Itaú Asset Management, the investment arm of Brazil’s largest private bank Itaú Unibanco, recommends that investors allocate 1% to 3% of their portfolios to Bitcoin in 2026. This guidance comes as part of the bank’s latest research, which highlights Bitcoin’s potential to enhance diversification and serve as a hedge against currency risks, even after a volatile year for the asset.

Itaú Asset Management's Bitcoin Allocation Recommendation for 2026

According to Itaú Asset, holding a small portion of Bitcoin—between 1% and 3%—can help investors manage risks linked to geopolitical tensions and ongoing currency fluctuations. The bank describes Bitcoin as a unique asset, distinct from traditional stocks, bonds, or domestic investments, offering its own return profile and acting as a global, decentralized hedge against currency volatility. See also: Luke Gromen Turns Bearish on Bitcoin: Warns of $40K Risk in 2026

Bitcoin Market Performance in 2025

Bitcoin experienced significant price swings throughout 2025. The year began with the asset trading near $95,000, followed by a drop toward $80,000 during a tariff crisis. Later, Bitcoin surged to an all-time high of $125,000 before returning to around $95,000. For Brazilian investors, these fluctuations were intensified by changes in the local currency, making the impact of Bitcoin’s volatility more pronounced compared to global markets. See also: Grayscale Forecasts Bitcoin to Reach New All-Time High in Early 2026

Impact of Brazilian Real Strengthening on Bitcoin Investments

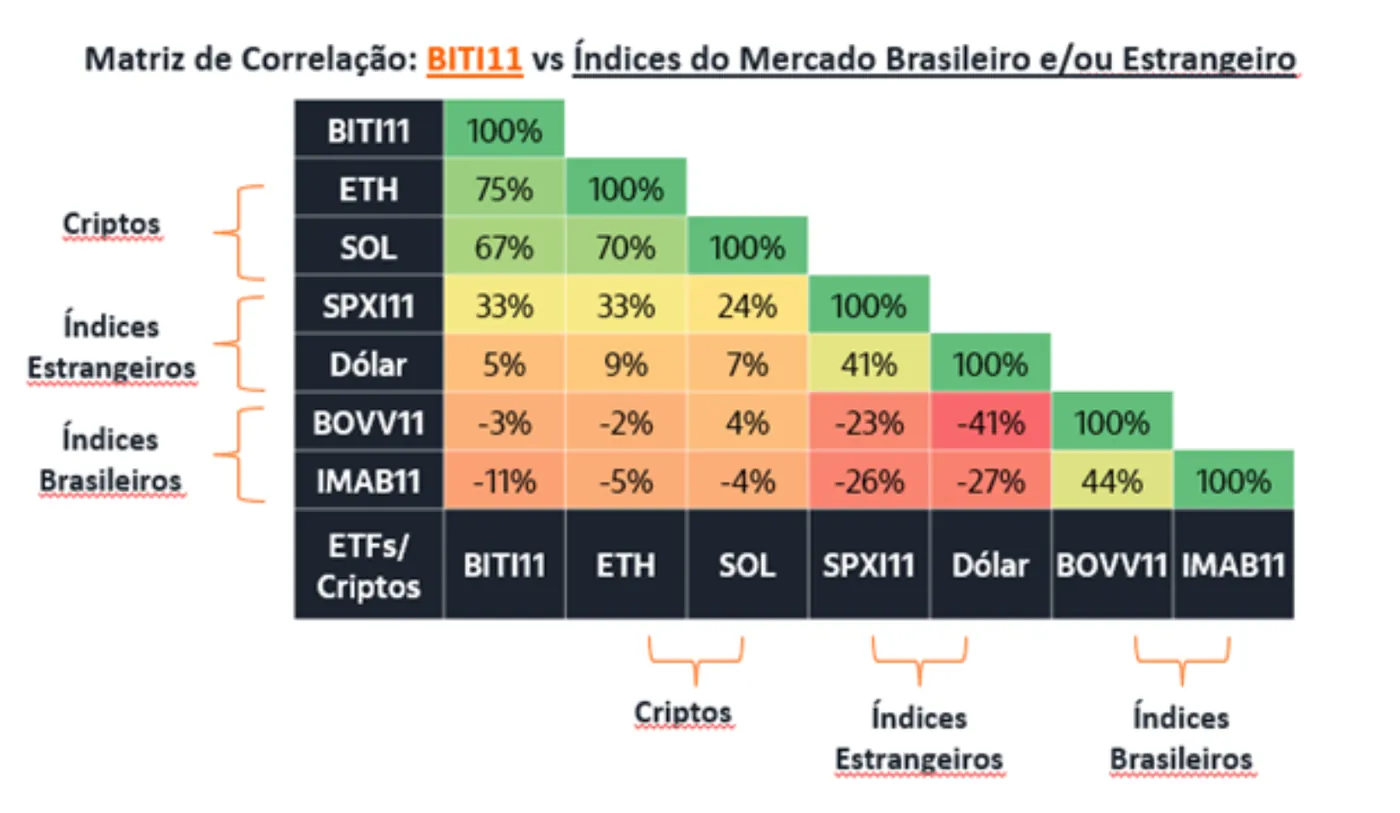

In 2025, the Brazilian real appreciated by approximately 15%. This currency movement amplified the effects of Bitcoin’s price changes for local investors, sometimes increasing losses when converting returns back to reals. Itaú Asset argues that maintaining a steady, modest allocation to Bitcoin can help smooth out risks that traditional assets may not address, especially given the low correlation between BITI11—its locally listed Bitcoin ETF—and other major asset classes.

Itaú Asset's Expansion into Crypto Products

In September 2025, Itaú Asset established a standalone crypto division, appointing João Marco Braga da Cunha, formerly of Hashdex, as its head. This move built on the bank’s existing digital asset offerings, such as its Bitcoin ETF (BITI11) and a retirement fund with crypto exposure. Itaú Asset also plans to introduce a broader range of crypto products, including fixed-income instruments and higher-volatility strategies like derivatives and staking. See also: Brazil's Banking Giant Updates Bitcoin Advice Amid Latin American Crypto Growth

Why This Matters

For Brazilian miners and investors, Itaú Asset’s recommendation signals growing institutional acceptance of Bitcoin as a legitimate portfolio component. The bank’s focus on diversification and currency hedging is particularly relevant in Brazil, where currency swings can significantly impact returns from crypto assets. Understanding these dynamics can help miners better evaluate the role of Bitcoin in their own investment strategies.

What Should You Do?

- Review your current portfolio to assess whether a 1–3% Bitcoin allocation aligns with your risk tolerance and investment goals.

- Monitor the performance of the Brazilian real, as currency movements can affect your returns from Bitcoin mining or investment.

- Consider using regulated products like BITI11 for easier access and potentially lower correlation with other assets.

- Stay informed about new crypto offerings from major institutions like Itaú Asset, as these may provide additional options for diversification.