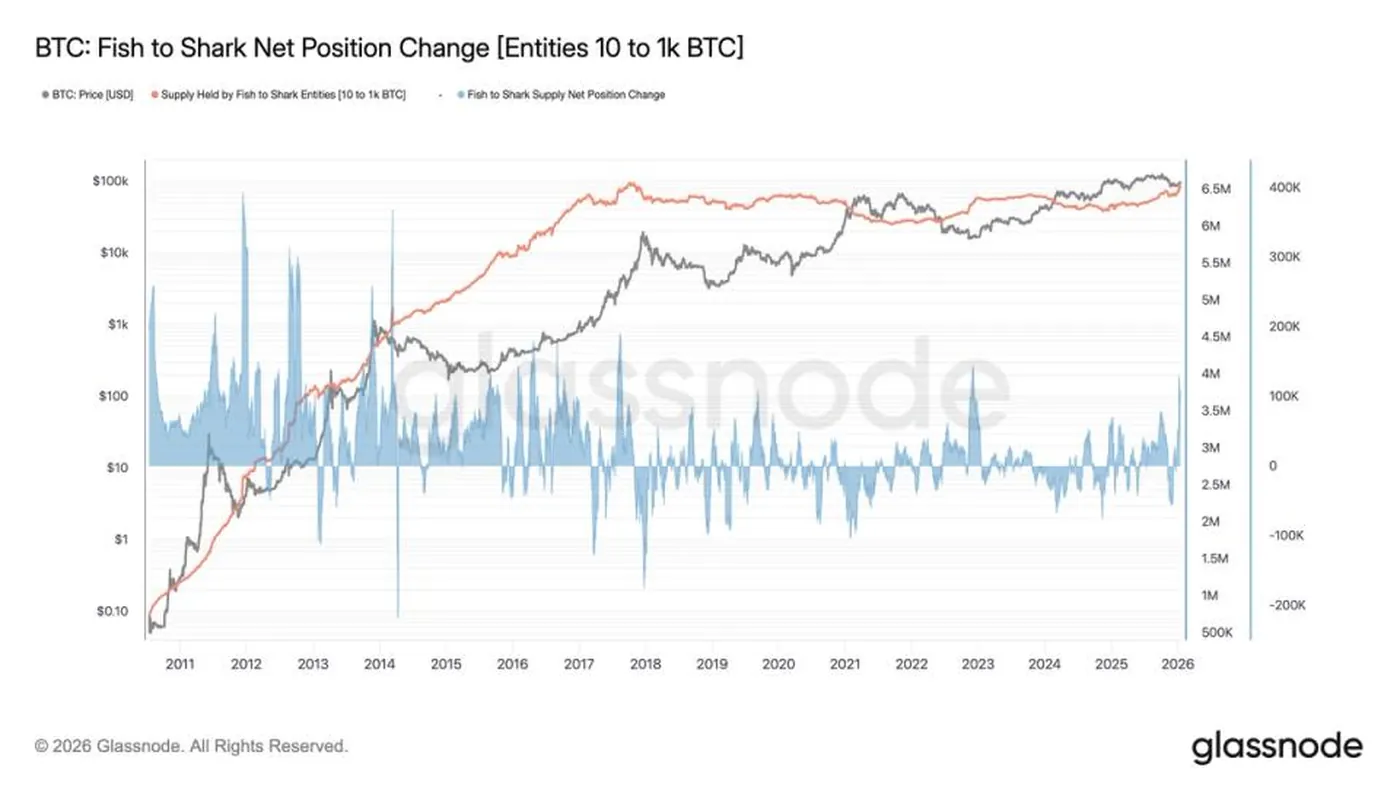

Mid- to large-sized bitcoin holders posted their strongest monthly accumulation since the FTX-related collapse of 2022, adding roughly 110,000 BTC over the past 30 days. That group — known as the Fish-to-Shark cohort and covering entities that hold between 10 and 1,000 BTC — now controls nearly 6.6 million coins, up from about 6.4 million two months earlier. At the same time, the smallest retail holders, the Shrimp cohort, have added over 13,000 BTC in recent weeks, bringing their collective holdings to about 1.4 million coins.

Bitcoin Accumulation Trends in January 2026

The Fish-to-Shark cohort's 30-day accumulation of approximately 110,000 BTC marks the largest monthly inflow for that group since the market fallout tied to FTX in 2022. These mid- to large-sized holders include high-net-worth individuals, trading desks and some institutional-sized entities, and their combined balance has risen to nearly 6.6 million BTC. This concentration increase followed a period of muted price movement, suggesting that this cohort has been steadily adding to positions despite limited volatility; for broader context on whale balance changes, see whales restored balances.

Small Holders Also Increase Bitcoin Holdings

Retail investors in the Shrimp cohort — those holding under 1 BTC — have added more than 13,000 BTC in the past weeks, the largest rise for that group since late November 2023. Their collective holdings are now roughly 1.4 million coins, indicating that small, reactive wallets were also accumulating during the recent quiet price action. The simultaneous accumulation by both small and larger cohorts points to buying across the spectrum rather than concentration in a single segment of holders.

Market Context and Price Range

The renewed accumulation happened while Bitcoin traded in a relatively tight range, remaining about 25% below its October record high and about 15% above the November low near $80,000. That price context helps explain why different holder groups could increase balances without sharp jumps in volatility. Although accumulation across cohorts can reflect broad-based demand, it coexisted with other activity such as recent whale sales, which provide additional perspective on market flows — see recent whale sales.

Why this matters

For a miner operating in Russia with anywhere from a single rig to a thousand devices, these on-chain shifts matter primarily as sentiment signals rather than immediate operational changes. Accumulation by both mid-sized and small holders shows demand exists across wallet types, which can affect market psychology and, over time, the liquidity backdrop miners face when selling mined BTC. At the same time, the reported accumulation occurred without a large price break, so miners should not assume instant changes to revenue or difficulty based solely on these flows.

What to do?

Practical, short actions a miner in Russia can take to respond to these developments are straightforward and focus on risk management and monitoring. First, keep routine operational metrics under control: track power costs, hashboard performance and payout schedules so you can respond quickly if market conditions change. Second, follow on-chain aggregation sources like Glassnode for holder-cohort updates to see whether accumulation trends continue or reverse.

- Set a clear cash-out plan: define regular BTC sell points tied to your local expenses and electricity bills rather than trying to time the market.

- Maintain an emergency buffer in fiat to cover several weeks of operating costs in case volatility affects short-term BTC liquidity.

- Review pool and fee structures periodically to ensure mining income is optimized while keeping operational overhead predictable.