Grayscale has filed an initial S-1 registration statement with the U.S. Securities and Exchange Commission to create a Bittensor-focused exchange-traded product (ETP). If approved, the proposed Grayscale Bittensor Trust would trade under the ticker GTAO and hold TAO directly, giving U.S. investors regulated access to the token. TAO currently has a market capitalization of around $2.3 billion, a detail cited in coverage of the filing.

Grayscale's Filing for Bittensor ETP

The filing is an initial S-1 registration statement with the SEC for what Grayscale describes as a path to convert the trust into an ETP. The firm said the move represents a next step toward offering regulated exposure to Bittensor through the proposed Grayscale Bittensor Trust (GTAO). Barry Silbert, chairman of Grayscale, commented on the filing and framed it as reflecting how quickly decentralized AI is developing, underscoring the firm's positioning in the space.

Market Context and TAO's Position

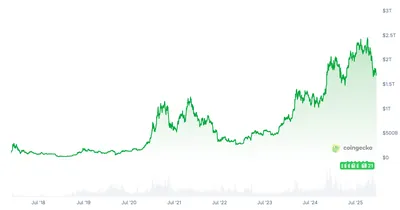

Bittensor is an open network that uses crypto-economic incentives to coordinate machine learning development, rewarding contributors with TAO. That mechanism has drawn investor attention as people seek exposure to AI-related crypto assets beyond traditional smart-contract tokens. With a market cap around $2.3 billion, TAO is among the larger tokens tied to decentralized AI narratives.

Industry Reactions and Competitive Landscape

Grayscale's filing is not the only ETP move for Bittensor. Deutsche Digital Assets previously announced a Bittensor ETP that will trade on the SIX Swiss Exchange under the ticker STAO, highlighting parallel product launches in Europe. Other providers have also placed Bittensor products on various venues, and Grayscale's step adds a U.S.-focused entrant to that developing landscape; for context on other listings, see the ETP on Nasdaq Stockholm.

Regulatory and Approval Outlook

The S-1 filing initiates a regulatory process with no guaranteed outcome, and approval by the SEC is required before the trust would begin trading as an ETP. The submission nevertheless signals that asset managers are packaging decentralized-AI exposure into regulated products, which market watchers interpret as growing institutional interest. For broader context on changing U.S. rules and how they affect crypto ETPs, see the piece on SEC standards for ETPs.

Why this matters

For small-scale miners and operators (1–1,000 devices) in Russia, the filing is primarily an investor-market development rather than an operational change. It shows that managers are seeking ways to bring decentralized AI tokens like TAO into regulated investment products, which could influence institutional flows and secondary-market liquidity. At the same time, SEC review and product approvals are separate processes, so immediate effects on day-to-day mining operations should not be assumed.

What to do?

If you run mining equipment in Russia, treat this news as informational and incorporate it into your monitoring routine rather than as an operational alarm. Track the S-1 progress and any ticker assignment for GTAO so you know when secondary-market access changes, and pay attention to custody and listing updates that could affect how TAO trades. For those curious about Grayscale's broader positioning in tokenized products, review Grayscale's market commentary and past filings to understand how similar launches were handled.

Practical checklist

- Monitor the SEC filing status for GTAO and announcements from Grayscale.

- Watch listings and liquidity changes for TAO on exchanges you use or follow.

- Review custody and tax implications for holding TAO through intermediaries if you plan to convert mined tokens to fiat or other assets.