The Evernorth–Doppler Finance partnership, confirmed in early 2025, sets out to build institutional-grade infrastructure for XRP. Evernorth brings strategic backing from Ripple and a large XRP treasury, while Doppler supplies the technical systems to operate XRPL-native assets in institutional settings. Together the parties aim to reduce operational and compliance friction for large organizations that want to use XRP.

Overview of the partnership

Evernorth is presented as a crypto venture with strategic backing from Ripple and sizable XRP holdings that support its institutional focus. Doppler Finance is described as a financial services infrastructure provider that implements XRP and XRPL-native assets to produce verifiable on-chain revenue. The announced collaboration targets the creation of reliable systems that make it easier for corporations and financial firms to engage with XRP at scale.

Key objectives of the collaboration

The partnership concentrates on building infrastructure suitable for institutional use, addressing common hurdles such as custody, compliance, and operational complexity. By combining strategic capital and technical platforms, the initiative intends to expand XRP’s utility beyond narrow use cases and into broader financial applications. In practical terms, the project focuses on delivering standardized, auditable on-chain processes that institutions can adopt without bespoke engineering.

Roles of Evernorth and Doppler Finance

Evernorth contributes strategic positioning and a large XRP treasury, which underpins its ability to support institutional initiatives. Doppler Finance provides the technical infrastructure and tools needed to generate verifiable on-chain revenue from XRPL-native assets. The partnership pairs Evernorth’s strategic resources with Doppler’s engineering to create a turnkey pathway for institutional engagement.

Core contributions

- Evernorth’s reported $1 billion-plus XRP treasury that signals long-term commitment to the asset.

- Doppler Finance’s institutional-grade systems that enable XRPL assets to generate verifiable on-chain revenue.

- Synergy between strategic vision and technical execution to lower barriers for large organizations.

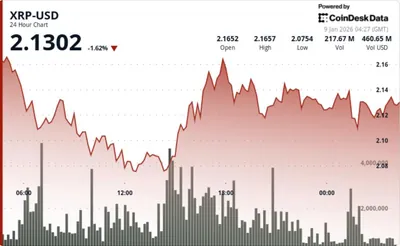

Impact on XRP and institutional adoption

The immediate aim is to make XRP and XRPL assets more accessible to companies and financial institutions by providing compliant and auditable infrastructure. If institutions use these systems, the partnership could shift some demand drivers toward utility-based use of XRP rather than only speculative trading. At the same time, the initiative must operate within an evolving regulatory context and compete with other infrastructure projects for institutional attention.

For further reading on related Ripple-backed initiatives and XRPL use cases, see Ripple invests in TJM and a broader discussion of institutional acceleration with XRP in Ripple institutional acceleration.

Expert analysis and outlook

The announcement in early 2025 positions this collaboration as part of a trend toward asset-specific infrastructure that pairs strategic capital with tailored technology. Such an approach aims to deliver optimized and auditable services for institutional users without relying on generic, one-size-fits-all solutions. The practical measure of success will be whether the partnership produces usable, compliant services that institutions can integrate into existing workflows.

Why this matters (short brief for a miner in Russia)

For a miner operating between one and a thousand devices in Russia, this development is primarily about broader ecosystem maturation rather than immediate operational change. Institutional infrastructure can increase real-world uses for XRP, which over time may affect market dynamics and network activity in indirect ways. However, the partnership itself does not change mining mechanics or device requirements.

What to do? (practical steps for a small-to-medium miner in Russia)

Keep monitoring ecosystem developments and official announcements from Evernorth, Doppler Finance, and Ripple to understand how institutional adoption unfolds. Maintain standard operational best practices: secure your keys, follow power and equipment maintenance routines, and document costs so you can adapt if market conditions shift. If you hold or plan to hold XRP, review custody options and tax/compliance obligations that apply locally.

If you want deeper context on XRPL services that institutions may use, consider reading about the XRPL lending protocol to see how infrastructure can enable financial products on the ledger.