Fluidstack is reportedly seeking approximately $700 million in a new funding round that would value the company at about $7 billion. Situational Awareness — the investment firm founded by former OpenAI researcher Leopold Aschenbrenner — is in talks to lead the financing. The startup has signed multi-year colocation leases with Cipher and Terawulf, and in those arrangements Google agreed to act as a backstop for creditors. Fluidstack also announced plans to relocate its headquarters to New York.

Fluidstack's Funding Round Details

The company is said to be targeting roughly $700 million in fresh capital, with the prospective financing implying a valuation near $7 billion. Situational Awareness is reported to be in discussions to lead the round, linking Fluidstack to a hedge fund active in AI investments. These terms highlight the scale of institutional capital now being directed toward firms that lease compute capacity for AI workloads.

Key Investors and Partnerships

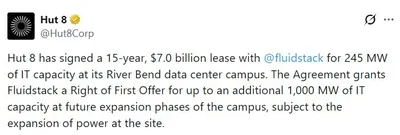

Situational Awareness, founded by Leopold Aschenbrenner, is a central potential backer and has recently increased its activity in related assets; the fund raised its stake in bitcoin miner Core Scientific to 9.4% as of October. Fluidstack has secured multi-year colocation agreements worth billions with public miners such as Cipher and Terawulf, and coverage of the funding round is available in related reporting on the deal (Fluidstack raises $700M). In those arrangements Google agreed to provide a creditor backstop, a feature that reflects more complex financing structures in AI data-center deals. Similar long-term leasing arrangements with miners are discussed in reporting on individual transactions, such as the Hut 8 lease, which illustrates how miners are becoming counterparties in AI hosting.

AI Data Center Market Trends

The prospective valuation and funding talks underline heightened investor interest in companies building infrastructure for AI workloads, and they accompany a wave of large-scale capital commitments across the sector. Bloomberg has noted large aggregate commitments by major tech firms to expand data-center capacity, an example being Meta Platforms' approximately $60 billion program for data-center expansion. These developments are part of broader moves by bitcoin miners and others to diversify into AI hosting and related services (miners investing in AI), and they have encouraged more elaborate financing models.

Fluidstack's Business Strategy

Fluidstack positions itself as a "neocloud" provider that leases compute capacity for AI development rather than operating a traditional public cloud. The company has transitioned from the UK and is relocating its headquarters to New York, while signing long-term colocation deals with miners to secure capacity and scale. Such partnerships tie Fluidstack's growth to public mining companies that are seeking additional revenue streams beyond Bitcoin mining, as illustrated by recent long-term miner agreements like the Hut 8 lease.

Why this matters

For individual miners in Russia with anywhere from one to a thousand devices, this news signals stronger institutional demand for colocated compute and an expanding market for non‑mining data-center services. Multi-year leases and creditor backstops indicate that large contracts and complex financing are becoming common, which can change how counterparties evaluate risk and cash flow. At the same time, the involvement of funds like Situational Awareness — and its stake in Core Scientific — shows investor crossover between crypto mining and AI infrastructure, which may affect partnership opportunities.

What to do?

- Review current contracts and capacities: if you operate excess utility or rack space, check whether leasing to AI neoclouds is feasible under your local regulations and power agreements.

- Scrutinize counterparties: before entering deals, examine the counterparty's financing structure and any creditor backstops such as the Google arrangement mentioned in reporting.

- Assess payment and default terms: insist on clear clauses for payment schedules, maintenance, and fault liabilities in multi‑year colocation agreements.

- Track relevant partners: keep an eye on public miners and providers that are signing long-term AI leases, since they may become customers or competitors.

- Consult advisers if needed: for cross-border contracts or large, multi-year deals consider legal and tax advice to understand obligations in Russia.