Bitfinex-linked whales have started reducing their BTC long exposure, a move that traders note often comes before big market swings. Data show whale long positions peaked at 73,000 BTC in late December and have since begun to decline, prompting renewed discussion about near-term price structure and risk.

Bitfinex Whales Reduce BTC Long Positions

Observers describe the current behaviour as an aggressive rotation out of longs on Bitfinex, echoing patterns that preceded past upside moves. The peak of 73,000 BTC in whale longs marked a local high, and the recent drop in those positions is drawing trader attention as a possible setup for the next market phase; see the related Bitfinex long trend for prior context. At the same time, commentators point to the Wyckoff framework when interpreting these flows rather than treating the moves as standalone signals.

Wyckoff Analysis and Market Signals

Analysis applying the Wyckoff method suggests a classic 'spring' — a flush lower that clears leverage — should appear before a larger reversal, according to market commentators. April 2025 provides a recent example: the start of a downtrend in longs coincided with BTC/USD dipping below $75,000, a swing low that Wyckoff practitioners label a spring and that preceded a rapid rally. That April flush removed leverage and was followed by a 50% rally to $112K over 43 days, which traders reference when considering how current whale behaviour might play out.

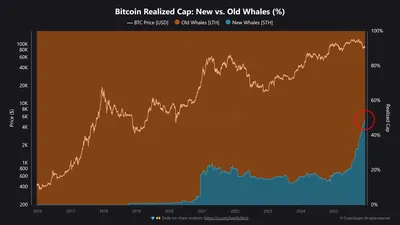

Decline in Whale Holdings

Over the past year onchain analytics indicate that overall whale holdings have fallen by over 200,000 BTC, with a specific drop of around 220,000 BTC in 2025. This reduction in large-holder inventories coincides with increased activity from smaller investor classes, a shift that onchain analysts describe as a sign of a maturing market cycle; for a focused look at those onchain trends see the CryptoQuant analysis. The net effect is a market structure less dominated by a single holder class, which can change how price moves when whales adjust positions.

Market Implications and Future Outlook

Whales closing long positions can increase short-term volatility, since liquidation of leverage and position rotation often amplify price swings. Some analysts connect the current pattern to a possible larger reversal and discuss a six-figure price target near $135K as one scenario, though the Wyckoff view stresses that a spring-type bottom would likely precede any sustained upside. In sum, reduced whale long exposure, lower whale inventories and growing participation from smaller holders together point to a market in transition rather than a single clear outcome.

Why this matters

If you run mining equipment, the immediate operational impact of whales closing longs is indirect: these flows influence short-term price volatility, which can affect revenue when you sell mined BTC. At the same time, a market shift away from whale-dominated holdings toward broader participation can mean price moves are driven by a wider set of actors, potentially changing the frequency and amplitude of spikes you may see when converting coins to fiat.

For miners in Russia with between one and a thousand devices, the key takeaway is that onchain shifts like these change market dynamics but do not directly alter mining mechanics or electricity needs. Still, awareness of periods with higher volatility helps plan cashflow and sell strategies, especially if you regularly convert mined BTC to cover costs.

What to do?

- Review your cashflow buffer and plan when to convert BTC to cover running costs; avoid forced sales during volatile flushes.

- Stagger sales of mined BTC instead of selling large batches at once to reduce exposure to sharp intraday moves.

- Keep operational records (consumption, uptime) and monitor price triggers so you can act promptly if a Wyckoff-style spring or rapid rally develops.

- Follow onchain and exchange flow reports for signs of renewed whale activity, as these often precede periods of elevated volatility.