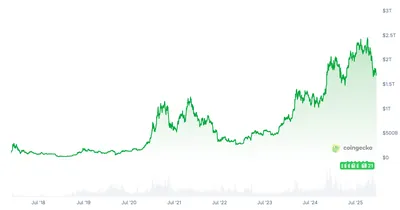

In 2024, the cryptocurrency market is experiencing a correction characterized by notable shifts in prices and investor sentiment. This correction phase is marked by various indicators, including declining asset values and increased market volatility, signaling a period of adjustment after previous growth trends.

Overview of the Crypto Market Correction

The crypto market correction refers to a temporary decline in cryptocurrency prices following a period of rapid increase. Recent trends show that this correction is influenced by multiple factors, which together contribute to the changing dynamics within the market.

Role of Federal Reserve Uncertainty

Uncertainty surrounding the Federal Reserve's monetary policies plays a significant role in shaping investor confidence. When the Fed's decisions on interest rates or economic measures are unclear or unexpected, it creates hesitation among investors, leading to fluctuations in cryptocurrency prices. Examples of such impacts include market reactions to announcements or speculations about future policy changes.

Concerns About an AI Bubble

Fears of an AI bubble have emerged as a factor affecting the cryptocurrency market. The AI bubble refers to the concern that excessive hype and speculative investments in artificial intelligence technologies may lead to inflated valuations. This hype can spill over into the crypto market, influencing valuations and contributing to increased volatility as investors reassess risks. See also: Crypto Market Correction Amid Fed Chair Uncertainty and AI Bubble Fears

Combined Impact on Cryptocurrency Market

The interaction between Federal Reserve uncertainty and AI bubble fears intensifies market volatility. These overlapping concerns cause investors to adopt more cautious behavior, often resulting in rapid price swings and a more unstable market environment. The combined effect underscores the complexity of factors driving the current correction.

Future Outlook and Considerations

Looking ahead, the cryptocurrency market may follow various paths, including recovery or continued correction, depending on developments in Fed policies and the AI sector. Investors are advised to stay informed about these factors and carefully evaluate their investment strategies amid ongoing uncertainties. See also: Crypto Fear & Greed Index Drops to 11 Indicating Extreme Market Fear

Understanding these dynamics is crucial for miners and other participants in the Russian crypto market, as global influences can affect local operations and profitability.