s network hashrate has dropped about 12% since November 11, marking the deepest drawdown since the market was recovering from China’s 2021 mining ban. CryptoQuant data shows the hashrate sitting near 970 exahashes per second, its lowest level since September 2025. The decline accelerated after extreme winter weather in the United States disrupted power at major mining hubs, and several publicly listed miners temporarily shut down machines to protect equipment and comply with grid curtailments.

Hashrate Decline and Causes

The roughly 12% fall in total network hashrate is the largest contraction since October 2021, according to the reported data, and leaves the network near 970 EH/s. That level is the lowest recorded since September 2025, underscoring a clear pullback in mining activity that began as bitcoin retreated from a $126,000 all-time high toward the $100,000 area late last year.

The drop sped up this week as extreme weather disrupted power supply across key U.S. mining regions, forcing some operations to curtail or temporarily power down equipment. Several publicly traded miners paused machines both to protect infrastructure and to comply with grid curtailment requests, amplifying an already softening trend in hashrate.

Impact on Mining Revenue and Production

The hashrate shock translated quickly into miner economics: daily bitcoin mining revenue fell from roughly $45 million on January 22 to about $28 million two days later, before rebounding modestly to around $34 million. That rebound remains well below recent averages, reflecting both lower network activity and weaker bitcoin prices.

Production contracted sharply across the industry. Output from the largest publicly traded miners fell from 77 bitcoin per day to 28 bitcoin per day, while production from other miners declined from 403 bitcoin to 209 bitcoin. On a 30-day rolling basis, publicly listed miners recorded a 48 bitcoin decline in production and non-public miners dropped 215 bitcoin, highlighting the scale of the pullback in supply.

Miner Profitability Challenges

Profitability measures have weakened alongside the production and revenue falls. CryptoQuant’s Miner Profit and Loss Sustainability Index declined to 21, its lowest reading since November 2024, indicating that a growing share of miners are operating under stressed economics. Revenues have in many cases failed to cover operational costs even after multiple downward difficulty adjustments, which have so far provided only limited relief.

Those difficulty adjustments reduced short-term pressure as machines went offline, but they have not fully offset falling prices and operational disruptions. The combination of lower output, compressed revenue and ongoing grid risks has produced one of the more severe stretches for mining economics since the post-China-ban reset.

Future Outlook for Bitcoin Mining

If hashrate remains suppressed, the network could see further difficulty cuts in coming weeks, which would give some margin relief to remaining operators. For now, the available data point to a marked deterioration in mining conditions reminiscent of previous major drawdowns, driven this time by weather-related disruptions and price weakness.

Why this matters

For a miner running from a single rig up to a few hundred units in Russia, the current hashrate and revenue swings mean daily earnings can be volatile and operational risks may increase. Grid curtailments and planned shutdowns abroad can still affect global difficulty and revenue, so even if local power is stable, income may fall when network production drops and prices slip.

Lower revenue and weaker profitability index readings imply tighter margins for many operators, increasing the importance of managing power costs, maintenance schedules and payout expectations. In short, the situation can reduce short-term cash flow and raise the chance that competitors will take machines temporarily offline, which changes network conditions.

What to do?

Short-term actions you can take to protect operations include checking local grid conditions and any curtailment notices, staggering maintenance to avoid simultaneous downtime, and confirming that cooling and surge protections are functioning before severe weather. These steps help reduce the risk of forced shutdowns and equipment damage if supply or conditions deteriorate.

Operational and financial steps to consider are prioritizing lower-cost power windows, reviewing contract terms with hosting providers, and updating cash-flow plans to reflect lower revenue scenarios. Track production and revenue trends closely and consult the mining profitability report for recent performance context, and monitor signals that difficulty could fall as machines remain offline.