Crypto investment products recorded a net outflow of $952 million over the past week, with the largest losses coming from Ether and Bitcoin funds—$555 million and $460 million respectively. CoinShares points to delays in the long-awaited Clarity Act as the main reason for worsening investor sentiment and capital withdrawals. As a result, total assets under management decreased to $46.7 billion compared to $48.7 billion in 2024.

Outflows from Crypto Funds

The total outflow amounted to $952 million: Ether funds led withdrawals with $555 million, followed by Bitcoin funds at $460 million. These sales marked the first week of net outflows after three weeks of inflows and significantly impacted the monthly inflow and outflow trends. For detailed insights into the drivers behind outflows from Ethereum funds, see the analysis on ETH ETF outflows.

Impact of Clarity Act Delays

The Clarity Act aims to clearly define which crypto assets should be classified as securities and which as commodities, thereby delineating regulatory jurisdictions. According to CoinShares, the prolonged regulatory uncertainty surrounding this legislation has been the primary catalyst for large-scale outflows and investor concerns. White House AI and crypto advisor David Sacks announced the bill’s Senate review has been postponed until January 2026, altering the expected approval timeline.

Market and Investor Reaction

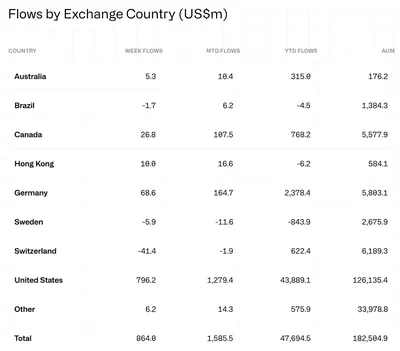

CoinShares notes that most net capital withdrawals originated from the US, intensifying the overall outflow trend. Meanwhile, the Nansen platform recorded that top-performing traders remained "long" on Ether: collectively, there were $476 million in leveraged long positions on Ether, while Bitcoin saw a net short position of $109 million. For comparison and context on Bitcoin ETF outflows, refer to the article on Bitcoin ETF outflows.

Outlook and Expert Commentary

CoinShares concludes that due to recent events, it is now unlikely that ETPs will surpass last year’s inflows, reflected in the drop of AUM to $46.7 billion from $48.7 billion a year ago. James Butterfill of CoinShares directly links the deterioration in investor sentiment to delays in the bill, while David Sacks set the new Senate review date for January 2026. These statements provide market participants with regulatory timeline guidance but do not guarantee short-term capital flow changes.

Why This Matters

If you mine in Russia managing from one to a thousand devices, understanding the reasons behind outflows is important for assessing liquidity and market sentiment, which indirectly affect demand and prices. The direct impact of Clarity Act delays on your physical mining operations is minimal: the changes mainly concern institutional demand and investment flows. Nevertheless, worsening sentiment may increase market volatility, which is crucial when deciding on converting mined cryptocurrency into fiat.

What to Do?

- Monitor news on the Clarity Act and Senate review timelines—this is the key regulatory indicator for the coming months.

- Assess your exposure to ETH and BTC: if you hold a high share of Ether, note that Ether funds suffered more significant outflows.

- Avoid panic decisions; if necessary, stagger the conversion of mined cryptocurrency over time to reduce the risk of selling during peak volatility.

- Maintain operational reserves to cover electricity and maintenance costs to weather periods of price instability.