A bill on tax benefits for cryptocurrencies is under discussion in the US, highlighting the need to protect bitcoin. This article briefly explains what such initiatives typically include, their potential implications, and practical steps that miners in Russia might find useful. The text sticks strictly to the stated topic without adding new facts or figures.

What Is a Bill on Tax Benefits for Cryptocurrencies?

Such a bill generally refers to a proposal to modify the tax regime for cryptocurrency transactions, including possible tax reliefs or exemptions. The bill may list key provisions—rules for income recognition, transaction accounting methods, and benefit eligibility criteria. Specific rules and conditions depend on the bill’s text and are not disclosed in this summary.

Main Provisions of the Bill

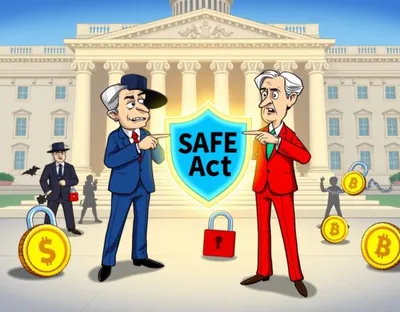

Typical provisions cover declaration procedures, criteria for receiving benefits, and accounting rules for crypto assets. The bill may establish separate mechanisms for different types of cryptocurrency operations, but this article does not cite specific norms from the initiative’s text. For related initiatives, it’s helpful to review discussions in Congress addressing rule changes—federal rule changes.

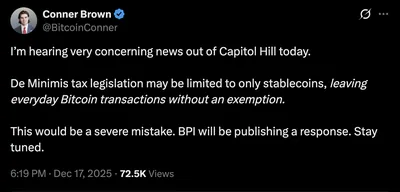

Which Cryptocurrencies Are Covered by the Law

Bill texts usually specify which asset categories are included—for example, cryptocurrencies with certain characteristics. Our overview maintains the wording: the tax benefits concern cryptocurrencies, with a focus on protecting bitcoin as a key asset. For broader context on related initiatives, see materials on bipartisan Senate proposals—the bipartisan SAFE Act.

Who Can Use the Tax Benefits

Such benefits are typically aimed at investors, service providers, and sometimes market participants involved in cryptocurrency transactions. Specific criteria—such as volume thresholds or operation types—depend on the final bill text. This article does not provide details beyond the original information.

Why Is Protecting Bitcoin Important?

Bitcoin is often regarded as a central asset in the crypto market, so provisions concerning it receive special attention. Protecting bitcoin in tax policy is discussed because tax rules affect asset recognition and their legal and financial usage. The news text only confirms the discussion of bitcoin’s protection without detailing the arguments from either side.

Bitcoin’s Role in the Cryptocurrency Market

Legislative initiatives often single out bitcoin as a widely used asset, but specific assessments of its role are not provided here. Mentioning bitcoin in the bill signals a focus on one of the most recognized crypto assets, and nothing more.

Tax Impact on Bitcoin’s Development

Tax regimes set rules for asset accounting and handling, so changes can influence market participants’ behavior. This article refrains from forecasts or evaluations, limiting itself to describing the subject—tax benefits and bitcoin protection.

Expert Opinions on the Need to Protect Bitcoin

The source emphasizes the importance of protecting bitcoin, but no expert quotes or detailed assessments are included. For arguments pro and con, consult full debate texts and participant comments.

Consequences of Passing the Bill

The bill’s impact depends on its final version and the scope of benefits. Possible changes include systematizing tax rules and clarifying crypto assets’ status in tax reporting. This note offers a neutral overview without predictions.

Impact on the Cryptocurrency Market

Tax bills usually affect the legal environment and administrative procedures, but the extent depends on the text and accompanying measures. This article notes the discussion of tax benefits for cryptocurrencies and the need to consider bitcoin protection.

Changes for Investors and Miners

If specific benefits are included, accounting and declaration approaches may change. Investors and miners will need to review the final document and official tax guidance to understand the consequences fully.

Potential Risks and Advantages

Discussions about benefits seek a balance between development incentives and abuse risks; however, the original material only mentions the general idea of protecting bitcoin. Detailed lists of risks or advantages are absent here.

Why This Matters for Miners in Russia

Miners with any number of devices should monitor international initiatives as they shape the overall regulatory agenda and influence exchanges, banks, and services. However, the US bill does not directly change Russian tax law, so its main effect on Russian miners will be indirect. For example, changes in the US legal status or accounting practices may affect how major international players handle crypto transactions.

What Should You Do?

Russian miners would benefit from a clear strategy to prepare for possible changes in the global regulatory environment. Below are practical recommendations you can apply now without waiting for specific US decisions.

- Keep detailed records of bitcoin mining and sales: save logs, receipts, and statements to have documentation ready if needed later.

- Maintain contact with tax consultants or accountants familiar with crypto assets; this helps prepare accurate declarations and account for potential changes.

- Follow news and official clarifications from platforms and regulators: US changes may affect policies of exchanges and payment services you use.

- Assess risks related to storage and conversion: have a liquidity and reserve plan to quickly adapt to market condition changes.

For more on related initiatives and federal changes, see the overview of upcoming federal rule changes and congressional discussions federal rule changes, as well as materials on bipartisan Senate initiatives the bipartisan SAFE Act.