Two wallets created on April 17, 2016 became active on January 16, 2026, moving a combined 1,087 BTC. On-chain activity shows the coins were shifted from legacy P2PKH addresses into new Taproot (P2TR) addresses, and the moved funds were valued at $103.8 million using Jan. 17 exchange rates.

Overview of the 2016 Bitcoin Whale Movement

The two wallets had held their coins for more than nine years before the January transfers, one containing 500 BTC and the other holding 587.29 BTC. The larger batch of activity registered on-chain as approximately 1,087.29 BTC and was processed across two nearby blocks.

Details of the Transaction

Wallet origins and amounts

Both wallets were created on April 17, 2016; one contained 500 BTC while the other held 587.29 BTC. Together they account for the 1,087 BTC figure referenced in on-chain summaries and valuation reports.

On-chain movement and block confirmation

The 500 BTC movement cleared at block height 932586, and the 587.29 BTC movement was recorded at block height 932590. In each case the coins moved out of P2PKH (Pay-to-Public-Key-Hash) addresses and into Taproot (P2TR) outputs before being split across new P2TR recipients.

Current Status of the Transferred BTC

After the shifts into Taproot addresses, the moved BTC remained unspent in their new P2TR homes as of January 17, 2026. There were no on-chain signs in these transactions that the coins were deposited to an exchange at the time they were moved.

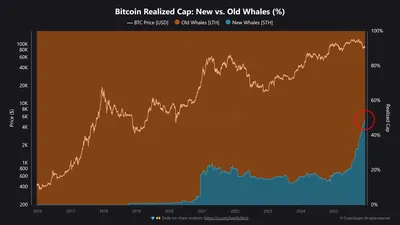

Broader Context of Dormant Wallet Activity

The January activity follows other recent awakenings of long-dormant wallets, including a separate early-era whale that sent 2,000 BTC to Coinbase on Jan. 10, 2026. Many reactivations in the period have involved smaller transfers, though the 2016 wallets represent a notably larger on-chain consolidation.

For background on earlier waves of reactivations you can see reporting on the prior year’s trend of old wallets becoming active again in активация старых кошельков, and the Jan. 10 transfer to an institutional exchange is covered in перевод на Coinbase.

Market Implications

The moves occurred while bitcoin was trading near the $100,000 mark, a price context that appears coincident with several resumptions of activity from aged wallets. The on-chain pattern in this case looks like consolidation into Taproot outputs rather than immediate distribution or exchange selling.

Почему это важно

Если вы майните в России, важно понимать, что подобные движения старых кошельков не обязательно означают немедленную распродажу. В этом случае монеты были переведены в Taproot-адреса и оставались непотраченными по состоянию на 17 января 2026 года, то есть долгосрочное предложение пока не вернулось массово в оборот.

Что делать?

Действия зависят от масштаба вашей фермы и личной стратегии, но полезно соблюдать простые правила управления рисками.

- Проверяйте связь ценовых пиков с волнами активности старых кошельков и не полагайтесь на одно событие при принятии решений.

- Если у вас 1–1000 устройств, поддерживайте резерв средств для покрытия периферийных расходов и не перераспределяйте всё под продажи по эмоциональным сигналам с on-chain.

- Обновляйте софт и безопасно храните ключи: перемещение в Taproot означает, что адреса могут выглядеть иначе, но принципы безопасности остаются теми же.