The U.S. Department of Justice recently released a massive set of records tied to Jeffrey Epstein that include references to bitcoin and early crypto figures. Among those records, Blockstream — the bitcoin infrastructure firm — appears in 45 separate entries connected to a 2014 seed‑round investor roadshow. Blockstream’s current CEO, Adam Back, has publicly said the company has no direct or indirect financial connection to Jeffrey Epstein or his estate.

Blockstream's Unexpected Link to Epstein Files

The DOJ release spans millions of pages and prompted renewed attention across the crypto community to old email threads and investor introductions. In those documents, Blockstream is repeatedly mentioned in relation to its 2014 fundraising activities and meetings tied to figures connected to the MIT Media Lab. Adam Back responded on social platforms to clarify that, while the company met with parties who were described as linked to Epstein at the time, Blockstream itself has no financial ties to Epstein or his estate.

2014 Investor Roadshow and Joi Ito's Fund

The files describe Blockstream’s 2014 seed‑round roadshow and note an introduction to then‑MIT Media Lab director Joi Ito. According to the record excerpts, Ito’s fund went on to invest a minority stake in Blockstream following those meetings. The same documents indicate that the fund later divested its Blockstream shares months after the investment due to a potential conflict of interest and other concerns.

Community Reaction and Criticism

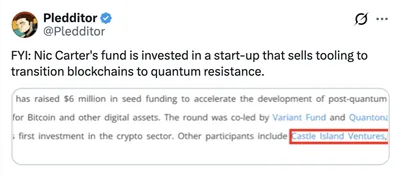

The disclosure prompted a wave of criticism on social media, with commentators questioning the timing and due diligence around meetings that took place in 2014. Some responses specifically asked why Blockstream met with someone described as linked to Epstein years after Epstein’s earlier legal troubles, and others challenged the company’s public statement. The debate included both direct critiques of the meetings and broader discussion about how early crypto relationships are examined today. In the midst of these exchanges, readers are also revisiting related reporting such as Epstein and bitcoin to trace the wider thread between Epstein‑linked figures and the crypto sector.

Epstein Files and Crypto Community Scrutiny

Beyond Blockstream, the released documents touch on bitcoin‑related conversations and involve several early crypto figures and firms. The threads include mentions of discussions tied to Stellar and Ripple Labs, and they reference exchanges about Bitcoin’s identity and adjacent ideas discussed among early participants. This broader context has reignited interest in how investor introductions and informal conversations from the early crypto era are now interpreted.

Why this matters

For miners with anywhere from a single rig to a small farm, the immediate operational impact of these documents is likely limited: they do not, by themselves, change protocol rules or mining software. However, reputational stories can affect partner companies, service providers, or public sentiment, which in turn may influence access to services or the behaviour of third parties you rely on. It’s useful to understand the scope of the release so you can judge whether any vendor or counterparty you work with is directly implicated.

What to do?

- Monitor official statements from companies and service providers you use, and keep an eye on reputable reporting about any direct ties to the documents.

- Keep your mining operation’s software and keys secure: update firmware, follow best practices for wallet security, and avoid sharing sensitive access with unverified third parties.

- Review contracts and partnerships for clauses related to reputational risk and be prepared to document transactions or communications if a service provider raises concerns.

- Maintain basic operational redundancy — backups of configuration and recovery procedures — so short‑term reputational shocks to a vendor won’t immediately disrupt your mining.

For further context on how Epstein‑linked records intersected with crypto reporting, see the coverage of the broader Epstein‑crypto connections and debates such as the Adam Back debate.