In Brazil, the main driver of cryptocurrency market growth in 2025 is the younger generation of investors. A report by Mercado Bitcoin shows that the fastest-growing investor group is people under 24 years old; their participation increased by 56% compared to last year, and many enter the market through less volatile instruments. These investors more often choose stablecoins and fixed-income digital products rather than speculative tokens.

Youth in Brazil Leading the Cryptocurrency Boom

The growth of the youth segment is changing demand profiles: new participants adopt a more cautious strategy and seek tools for capital preservation. According to the exchange, many young investors use stablecoins and tokenized fixed-income products as their "entry point" into the market. If you're curious why the younger generation invests this way, check out the article on why the younger generation, which discusses related motivations and behaviors.

Rising Popularity of Tokenized Bonds

Platform products called Renda Fixa Digital (RFD)—tokenized shares of real assets with fixed income—have shown significant growth: the volume of RFD transactions in 2025 more than doubled. Mercado Bitcoin reported distributing 1.8 billion reais among users, with these products averaging 132% of the CDI benchmark. Other platforms with similar offerings, including Liqi and AmFi, also operate in the country.

Shifts in Investment Strategies

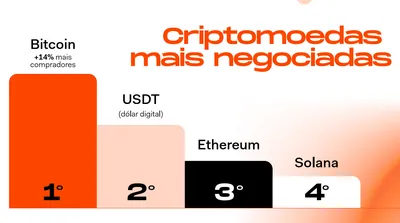

Strategies vary noticeably by income level: users with medium income tend to allocate up to 12% of their portfolio to stablecoins and hold most funds in less volatile instruments, sometimes about 86% of their portfolio. Meanwhile, lower-income investors allocate over 90% of funds to traditional cryptocurrencies like Bitcoin, accepting higher risk for potential returns. The exchange also recorded a 43% annual growth in total transaction volume, with Monday being the busiest day for new investors and trading activity.

Cryptocurrency Regulation in Brazil

Brazil’s Central Bank introduced new rules for cryptocurrency services last month: providers must now obtain licenses and meet established capital requirements. These changes aim to formalize the market and raise operational standards for organizations offering digital asset services. For ecosystem participants, this means increased oversight and the need to comply with new requirements.

Why This Matters

For a miner from Russia with a small or medium mining setup, the main changes in Brazil do not introduce direct technical innovations in mining. However, the rise in transactional activity on exchanges (a 43% volume increase) and the shift in demand toward stablecoins and tokenized bonds are reshaping cryptocurrency use. Meanwhile, the new rules introduced by Brazil’s Central Bank show that regulators are increasingly formalizing services around digital assets.

Practically, this means the global demand structure for cryptocurrencies may gradually change, but direct effects on mining power, electricity, or miner profitability depend on many factors—not just investor behavior in one country. Monitoring these trends is useful, but urgent technical actions for a home miner in Russia are usually unnecessary.

What to Do?

- Monitor overall network activity and transaction volumes: increased trading activity can affect network load and fees, impacting your profitability.

- If you plan to work with Brazilian services or tokens, study regulatory requirements and verify whether the platform holds licenses and capital per the new Central Bank rules.

- Keep in mind that some demand is shifting toward stablecoins and RFD—this affects liquidity and market volatility when diversifying your portfolio and selling mined crypto.

- Watch for days of heightened activity (Monday is noted in the report): plan sales and withdrawals considering peak trading times to avoid unexpected fees or delays.

- Maintain cash reserves and monitor changes in platform rules and requirements, especially if you use exchanges to convert mined assets to fiat.

Brief Conclusions

Youth is driving a shift toward less volatile products and tokenized bonds; RFD is growing actively, and regulation is tightening. For most Russian miners, this signals to watch the market and liquidity but does not call for immediate technical changes.

Frequently Asked Questions

Question: Will the growth of stablecoins in Brazil affect mining profitability?

Answer: The report does not indicate a direct and clear effect; increased activity and changing demand for asset types may indirectly impact liquidity and fees, but the specific impact depends on the network and market where you sell your coins.

Question: Should a Russian miner consider Brazil’s Central Bank regulations?

Answer: If you do not interact with Brazilian platforms or assets, the new rules do not impose direct obligations. However, they indicate regulatory trends and rising standards in the global crypto ecosystem.