The Morgan Stanley Capital International Index (MSCI) is considering excluding crypto treasury companies that hold the majority of their balance sheets in cryptocurrency. Such a move could force these firms to sell as much as $15 billion in crypto assets, significantly impacting the market. This potential exclusion has sparked concern among industry participants and investors due to the scale of possible forced selling and market outflows.

Potential Impact of MSCI Exclusion on Crypto Treasury Firms

Analysts estimate that crypto treasury companies could face outflows totaling approximately $11.6 billion if MSCI proceeds with the exclusion. BitcoinForCorporations, an advocacy group opposing the proposal, projects outflows between $10 and $15 billion based on a verified list of 39 companies with a combined float-adjusted market capitalization of $113 billion. Notably, JPMorgan's analysis highlights that Michael Saylor's Strategy alone could experience $2.8 billion in outflows if removed from the MSCI indexes. This firm accounts for 74.5% of the total impacted market capitalization. Such significant selling pressure could exacerbate the ongoing downward trend in crypto markets that has persisted for nearly three months.

These figures underscore the substantial financial implications for crypto treasury firms and the broader market should MSCI finalize its exclusion decision.

MSCI’s Proposal and Industry Response

In October, MSCI announced it was consulting with the investment community about the possibility of excluding crypto treasury companies whose balance sheets are predominantly composed of cryptocurrency. MSCI indexes serve as key benchmarks influencing which companies passive investment funds include, making these decisions critical for companies' access to capital.

BitcoinForCorporations argues that using balance sheet composition as the sole exclusion criterion is unfair. They advocate for classification based on companies' actual business models, financial performance, and operational characteristics rather than a simple balance sheet metric. Reflecting widespread concern, a petition opposing the proposal had garnered 1,268 signatures at the time of writing.

Industry voices have also expressed opposition. Nasdaq-listed Strive urged MSCI to allow the market to decide on including Bitcoin-holding companies in passive investments. Similarly, Strategy stated that the proposed policy change would introduce bias against crypto as an asset class, compromising MSCI’s role as a neutral index provider. For more on Strategy’s position, see Strategy увеличила резервы Bitcoin и создала долларовый фонд $1,44 млрд на фоне волатильности.

Timeline and Next Steps

MSCI plans to announce its final conclusions by January 15, 2026, with the proposed implementation included in the February 2026 Index Review. The discussions continue regarding the appropriate criteria for classifying crypto treasury companies and the broader implications of their inclusion or exclusion from indexes.

The outcome will influence investment flows and market dynamics, particularly for companies with significant crypto holdings. It remains a pivotal moment for the crypto market and institutional investment landscape.

Broader Market and Regulatory Context

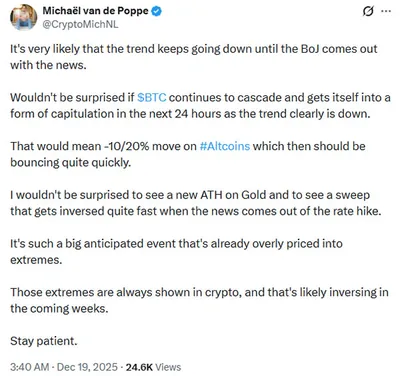

The crypto market has been under selling pressure for several months, and large forced outflows could intensify this trend. MSCI indexes play a crucial role in shaping investment flows, especially for passive funds that track these benchmarks. Concerns have been raised that the proposed exclusion policy may unfairly bias MSCI against crypto as an asset class, rather than maintaining neutrality.

Calls from industry groups emphasize the need to classify companies based on their business models and financial performance rather than solely on balance sheet composition. This approach aims to ensure fair treatment and accurate representation within investment indexes.

For additional insights on market outflows and institutional investor behavior, see Bitcoin ETF Outflows of $358M Amid 31% Price Drop: Institutional Investor Insights and Spot Bitcoin ETFs Experience $351.7M Outflow Led by Fidelity.