The publication Vedomosti, citing sources, reports that using gas from Alrosa's fields is being considered not only for connection to the main gas pipeline but also for internal power supply alongside evaluating crypto mining models. Previously, the main monetization scenario was connecting to the Power of Siberia pipeline, but now discussions include directing gas to Alrosa's own facilities while simultaneously exploring mining possibilities. Market participants and company representatives offer varying assessments of economic feasibility — the key issue remains electricity cost and investment payback.

Key Points Summary

The report is based on Vedomosti material and reflects the idea of using Alrosa's gas for internal needs with parallel testing of mining scenarios. A representative of a mining company confirmed interest in operating in the region, including the Ulugur and Ergedzhay sites, while Alrosa emphasizes that only geological exploration is ongoing there and no gas supply requests have been received.

Gas Usage Plans and Alternative Scenarios

Previously, the primary monetization option was connection to the Power of Siberia pipeline, but now a scheme is being discussed where part of the gas would supply power to Alrosa's extraction sites. Simultaneously, companies and investors are assessing the commercial viability of mining as an additional fuel use model. This approach involves parallel comparison of options to select the most economically justified project.

Mining Companies' Position and Site Requests

A representative of a mining company confirmed to Vedomosti their interest in working in Yakutia, including the Ulugur and Ergedzhay sites, but noted that the economic model depends on electricity costs. For miners, the key factors remain energy cost and related operational expenses, which ultimately determine the profitability of any infrastructure investments in the region.

Official Response from Alrosa

Alrosa stated that only geological exploration is being conducted at the Ulugur and Ergedzhay sites and that the company has not received any gas supply requests from mining companies. This underscores that discussions about mining are still preliminary and no fuel supply decisions have been made.

Tech-Economic Assessments and Project Scale

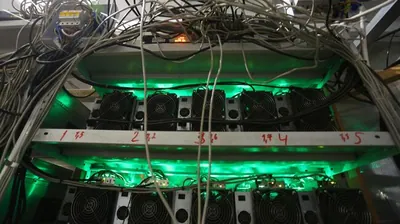

Available estimates provide rough guidelines on project scale and cost, helping to envision possible implementation parameters. According to Maxim Shaposhnikov, advisor to the Industrial Code fund manager, resources could support 4–5 power units of 20 MW each, with one mining module including generation and equipment estimated at 4–5 billion rubles. Valery Petrov, vice president of Mera Capital Group, notes that a 50–100 MW project might require hundreds of millions of dollars, and due to crypto market volatility, starting with a small pilot project is advisable.

Related Initiatives and Trends

Previously, Delovoy Peterburg reported that the St. Petersburg company Rozetki SPb patented a charging station model for electric vehicles with an integrated mining module. The emergence of such solutions raises questions about interaction with local energy facilities and potential gas demand, important factors when assessing regional infrastructure needs.

Conclusions and Next Steps

Key market signals will be Alrosa's official decisions regarding gas allocation, as well as actual requests from mining operators and infrastructure applications for supply and power capacity construction. Possible scenarios include small-scale pilot mining, rejection in favor of direct quarry power supply, or hybrid models where part of the resource is used for electricity generation and part for mining.

Why This Matters

For miners in Russia, this news is significant because it discusses a real gas source near operational sites, potentially affecting access to cheap generation in the region. However, no official gas supply requests to Alrosa have been recorded, and economic feasibility remains uncertain, mainly due to electricity costs. Having rough estimates of capacity and module costs provides insight into investment scale but does not imply decisions have been made.

What to Do?

- Evaluate current electricity costs and their impact on profitability: compare your rates with potential local generation conditions.

- Monitor official Alrosa announcements and mining operator requests to gauge the likelihood of gas supply and pilot project launches.

- Consider phased development: pilot or modular small-scale schemes reduce risks amid market volatility.

- Study local regulatory and infrastructure factors — consumption limits or connection requirements may be critical for projects.

- Read specialized materials on mining electricity consumption and local precedents to compare real scenarios and assessments.

For additional context on mining electricity consumption impact on regional grids and related restrictions, see the article on electricity consumption. Also useful are precedents of regional restrictions — for example, the publication on the crypto mining ban in southern Priangarye to understand possible regulatory risks.