Tennessee regulators have ordered Kalshi, Polymarket and Crypto.com to stop offering sports event contracts to residents of the state, saying those products amount to unlicensed sports wagering. The Tennessee Sports Wagering Council (SWC) sent cease-and-desist letters dated Jan. 9 asserting the firms operate without the state license required under the Sports Gaming Act.

Tennessee Regulators Issue Cease-and-Desist Orders

The SWC’s letters accuse the three platforms of illegally offering sports wagering products under the guise of event contracts and say none holds the state-issued license required to accept sporting wagers. While the platforms operate under registration with the Commodity Futures Trading Commission (CFTC) as designated contract markets, the SWC says state law still applies to wagers taken from Tennessee residents.

Details of the Cease-and-Desist Letters

The letters, dated Jan. 9, require the companies to shut down all Tennessee-based activity, void any open contracts involving state residents, and refund deposits. The firms were given until Jan. 31 to complete those steps, according to the SWC’s notices to the companies.

Potential Penalties for Non-Compliance

The SWC warned that failing to comply could lead to civil penalties of up to $25,000 per violation and to criminal referrals for aggravated gambling promotion, which is a felony under Tennessee law. The letters present those penalties as the enforcement mechanisms if the firms do not meet the Jan. 31 directives.

Background on the Companies' Operations

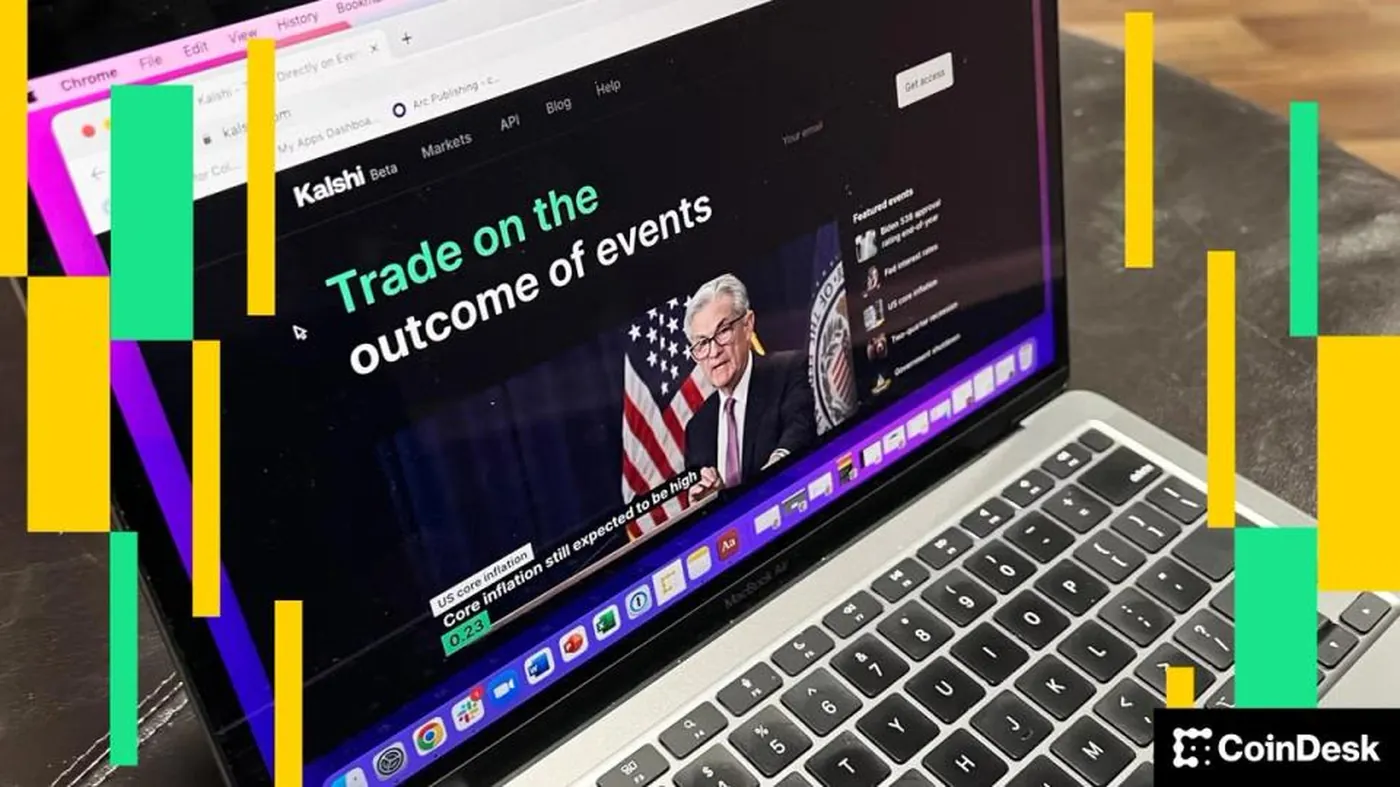

Kalshi, Polymarket and Crypto.com operate as designated contract markets under CFTC registration and offer contracts tied to the outcomes of sports events. The firms have defended their business models on the basis of federal derivatives regulation, a position that has been central in related disputes such as the Coinbase lawsuit over prediction markets.

Previous State Actions Against Similar Platforms

States have previously pursued similar platforms; for example, Connecticut issued cease-and-desist orders to several firms last December. Related regulatory developments include recent CFTC actions and approvals involving other prediction markets, such as Bitnomial approval and a separate Bitnomial exemption, which reflect ongoing legal and regulatory attention to these markets.

Response from Kalshi

Kalshi has previously argued that its products are different from offerings by state-regulated sportsbooks and casinos; a company spokesperson, Jack Such, said their offerings are "very different from what state-regulated sportsbooks and casinos offer their customers." At the time of publication, Kalshi, Polymarket and Crypto.com had not provided additional comments to CoinDesk.

Why this matters

For a miner in Russia with between one and a thousand devices, this action does not directly change how you operate mining hardware or manage energy and equipment. The orders affect platforms that sell contracts tied to sports outcomes, not cryptocurrency mining itself, so the technical and logistical aspects of mining remain the same.

However, the case is part of a broader pattern of state regulators challenging CFTC-regulated prediction and event markets, which can influence where and how those platforms offer services. If you trade on prediction or derivatives-style platforms, this regulatory activity could affect access or settlement practices on those sites, so it is worth monitoring.

What to do?

If you do not use prediction-market or sports-contract products, no immediate action is required for your mining operations; continue routine maintenance, firmware updates and secure storage of earnings. If you do hold funds or contracts on Kalshi, Polymarket or Crypto.com, check your account activity and platform communications to confirm whether your holdings are affected and to follow any instructions about refunds or voided contracts.

In all cases, keep records of your balances and transactions, enable account security measures such as two-factor authentication, and follow official channels from the platforms for updates. Monitoring reputable news sources and platform notices will help you respond quickly if access or settlement procedures change.

Related reading

For more on regulatory fights over prediction markets and CFTC oversight, see the Coinbase lawsuit and recent CFTC decisions such as the Bitnomial approval.