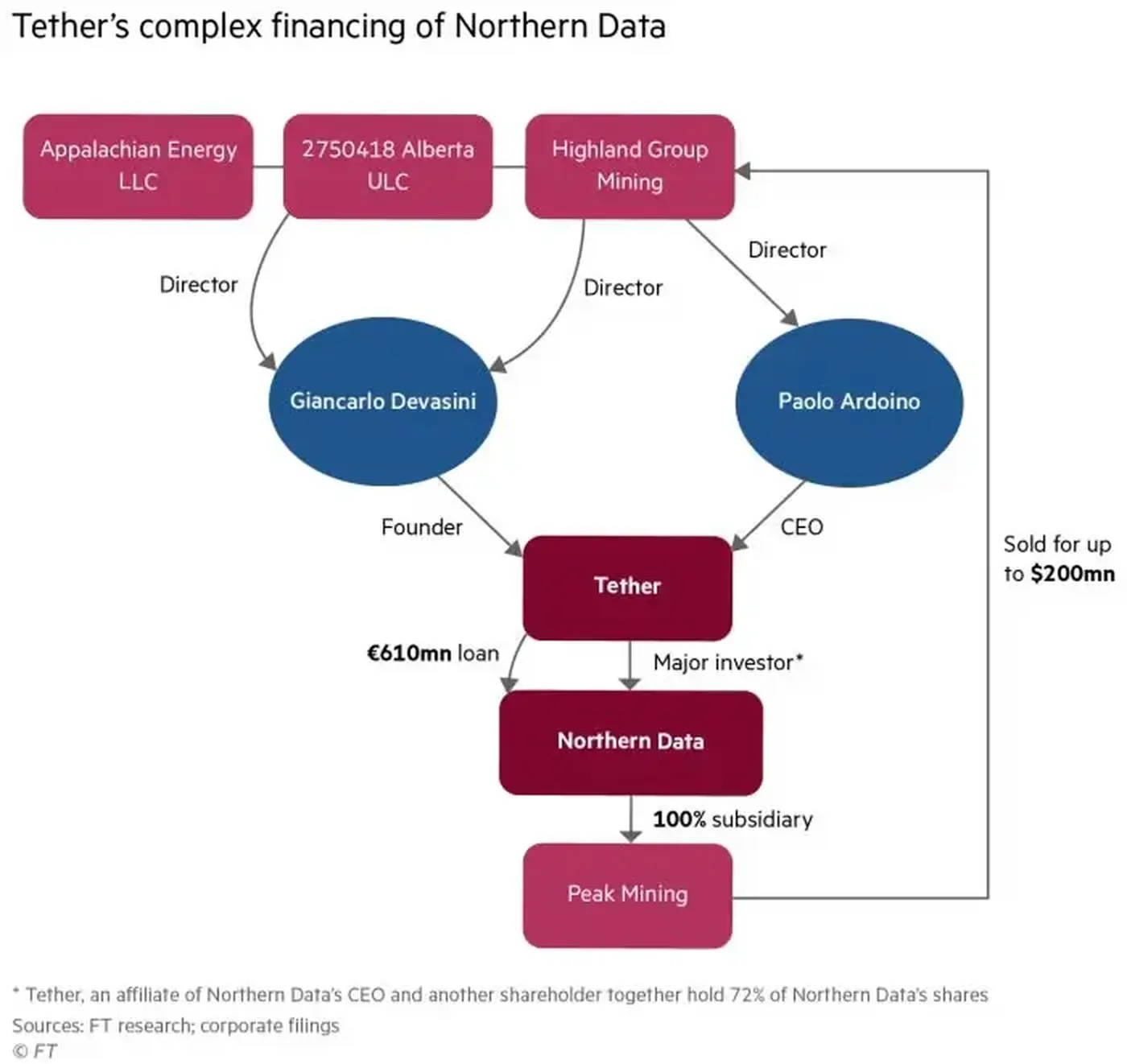

Northern Data has sold its Bitcoin mining division, Peak Mining, to three companies managed by Tether executives. According to the company, the deal is valued at up to $200 million, with buyers identified as Highland Group Mining, Appalachian Energy, and a firm from Alberta province. The transaction is overseen by Tether co-founder and chairman Giancarlo Devasini and CEO Paolo Ardoino; official documents list them as directors of Highland Group. However, it remains unclear who directly manages Delaware-based Appalachian Energy.

