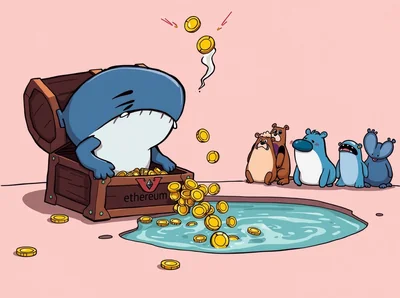

Spot Ethereum Exchange-Traded Funds (ETFs) have recently experienced significant net outflows, totaling $224.9 million over three consecutive days. This trend highlights a notable shift in investor behavior within the Ethereum ETF market. Understanding the nature of Spot ETH ETFs and the implications of these outflows is essential for market participants.

Overview of Spot ETH ETFs Outflows

Spot ETH ETFs are investment funds that track the price of Ethereum by holding the actual cryptocurrency, offering investors direct exposure without owning ETH themselves. The recent pattern of net outflows amounting to $224.9 million over three straight days signals a sustained withdrawal of capital from these funds. This consecutive exodus underscores a significant movement in the market that warrants attention. See also: Spot Bitcoin ETFs Experience $351.7M Outflow Led by Fidelity

Factors Contributing to the Exodus

Several market conditions may be influencing this investor behavior. Changes in broader cryptocurrency market sentiment, shifts in regulatory outlooks, or alternative investment opportunities could be driving the sustained outflows. Comparing this period to previous ones reveals that such consecutive withdrawals are unusual, suggesting a notable change in how investors view Spot ETH ETFs currently.

Impact on Ethereum and ETF Market

The outflows from Spot ETH ETFs can affect Ethereum's price and liquidity by reducing demand within these investment vehicles. For ETF providers, this trend may lead to adjustments in fund management and strategy to retain investor interest. Additionally, the market sentiment reflected by these outflows could influence future developments and investor confidence in Ethereum-related products.

Investor Strategies Amid Outflows

In response to these outflows, investors might consider reassessing their portfolios to manage associated risks effectively. This could involve diversifying holdings or exploring other investment avenues within the cryptocurrency space. Despite the challenges, current market conditions may also present opportunities for strategic entry or repositioning in Ethereum assets. See also: Bitcoin and Ether ETFs Experience Heavy Outflows While Solana and XRP ETFs Remain Positive

Why This Matters

For miners and investors in Russia operating between one and a thousand devices, understanding these outflows is important even if direct impacts seem limited. Market shifts in Spot ETH ETFs reflect broader investor sentiment that can influence Ethereum's ecosystem and price stability. Staying informed helps in anticipating potential changes in liquidity and market dynamics.

What To Do

- Monitor Spot ETH ETF trends regularly to stay updated on market movements.

- Evaluate your investment portfolio for exposure to Ethereum and related ETFs.

- Consider risk management strategies, including diversification and cautious allocation.

- Stay informed about regulatory and market developments affecting Ethereum and ETFs.