The largest Brazilian stock exchange, B3, announced it will include a stablecoin among its liquidity tools, with a target launch window in Q1 2026. Luiz Masagão, B3’s Vice President of Products and Customers, attributed the timing to the company’s effort to accelerate adoption of new technologies. Masagão said the stablecoin will enable trading of tokenized assets and argued that “It can be much more than that,” citing demand after the slimming down of DREX. The exchange also stated the new token will be fully backed by B3.

Details of the planned stablecoin

B3 aims to launch the stablecoin in Q1 2026, according to the company’s vice president, Luiz Masagão, who spoke about the initiative at a recent event. The announcement describes the instrument as fully backed by the exchange and intended to function as a liquidity tool for both tokenized and traditional offerings. Masagão framed the plan partly in the context of DREX’s scaled‑back rollout, saying the market needs an asset to help liquidate digital‑economy transactions. He also noted that the stablecoin could evolve beyond its initial scope.

How the product will work and infrastructure plans

B3 expects to adopt a hybrid tokenization model and to create a central depository for tokenized assets that will be connected to its central depository for traditional assets. That architecture is intended to let tokenized instruments interact with existing market infrastructure while keeping settlement and custody aligned with exchange processes. This approach complements other tokenization developments in the region and links to prior coverage such as the Solana ETP on B3 mentioned in related reporting.

Market context and significance

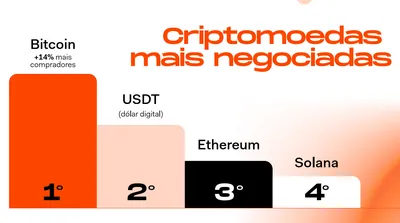

B3 presented the token as a potential alternative to DREX after the central bank reduced the scope of its CBDC implementation, suggesting the stablecoin could fill some market needs left open by that change. The exchange also pointed to the existing regional use of stablecoins, noting that instruments like USDT and USDC already settle thousands of transactions in Brazil and LatAm daily. In this context, B3 positions its stablecoin as part of a broader push to increase liquidity and adoption of tokenized markets.

Business roadmap and related product launches

Masagão said the stablecoin forms part of a wider product roadmap: B3 plans to launch 22 products next year, including weekly bitcoin dollar options, as it seeks to expand its technology offerings. The exchange described product‑scope expansion as a key factor in accelerating adoption of new market tools. These steps are presented as complementary moves to support trading across tokenized and traditional markets.

Implications and open questions

The announcement highlights potential benefits for liquidity in tokenized markets and for tighter links between digital and traditional assets, but it leaves open whether traders and market participants will adopt the new stablecoin. Operational and regulatory considerations remain relevant given the changed outlook for DREX, and B3’s plans will depend on market acceptance and implementation details that the company has not fully disclosed. As B3 rolls out its roadmap, observers will be watching actual usage and integration with existing settlement flows.

Why this matters

For miners and small operators, the news is primarily about market plumbing rather than mining operations themselves, yet it can affect the options you have for moving value between crypto and traditional finance. A widely used exchange‑backed stablecoin could change settlement choices and counterparty options when you convert mined coins into fiat or other assets. At the same time, existing stablecoins such as USDT and USDC already play a large role in daily settlements across Brazil and LatAm, so B3’s move signals another potential venue for liquidity rather than an immediate disruption.

What to do?

- Monitor liquidity and settlement options: track whether the new stablecoin appears on the venues and services you use for converting crypto to fiat.

- Review counterparties and custody: ensure exchanges, wallets, or OTC desks you use list or plan to support B3’s stablecoin before relying on it for large settlements.

- Keep an eye on regulatory announcements: changes related to DREX or other local rules can affect which instruments are practical for on‑ramps and off‑ramps.

- Maintain diversification: continue to use established settlement rails (for example, routes that accept USDT/USDC) while B3’s product gains traction.

FAQ

What is B3 planning? B3 plans to issue an exchange‑backed stablecoin as part of its liquidity tools to enable trading of tokenized assets, according to Luiz Masagão. The company describes the token as fully backed by the exchange and part of a broader tokenization push.

When is it expected? B3 targets Q1 2026 as the stablecoin’s launch window, per statements attributed to Luiz Masagão.

How will it be backed? The announcement states the stablecoin will be fully backed by the exchange and will work alongside a central depository for tokenized assets connected to B3’s traditional depository.

Related coverage: See reporting on other stablecoin initiatives such as the BNB Chain stablecoin for additional context on liquidity tools in the region.