Brighty App, a Lithuania-licensed crypto payments platform co-founded by Nikolay Denisenko, has formalized a process for wealthy customers to buy real estate in Europe with digital assets. Since launching the service, Brighty has brokered over 100 deals that enabled purchases of apartments in destinations such as the UK, France, Malta, Cyprus and Andorra. Transactions handled via the platform range from roughly $500,000 to $2.5 million, while Brighty’s wealthy clients spend on average about $50,000 per month.

Introduction to Crypto Real Estate Purchases

The trend reflects a segment of investors using cryptocurrency to move liquid value into hard assets like property, and banks have often been reluctant to process such deals. Brighty set out to serve those customers by formalizing the workflow: accepting crypto, performing compliance checks and arranging fiat payouts so sellers receive cleared funds. The company reports active conversations with estate agencies to make property sellers and intermediaries comfortable with properly vetted crypto-origin funds.

The Process of Buying Real Estate with Crypto

Brighty’s workflow begins with compliance checks on the source of funds. The firm uses blockchain analytics tools, including Elliptic, to assess wallets and perform due diligence before accepting funds, and its compliance team must be satisfied with the provenance of the crypto. Once approved, Brighty opens a fiat currency account in the buyer’s name and executes a payout to the seller, ensuring the money reaching the seller comes from the customer rather than directly from Brighty or from third-party exchanges like Binance or Kraken.

Advantages of Using Crypto for Real Estate

Using crypto can be faster and less complex than traditional bank transfers routed via networks such as SWIFT, which Brighty cites as one of the conventional alternatives. For buyers converting stablecoins into euros, Brighty’s experience shows that euro-pegged stablecoins remove an additional conversion step and its costs. That practical advantage has driven a shift among wealthy customers toward euro stablecoins when executing large transfers for European property purchases.

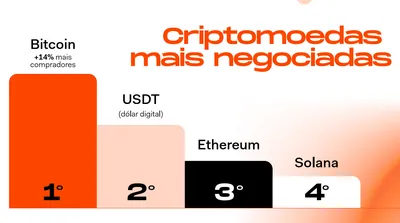

Market Trends and Statistics

The broader market context includes a notable rise in high-net-worth crypto holders: the Crypto Wealth Report 2025 recorded a 40% increase in global crypto millionaires to 241,700. Brighty itself counts between about 100 and 150 wealthy customers and has facilitated over 100 property deals. The firm also recorded a jump in average euro-backed transaction sizes, from €15,785 in one quarter to €59,894 in the next, as customers moved from USDC toward Circle’s EURC to avoid exchange costs.

Future Outlook and Industry Adoption

Brighty says it is engaging estate agencies to expand acceptance of transparently sourced crypto funds for apartment purchases. The company sees growing demand from customers seeking to de-risk portfolios by allocating some assets into real estate, and it continues to broker deals while onboarding intermediaries. Wider industry moves toward regulated crypto banking and institutional participation may affect how easily such transactions are adopted by the market.

Why this matters (for a miner in Russia with 1–1,000 devices)

For an individual miner, this news does not change how you operate mining equipment, but it affects practical routes for turning crypto into large, real-world purchases. If you ever plan to convert mined coins into cash for a big purchase in Europe, the Brighty model shows you may need clear transaction records and provable provenance of funds to pass compliance checks. Brighty’s use of on‑chain analytics like Elliptic illustrates the kinds of checks counterparties may expect when large sums move from crypto to property.

What to do (practical steps)

If you consider selling coins for a major purchase, keep thorough records of how you acquired funds, including timestamps and wallet histories, so you can show transparent provenance during due diligence. Consider which stablecoins you hold: euro‑pegged stablecoins can remove a currency conversion step when buying in euros, though choosing a coin depends on availability and your trusted counterparties. Finally, work with services that offer compliance and fiat payout options and be ready to open a fiat account tied to the transaction so sellers receive cleared funds.

For more context on regulated crypto banking and market moves that affect on‑ramps and compliance, see the recent coverage of a regulated crypto bank and reporting on Morgan Stanley filings related to institutional crypto interest.