The Lighter perpetual futures exchange recorded approximately $250 million in withdrawals following its LIT token airdrop, an outflow that represents about 20% of the protocol’s previous $1.4 billion total value locked (TVL). Despite the drop, on-chain data show Lighter retained roughly $1.15 billion in TVL after the withdrawals, leaving the platform still significant in the perpetual futures space.

Overview of Lighter’s $250M Withdrawals

Bubble Maps’ analytics flagged heavy withdrawal activity from Lighter’s smart contracts in the days after the LIT distribution, with the largest movements clustered close to the token drop. Most large withdrawals occurred within 48 hours of the airdrop, after which activity tapered off, suggesting many users followed preplanned reallocation strategies rather than reacting gradually to market changes.

Expert Analysis of Post-Airdrop Capital Movement

Nicholas Vaiman, CEO of Bubble Maps, told CoinDesk that such capital reallocation is common in decentralized finance: users often rebalance positions after receiving airdropped tokens and chase new yield opportunities. This explanation is consistent with on-chain traces and helps place Lighter’s outflows in the broader context of routine post-airdrop behavior; see the Lighter airdrop report for more on the withdrawal timeline and flows.

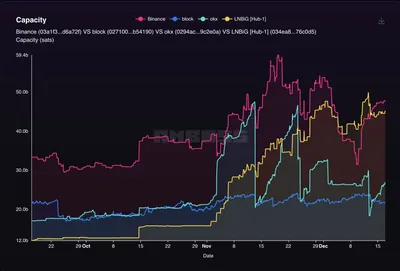

Comparison with Other DeFi Protocols

Post-airdrop capital movements are not unique to Lighter. For example, Uniswap retained approximately 85% of its TVL after a distribution, while smaller protocols have at times seen larger relative declines. Historical data indicate that many major protocols experience TVL reductions in the 15–20% range in the week following token distributions, which aligns with the scale of Lighter’s outflow.

Where Did the Capital Go?

On-chain analysis shows withdrawn funds flowed to several clear destinations, reflecting how DeFi users reallocate capital in response to changing incentives. The primary destinations identified were:

- other perpetual futures exchanges offering incentives;

- newly launched DeFi protocols with yield farming opportunities;

- stablecoin pools, where users parked liquidity while deciding next steps.

Future Outlook for Lighter

Even after the withdrawals Lighter’s remaining TVL — about $1.15 billion — keeps it among the larger perpetual futures venues. The platform has signalled planned protocol upgrades in Q2 2025, and those development steps will likely factor into whether Lighter re-attracts capital over time; for background on the token distribution itself, see the token launch details.

Why this matters

If you run miners in Russia with anywhere from a single device to a small farm of up to a thousand machines, this event is a reminder that DeFi liquidity can shift quickly around token events without signaling a platform failure. The withdrawal pattern affected Lighter’s TVL but left the protocol with significant liquidity, so everyday trading and liquidity access for users on the platform continue to be available.

What to do?

For a miner in Russia concerned about how such moves can affect available markets and yields, a few practical steps help manage risk and keep options open.

- Monitor liquidity: check TVL and on-chain flows for platforms you use to see if liquidity is moving away from markets you rely on.

- Use stablecoin pools selectively: if you want to reduce exposure while deciding, stablecoin pools were a common destination after this airdrop.

- Diversify destinations: consider spreading funds across exchanges and trusted protocols rather than concentrating on a single platform.

- Follow development updates: planned upgrades and token utility announcements can influence whether a protocol re-attracts capital later.