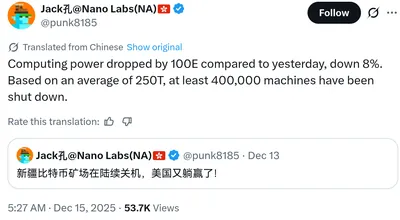

The Bitcoin network's hashrate dropped by 8%—approximately 100 EH/s—sparking widespread discussion in the industry. TheMinerMag analyzed the situation and concluded that the decline was temporary and not solely due to events in China. Industry figures, including Jack Kong, former co-chairman of Canaan and founder of Nano Labs, who was among the first to point out the shutdowns, participated in the discussion.

Summary: What Happened

On December 13, social media reported mass shutdowns of mining equipment, citing figures between 200,000 and 400,000 devices. A few days later, Kong stated that the hashrate fell by 8%—about 100 EH/s—which analysts confirmed. A review of causes and data was published by TheMinerMag; a detailed analysis can be found in another article Why Bitcoin's Hashrate Dropped.

Circulating Rumors

During the discussions, speculation arose about large-scale shutdowns: some claimed up to 500,000 machines totaling around 2 GW might have been involved. These estimates were cited on social media and by industry participants, including posts by Jack Kong. While these reports fueled debate, they are not confirmed facts of extensive or prolonged shutdowns.

Expert Data: Real Causes of the Decline

Experts indicate that the main contribution to the hashrate drop came from US-based pools; Foundry USA and Luxor recorded the largest declines, together accounting for about 200 EH/s reduction. Simultaneously, major Chinese-origin pools—Antpool, F2Pool, ViaBTC, SpiderPool, and Binance Pool—reduced their hashrate by roughly 100 EH/s. These figures suggest the decline had multiple causes and was not limited to events in a single region.

Recovery Dynamics and Exceptions

By December 17, most of the mentioned pools had nearly recovered, which experts interpret as a sign of a temporary disruption rather than a prolonged equipment shutdown. The exception was SpiderPool: by December 18, its hashrate remained about 20 EH/s lower, distinguishing it by the duration of its decline. This pattern helps differentiate short-term interruptions from actual equipment losses.

Impact on Other Networks

Alongside Bitcoin's events, Litecoin suffered notably: on December 15, its hashrate dropped 20%, from 3.38 PH/s to 2.65 PH/s, and had not recovered by the time of publication. Experts note that other PoW-based networks may show vulnerability during similar localized disruptions, reflected in their hashrates.

Context: China's Role in Mining

At the end of November, China's share in mining the leading cryptocurrency exceeded 14%, ranking it third globally. However, many large Chinese-origin pools are physically located outside China, so their hashrate drops may have been caused by factors unrelated to internal raids. This is important to consider when interpreting the geographic impact on the network.

Expert Conclusions and TheMinerMag Commentary

TheMinerMag believes that raids and inspections in China may have played a role but do not explain the entire hashrate decline; the article also suggests some miners in Xinjiang might have voluntarily shut down over the weekend and then rejoined the network. Experts thus view the drop as multifactorial and mostly temporary, supported by partial recovery by December 17.

Why It Matters

For owners of one or more farms in Russia, this event shows that large hashrate fluctuations can be short-lived and have various causes, including pool operations and local disruptions. Understanding that the decline was not solely due to raids in one region helps assess risks without undue panic and make balanced decisions about equipment operation.

Additionally, temporary hashrate drops in individual pools can affect revenue distribution and block discovery speed over short periods, so monitoring pool status and market news is advisable. Finally, hashrate declines in other PoW networks like Litecoin remind us that vulnerabilities may extend beyond a single protocol.

What to Do?

- Maintain monitoring: track your farm's hashrate and pool status in real time to quickly notice anomalies.

- Diversify pools: connect to a backup pool and test switching to minimize downtime if the main pool has issues.

- Schedule maintenance outside peak periods: avoid mass equipment shutdowns during network spikes.

- Follow industry news: timely information from sources like TheMinerMag and specialized publications helps distinguish rumors from confirmed data.

- Analyze geographic risks: consider that some pools may physically operate outside their stated countries and verify their data center status.

For a deeper dive into the reasons behind the hashrate drop and pool data, see our analysis Why Bitcoin's Hashrate Suddenly Dropped, as well as the article on the impact of Xinjiang mining shutdowns on hashrate Bitcoin Hashrate Fell 8%.