Argentina enters 2026 with high cryptocurrency adoption: Chainalysis reports adoption levels of nearly 20%, which translates to roughly 8.6 million people who have or are using some form of crypto. The Argentine Blockchain Foundation ranks the country as the top adopter in Latin America, and local usage patterns are shifting beyond basic preservation of purchasing power.

Argentina's Cryptocurrency Adoption in 2026

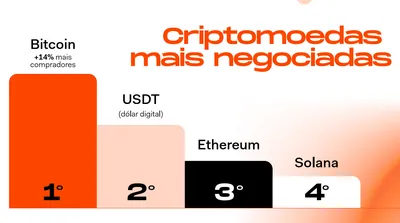

Blockchain data firm Chainalysis places Argentina's adoption rate at nearly 20%, reflecting a broad reach of digital assets among the population. With an estimated 8.6 million Argentines using cryptocurrencies, the country stands out in the region for active crypto engagement and diverse use cases.

Evolution of Stablecoin Usage

Stablecoins initially gained traction in Argentina as a tool to protect purchasing power amid fiat currency devaluation, and they remain the de facto standard digital asset for many users. Over time, however, holders have begun to use stablecoins not only to hedge but also to generate returns: users are now taking advantage of yield opportunities on their stablecoin balances, and local providers have responded by offering higher rates to attract funds. This wider usability includes payments and other functions that connect crypto to everyday transactions, a trend reflected in recent product launches such as QR crypto payments in Argentina.

Regulatory Developments

The Central Bank of Argentina is drafting a resolution that would permit banks to provide digital asset services, a move that would bring traditional financial institutions into competition with existing crypto platforms. Increased participation by banks could shift where users keep funds and how easily they access crypto-linked services, intensifying competition for deposits and yield-bearing products. These regulatory discussions connect to broader domestic policy debates, including recent proposals on monetary measures such as tetherization plans being discussed in Argentina.

Expert Insights

Local analyst Rodrigo Mansilla summarized the change by noting: "Today, crypto usability, crypto dollar yields, and other attractive features have been significantly expanded." That expansion has prompted fierce competition among local players, who increasingly compete on yields and product features to capture user funds. The combination of higher yields and possible bank entry suggests the ecosystem is maturing from simple hedging toward broader financial use.

Why it matters

For a miner in Russia with between one and a thousand devices, these developments are mostly about market evolution rather than technical or operational changes to mining rigs. The shift toward yield-bearing stablecoin products and potential bank involvement affects where users store and move fiat-pegged crypto, which can indirectly influence liquidity and on-ramps for crypto holdings.

At the same time, the facts preserved here describe Argentina's domestic market: higher adoption and expanded stablecoin use signal growing retail engagement, but they do not change local mining hardware requirements or mining profitability for operators outside Argentina.

What to do?

If you run mining equipment and follow global crypto developments, consider these practical steps to stay prepared and benefit from market changes.

- Monitor stablecoin yield products and platforms mentioned in market reports before moving large balances; understand the counterparty and custody model.

- Keep your operations secure and separate from treasury: store earned proceeds in wallets or custody solutions you control rather than on third-party platforms that advertise high yields.

- Follow regulatory news in markets of interest—such as bank involvement in crypto services—to anticipate changes in liquidity and fiat on-ramps that could affect how and where you convert crypto into fiat.

- Diversify how you hold proceeds from mining (stablecoins, established exchanges, cold storage) to reduce concentration risk while you evaluate new yield options.