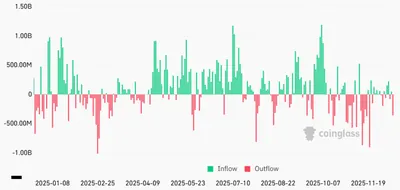

Glassnode reports that Bitcoin and Ether exchange-traded funds have shown a prolonged streak of outflows beginning in early November, a pattern the analytics platform links to reduced institutional engagement. The 30-day simple moving average of net flows into US spot Bitcoin and Ether ETFs has turned negative, which Glassnode sees as evidence of muted participation by institutional allocators and a broad liquidity contraction across the crypto market.

Sustained Outflows in Bitcoin and Ether ETFs

Since early November the flow picture for US spot Bitcoin (BTC) and Ether (ETH) ETFs has shifted: Glassnode notes the 30-day simple moving average of net flows has gone negative, reflecting sustained outflows from these funds. This trend is presented as a signal that institutional investors are stepping back, reinforcing an overall reduction in available liquidity for crypto markets.

Recent Trends in Crypto ETF Flows

Data from market trackers show aggregate Bitcoin ETF flows were in the red for four consecutive trading days, while industry reports put crypto fund outflows at $952 million for the last week. Reporting also indicates investors have withdrawn capital in six out of the last ten weeks, and some funds still registered only minor inflows amid the broader selling pressure.

BlackRock’s IBIT Performance

BlackRock’s iShares Bitcoin Trust (IBIT) has seen minor inflows over the most recent week, even as the wider ETF complex experienced outflows. Over its life, IBIT has collected $62.5 billion in inflows, making it the largest spot Bitcoin ETF by cumulative inflows, and it is noted as the only ETF on Bloomberg’s 2025 Flow Leaderboard with a negative return for the year.

Impact of Institutional Sentiment

ETFs are commonly treated as a barometer of institutional sentiment, and the current streak of outflows is interpreted as a shift toward lower institutional participation. Glassnode describes this as a phase of muted engagement and partial disengagement by institutional allocators, which contributes to the wider liquidity contraction in crypto markets.

Why this matters

For miners, institutional flows matter because large-scale buying or selling can affect market liquidity and price discovery, which in turn influences the fiat value of mined coins when you convert them. Even if you operate one rig or several hundred, a sustained drop in institutional demand can mean thinner order books and larger price moves on sell-offs, making timing of sales more consequential.

What to do?

If you mine in Russia and run between one and a thousand devices, focus on simple, practical steps: keep short-term cash needs covered to avoid forced sales during low liquidity, monitor ETF flow updates and the 30-day SMA for signs of changing institutional participation, and consider spreading coin sales over time to reduce market impact. For more context on ETF outflows and specific fund behavior, see related coverage on ETH ETF outflows and the recent report on IBIT outflows, which provide closer looks at token- and fund-level movements.