Details of the Peak Mining Sale

Who Are the New Owners?

The buyers of Peak Mining are three companies: Highland Group Mining, Appalachian Energy, and a company from Alberta. Official filings indicate that Giancarlo Devasini and Paolo Ardoino serve as directors of Highland Group, while Devasini is the sole director of the Alberta-based firm. Information about Appalachian Energy's management is not disclosed in the submitted documents, leaving this point uncertain.

Deal Value and Participants

The sale price for Peak Mining is stated as "up to $200 million." Previously, Northern Data announced an initial attempt to sell the division to another buyer, which did not materialize. German regulators did not require disclosure of the buyers' identities during the initial announcement, so details emerged later through filings and media reports.

The Role of Giancarlo Devasini and Paolo Ardoino

According to submitted documents, Devasini and Ardoino manage the transactions and appear in leadership roles within some of the purchasing entities. Their involvement highlights a direct connection between Peak Mining's new owners and Tether's leadership, as noted in materials related to the deal.

Financial Links Between Northern Data and Tether

Northern Data's Loan Obligations to Tether

Northern Data holds a €610 million loan from Tether. Under agreed transactions, part of this loan balance will be transferred to the stablecoin issuer in the form of Rumble shares, while the remaining portion is expected to be repaid through a new loan from Tether secured by Northern Data's assets.

The Rumble Deal and Its Terms

The Rumble transaction involves transferring shares and refinancing Northern Data's obligations, creating a complex web of interdependencies among the parties. These arrangements form part of a broader reshuffling of assets and liabilities involving both Peak Mining's purchasing entities and platforms where Tether holds stakes.

Tether's Mining Development Plans

The deals and investments surrounding Northern Data reflect Tether's interest in expanding areas related to data processing and mining. The exchanges and financial operations involve stakes in other platforms as well as operational assets, demonstrating an effort to build integrated service and capital chains.

Legal Issues Facing Northern Data

Investigation for Suspected Tax Fraud

Northern Data is currently under investigation by European prosecutors on suspicion of tax fraud. The probe has included inspections and raids at the company's offices, as reported in official statements and reports. These procedures contributed to earlier attempts to restructure sales and reorganize assets.

Office Raids

According to materials on Northern Data's operations, raids were conducted at its offices as part of investigative actions. These events have heightened regulatory and investor scrutiny regarding the chain of transactions and how rights to Peak Mining assets and related obligations will be settled.

Previous Attempts to Sell Peak Mining

This marks the second attempt to sell Peak Mining to companies linked to Tether's leadership: an earlier deal with a different entity was announced but did not proceed. The repeated sale concluded with the formalization through the three named purchasing companies.

Other Tether Investments

Offer to Purchase Juventus Football Club

Beyond mining and data hosting platform deals, Tether has shown interest in sports assets. Available information indicates the company made a €1 billion offer to acquire the Italian football club Juventus, which was rejected by the club's owners.

Development in AI and Video Sectors

Tether is also involved in projects related to video platforms and technology sectors that may utilize computing power, including GPUs. These investments complement the company's activities in mining and infrastructure services.

Tether's Share in the Stablecoin Market

Public materials identify Tether as a major player in the stablecoin market, giving the company influence over financing structures and investments in adjacent industries, including mining and platform services.

Why This Matters

For miners in Russia, this news means ownership and management of Peak Mining have transferred to entities directly connected to Tether's leadership, while Northern Data remains under investigation. Financial obligations between the companies remain significant: Northern Data has a large loan from Tether, part of which will be restructured through shares and a new loan. This complexity in ownership and financial structure around the assets may impact platform management and service availability.

What to Do?

- Monitor official announcements from your equipment provider or platform and verify if the legal address or service owner has changed.

- Keep your electricity and lease contracts, along with payment confirmations, organized—these are useful if operational models at platforms change.

- If you rent capacity in data centers, check with the operator how guarantees for equipment access and maintenance will be handled during reorganizations.

- Subscribe to updates on Northern Data and Tether's case and financial reports to respond promptly to possible changes in operating conditions.

For a detailed chronological analysis of the deal, see the article on the buyout of Peak Mining by companies founded by Tether's founder, and for insights on the connection with Northern Data's acquisition and Rumble's role, refer to the article about the Northern Data takeover supported by Tether.