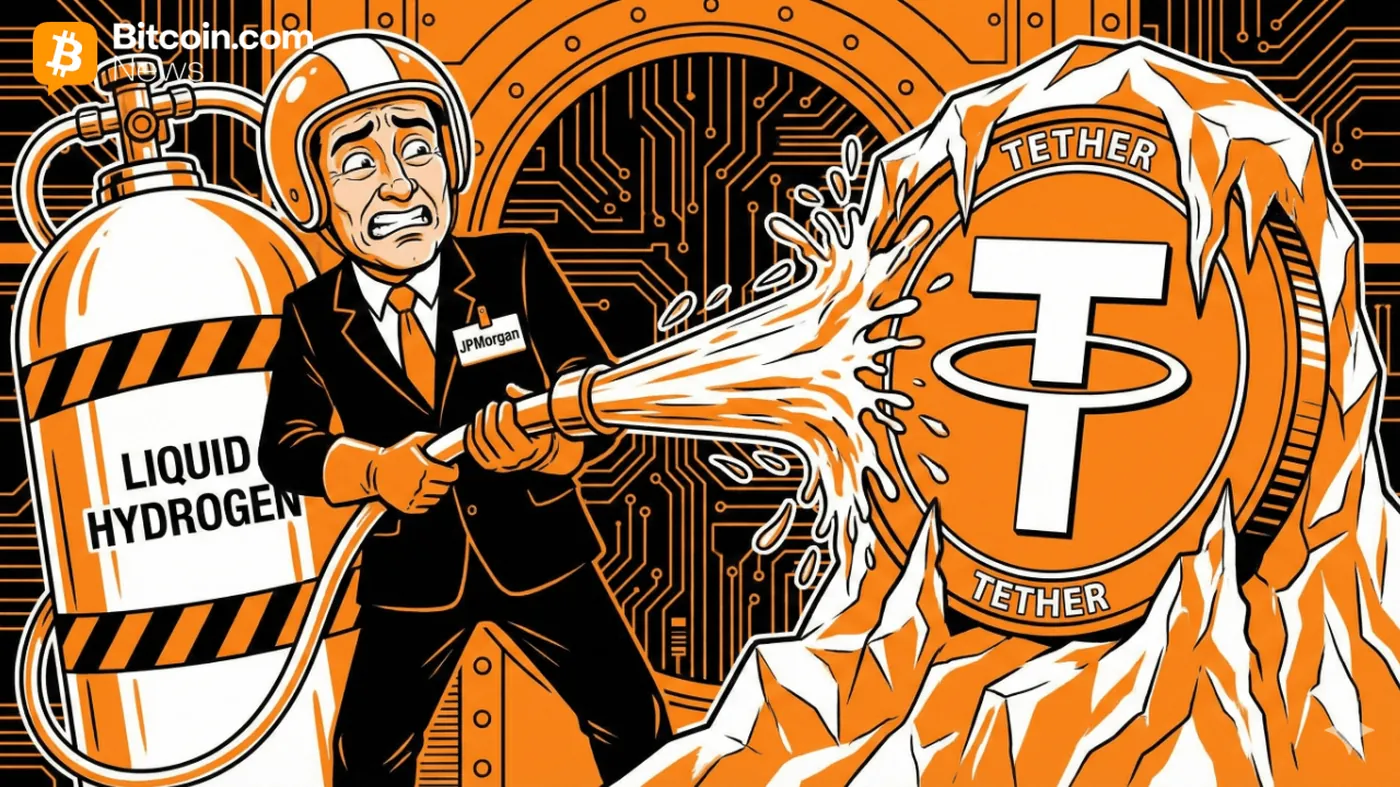

JPMorgan has frozen the bank accounts of two startups working with stablecoins: Kontigo and Blindpay. The bank classified the companies as "high-risk," leading to restricted access to their accounts. At the same time, bank representatives emphasized that these measures are not related to the essence of the stablecoin companies' business but reflect a risk assessment.

Reasons for Account Freezes

According to public statements, the bank categorized Kontigo and Blindpay as high-risk clients, which became the formal reason for freezing their accounts. JPMorgan notes that these decisions reflect risk evaluation rather than a general stance against stablecoins. Limited access to banking services is often explained by operational challenges in certain jurisdictions where banks aim to minimize liability risks.

- JPMorgan froze Kontigo and Blindpay accounts, labeling them high-risk.

- The bank stated the actions are not related to the nature of stablecoin businesses.

- The likely cause is reducing legal and compliance risks linked to the jurisdictions of operation.

About the Startups Kontigo and Blindpay

Blindpay focuses its operations in Latin American countries including Argentina, Mexico, Colombia, and Brazil. The company has raised $3.3 million in funding from investors such as Y Combinator, 468 Capital, Circle Ventures, Bitso Business, Transpose Platform, and Acacia Venture Capital Partners.

Kontigo targets the Venezuelan market, providing on-ramping, stablecoin transfers, and payment services. The startup announced a $20 million funding round involving Coinbase Ventures and reported achievements in revenue, payment volume, and user numbers.

JPMorgan's Response

A bank representative explicitly stated that the measures do not reflect a refusal to work with issuers or companies related to stablecoins and emphasized ongoing banking services for some industry players. In the context of the bank's institutional role, this decision may correlate with assessments of operational and compliance risks; see also materials on market impact for broader context. In some cases, banks justify such steps by aiming to reduce the likelihood of involvement in illegal schemes in certain jurisdictions.

Consequences for the Startups

It is currently unknown how exactly the account freezes will affect the daily operations of Blindpay and Kontigo. Public statements indicate the companies may be seeking alternative banking services, but there is no confirmation of a full transition. In any case, restricted account access creates additional operational challenges and requires startups to urgently work on payment infrastructure.

Why This Matters

From the perspective of a miner in Russia, the direct impact of this news on cryptocurrency mining is limited: the decision concerns banking relationships of two specific startups. However, limiting banking services for stablecoin infrastructure providers can reduce liquidity and convenience of settlements in necessary jurisdictions, indirectly affecting fiat transfers and user service operations.

A miner with 1–1000 devices should understand that even distant banking decisions can lead to payment delays, changes in exchange routing, and the need to find alternative providers for fund withdrawals. Therefore, it is useful to monitor the availability of payment gateways and partners you work with.

What to Do?

Below is a concise action plan for miners in Russia to minimize the impact of such events on operational activities and cash flow.

- Monitor banking and payment partners: check with providers if they have restrictions in required jurisdictions.

- Diversify withdrawal channels: use multiple exchangers and payment gateways to avoid dependency on a single counterparty.

- Plan liquidity reserves: keep part of funds in liquid assets or alternative accounts in case of temporary disruptions.

- Verify counterparties for compliance risks: choose partners with transparent KYC/AML policies and stable banking relationships.

- Maintain communication with clients and providers: promptly inform about possible delays and seek workarounds.