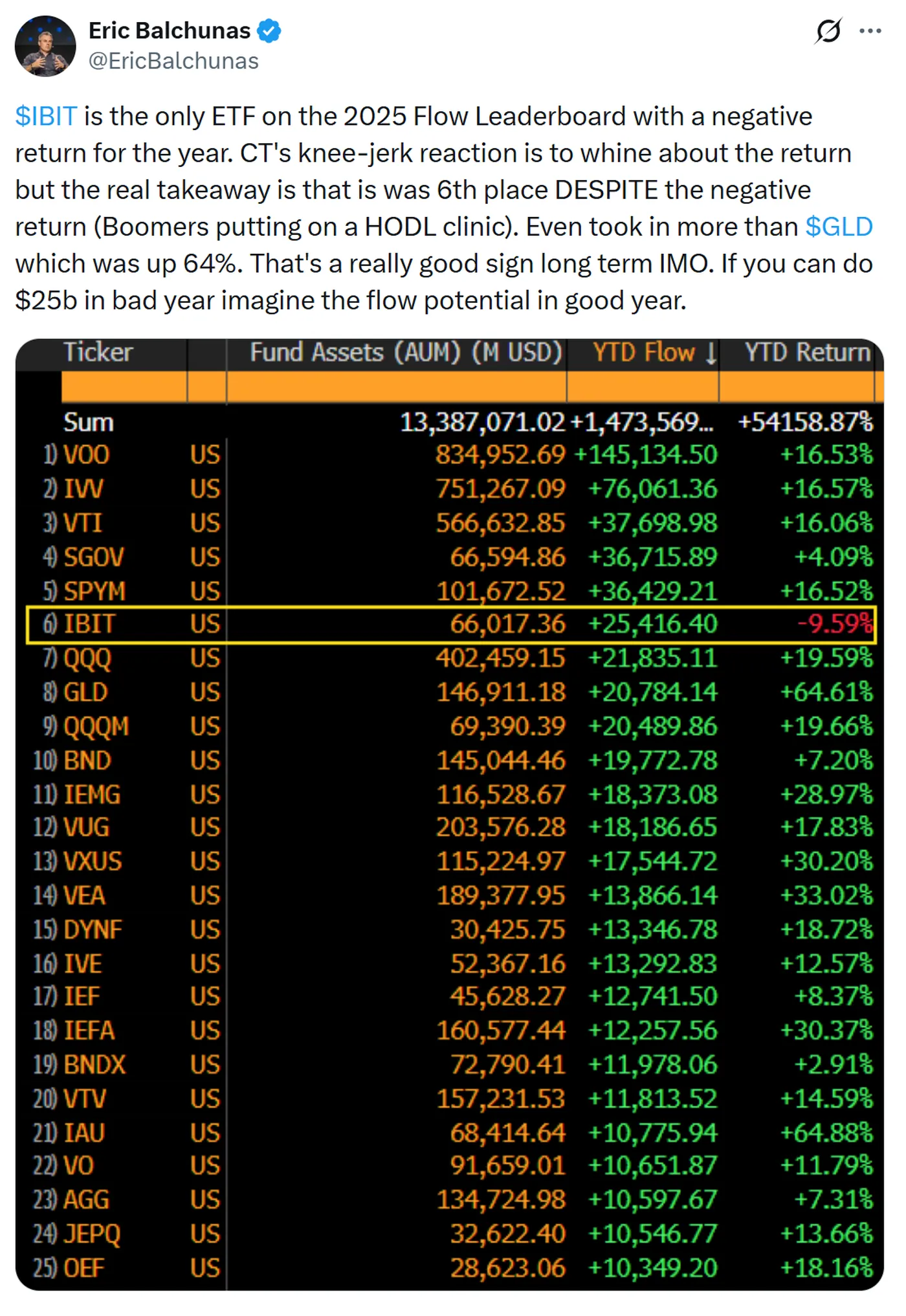

BlackRock’s iShares Bitcoin Trust (IBIT) emerged as one of the top ETF inflow leaders in 2025, ranking sixth overall despite posting negative annual returns. According to Bloomberg and analyst Eric Balchunas, the fund attracted roughly $25 billion year-to-date, demonstrating capital interest even amid a loss-making yearly performance.

IBIT ETF: Strong Inflows Despite Negative Returns

IBIT stands out by ranking among the top inflows while being the only fund in this group with negative annual returns. Bloomberg data highlights that inflows of about $25 billion entered the fund despite the negative yearly trend, and Eric Balchunas called this a "very good sign" for long-term investors. His commentary suggests that capital flows reflect investor behavior beyond just short-term price movements.

Comparison with Other ETFs

The top-performing ETFs in 2025 included traditional stocks and bonds, many showing double-digit gains, yet they did not attract as much capital as IBIT. Notably, the gold ETF GLD rose more than 60% over the year but received fewer inflows than IBIT, underscoring the unusual combination of inflows and negative returns for the Bitcoin fund. For more examples of inflows and their distribution, see the materials on Spot Bitcoin inflows.

Why Institutional Buying Doesn’t Boost Bitcoin Price

Some market participants wonder why significant ETF purchases don’t lead to a clear Bitcoin price increase. Balchunas suggests the market may behave like a mature asset class: large, long-term holders take profits and employ yield strategies, such as selling options, which dampen the direct impact of inflows. He also noted Bitcoin rose over 120% in the previous year, which may limit expectations for sustained immediate growth.

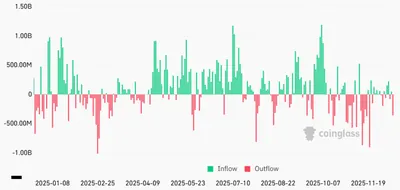

Outflows from IBIT in November 2025

Despite strong annual inflows, IBIT faced pressure in November, recording about $2.34 billion in net outflows, including two significant withdrawal days. On a single trading day, all US spot Bitcoin ETFs combined showed $158 million in net outflows, with FBTC being the only fund reporting inflows. For a comparison of recent fund outflows, see the note on IBIT outflows and on the outflow leadership influenced by other funds managed by Fidelity.

BlackRock’s View on IBIT’s Future

BlackRock representatives downplay the outflows, explaining that ETFs serve capital and cash flow management purposes, so phases of contraction and outflows are normal. At the Blockchain Conference 2025, Business Development Director Cristiano Castro stated that Bitcoin ETFs have become one of the company’s largest revenue sources, emphasizing the product’s commercial significance within BlackRock.

Why This Matters

If you mine in Russia and manage from a few to a thousand devices, this news shows that inflows into IBIT don’t necessarily mean a rapid Bitcoin price increase, and funds can attract capital even with annual losses. Meanwhile, ETF inflows and outflows reflect capital redistribution among investment products rather than directly impacting miners’ operational decisions.

What to Do?

- Monitor total flows and price but avoid making urgent technical decisions based solely on inflow data; operational parameters for most miners remain unchanged.

- Evaluate mining profitability based on actual revenue and expenses rather than ETF performance; inflows and short-term outflows may not affect your operational balance.

- Maintain regular market and liquidity monitoring: watch for large inflow/outflow days and potential volatility changes that could impact asset price and your margin.