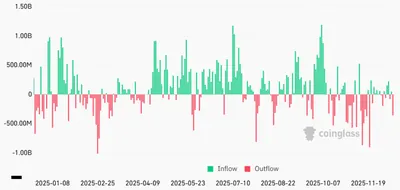

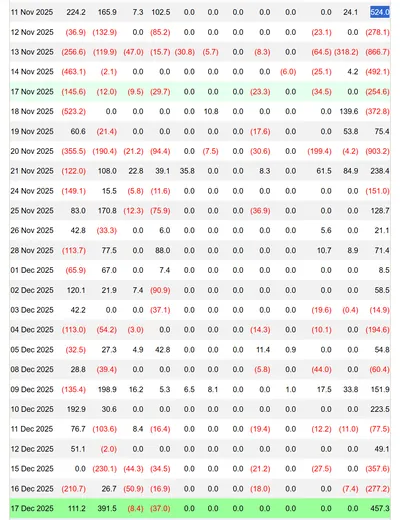

Spot Bitcoin exchange‑traded funds recorded a combined $782 million in net outflows during the Christmas week, according to SoSoValue data. The single largest withdrawal came on Friday, when spot Bitcoin ETFs posted $276 million of net outflows, and that day marked the sixth consecutive day of redemptions.

Christmas Week Outflows in Detail

The weekly outflows were broad across major products, with BlackRock’s IBIT leading the losses as nearly $193 million left the fund and Fidelity’s FBTC seeing $74 million in outflows. Grayscale’s GBTC also registered modest redemptions during the same period, contributing to the overall pullback.

- Combined net outflows over the week: $782 million.

- Largest single‑day outflow (Friday): $276 million.

- Top fund outflows: IBIT ~$193 million, FBTC $74 million.

- Total US spot Bitcoin ETF assets fell to roughly $113.5 billion, down from peaks above $120 billion earlier in December.

For related context on recent short‑term losses in ETF flows, see five-day ETF losses in our coverage.

Six‑Day Outflow Streak

Friday completed a six‑day streak of net outflows for spot Bitcoin ETFs, the longest continuous withdrawal period since early autumn. Over that six‑day stretch, cumulative outflows exceeded $1.1 billion, underscoring the concentrated nature of the redemptions across multiple trading days.

Analyst Perspective: Holiday Positioning

Vincent Liu, chief investment officer at Kronos Research, described the moves as seasonal, attributing them to "holiday positioning" and thinner liquidity rather than a collapse in institutional demand. He noted that institutional desks often reduce activity over holiday periods and tend to re‑engage once trading desks return.

Liu also pointed to broader market factors that could influence demand going forward, including expectations for rate easing and ongoing scaling of bank‑led crypto infrastructure, which he said reduces friction for large allocators.

Future Outlook and Fed Policy

- Rates markets are pricing in about 75–100 basis points of cuts, a dynamic analysts say could support ETF demand if realized.

- Improved institutional activity and reduced operational frictions may help flows normalize when trading resumes after holidays.

Institutional Demand Cooling

Data cited by Glassnode show the 30‑day moving average of net flows into US spot Bitcoin and Ether ETFs has been negative since early November, signaling muted institutional participation over the past weeks. Because ETFs are widely used as a proxy for institutional sentiment, prolonged outflows have been interpreted as cooling demand among larger allocators.

For a contrasting view of recent inflows and allocations, some readers may find our piece on spot ETF inflows useful when comparing short‑term swings to broader allocation trends.

Why this matters

If you run 1–1,000 mining devices in Russia, these ETF outflows are primarily a signal of short‑term institutional re‑positioning rather than an operational shock. They reflect how large allocators adjusted holdings over the holidays, which can influence liquidity and sentiment but does not directly change your mining hardware performance or local power costs.

At the same time, prolonged outflows and a negative 30‑day moving average are useful market indicators: they suggest institutions were net sellers through November and December, which affects broader market sentiment and may coincide with periods of higher volatility in crypto markets.

What to do?

Monitor flows and reputable on‑chain and ETF flow trackers to see when institutional participation re‑engages; analysts expect desks to return after holidays and normalize activity. Keep operational priorities like uptime, wallet security, and payout arrangements in order so you can respond quickly when market conditions change.

Maintain a cash or fiat buffer to cover costs during short‑term market moves, and review your selling and hedging plans ahead of the post‑holiday re‑entry of institutional flows. For more detail on where specific funds saw outflows, check recent coverage on IBIT outflows which highlights fund‑level activity.