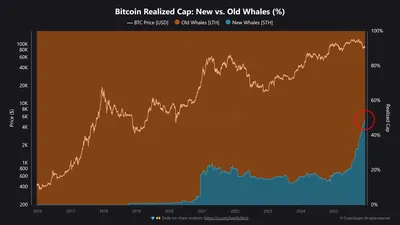

Bitcoin has struggled to regain momentum after the price dipped below $90,000 on Tuesday, and multiple analysts point to persistent selling pressure in the near term. Market data shows a growing share of realized capital now sits with recently active large holders, which shifts short-term dynamics away from long-term conviction. Taken together, these signs have analysts flagging a possible pullback toward the mid-$80,000s.

New Bitcoin Whales Dominate Market

On-chain analysis indicates that new BTC whales — defined as addresses holding over 1,000 BTC with UTXOs younger than 155 days — now control more realized capital than older, long-term holders. The realized price for this cohort sits near $98,000, meaning that with BTC trading below that level these new whales carry roughly $6 billion in unrealized losses. For more on how this cohort changes supply dynamics, see how new whales change in market structure.

Exchange Flows and Market Structure

Exchange data shows the Exchange Whale Ratio has surged into the 0.52–0.55 range, signaling that a large share of inflows is dominated by big transactions often associated with selling or reallocation. At the same time, Bitcoin is trading below both the 21-period daily and 12-period weekly exponential moving averages (EMAs), and several prior higher lows have been broken, reinforcing a bearish market structure in the short term. Order flow analysis records large negative delta clusters below $91,000 with more than $300 million in realized selling pressure, and related coverage has tracked how BTC has been unable to hold higher levels such as when the price recently stalled near $90,000 price stuck at $90,000.

Potential Price Drop to $85,000

Analysts point out a setup consistent with distribution: Bitcoin briefly broke above the Value Area High (VAH) only to re-enter the value area, a pattern futures analysts described as a "failed auction." Such moves increase the chance of rotation toward the Value Area Low (VAL), which currently sits near $86,000, and some market observers mark a pullback toward $85,000 as a plausible near-term scenario. While reclaiming key levels like $91,000 could trigger a short squeeze, current order flow and exchange metrics reinforce downside momentum unless those levels are decisively retaken.

Почему это важно

Для майнера в России, независимо от того, управляет ли он одной фермой или сотней устройств, такая концентрация капитала у новых китов увеличивает вероятность резких ценовых колебаний. Если крупные держатели под давлением продают на биржи, это может усилить краткосрочное снижение цены и повлиять на доходность майнинга и планирование продаж.

Кроме того, торговля ниже ключевых EMA и наличие крупных негативных дельта‑кластеров указывают на повышенную вероятность волатильности вблизи уровней $91,000–$95,000. Это означает, что периоды с пониженной выручкой от майнинга и быстрые ценовые движения не стоит считать редкостью в ближайшей перспективе.

Что делать?

- Проверить расчёт себестоимости: пересмотрите порог безубыточности с учётом текущих цен и тарифов на электроэнергию, чтобы понимать, при каких ценах майнинг остаётся целесообразным.

- Контролировать ликвидность: держите часть выручки в доступных средствах или на холодных кошельках, чтобы не продавать в периоды сильной распродажи.

- Следить за притоками на биржи: повышенные крупные переводы на биржи и рост Exchange Whale Ratio могут служить ранним сигналом усиления давления продавцов.

- Настроить прайс‑алерты: установите уведомления на ключевых уровнях ($91,000, $86,000 и $85,000) и по движению EMAs, чтобы быстро реагировать на изменение рынка.

Эта статья носит информационный характер и не является инвестиционной рекомендацией. Каждый майнер должен принимать решения, опираясь на собственные расчёты и уровень риска.